Technically Speaking

DJIA: It Don't Mean Nothin'

Late Friday I was asked my thoughts on the 666 (did you catch that?) point sell-off by the Dow Jones Industrial Average, part of a 1,096 point sell-off for the week. Channeling my inner Richard Marx (you know we all have one) I responded with, "It don't mean nothin'".

Now that you've got that little ditty stuck in your head, let's continue.

A 1,000 points doesn’t mean what it used to. As a percentage, last week's sell-off was 4.2% of the index's total value at its high the previous week. That sounds substantial, and if downside momentum continues to grow then this past week will be remembered as a key turning point. But from a technical point of view nothing has changed, yet.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

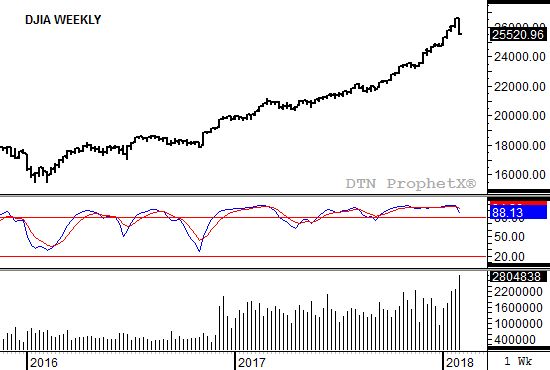

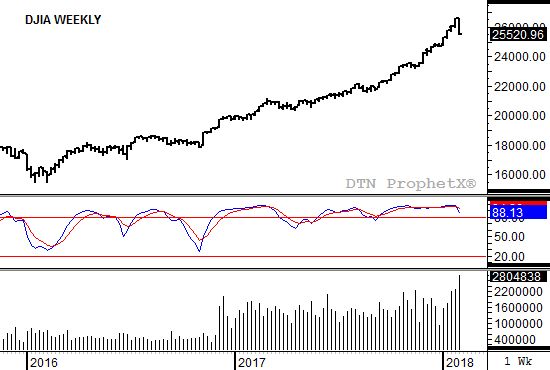

No, the DJIA did not establish a bearish reversal on its weekly chart as it failed to take out the previous week's high of 26,616.71 before falling this past week.

No, the DJIA did not establish a new 4-week low on its weekly chart, with that particular support this coming week pegged at 25,235.41. The DJIA closed this past week at 25,520.96.

Yes, weekly stochastics for the DJIA did indeed establish a bearish crossover above the overbought level of 80%, but look back over the last year and see how many times that signal was a train wreck for this particular market.

Yes, weekly volume spiked as the DJIA's sell-off gained momentum this past week, and that's a bearish technical signal. Oh, wait a minute...

Okay, while last week's collapse in and of itself doesn't mean anything technically, it sets the stage for some potential bearishness in the near future. Possibly as soon as this coming week. The downside trade volume is interesting, and if selling continues early Monday and the 4-week low gives away, we could be having a completely different conversation.

For now, though, the break in the Dow should be considered a bad week. Time will tell if this bad week turns into a bad month, a bad quarter, a bad year.

Stay tuned.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .