Technically Speaking

Monthly Analysis: Livestock Markets

Live Cattle: The April contract closed at $122.925, up $1.375 on the monthly chart. The market remains in a major (long-term) uptrend, rallying after a test of support near $115.75 in January (monthly low of $116.25). Initial resistance is at the November high of $127.875, with a move beyond that level setting the stage for a test of the targeted $134.425. This price marks the 50% retracement level of the previous major downtrend from $172.75 through the low of $96.10. Monthly stochastics remain bullish below the overbought level of 80%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

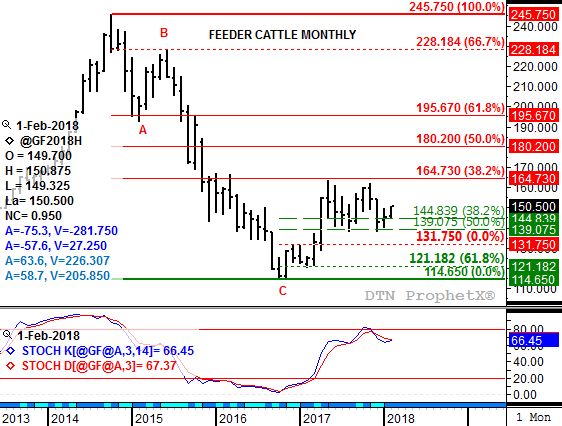

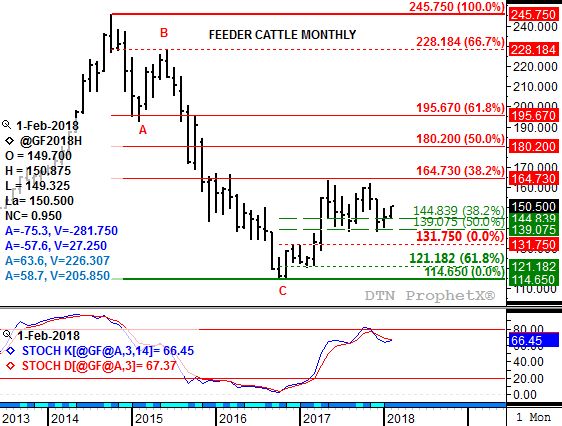

Feeder Cattle: The March contract closed at $145.05, up $2.375 on the monthly chart. The market looks to be in a major (long-term) sideways trend between support at $139.075 and resistance near $164.725. Monthly stochastics are neutral-to-bearish below the oversold level of 80%. If the March contract falls through support it would suggest, by simple measuring techniques, an extended sell-off to test the previous major low of $114.65 (October 2016) if not lower. A move through resistance would indicate an uptrend that could test $180.20, the 50% retracement mark of the previous downtrend from $245.75 through the low of $114.65.

Lean Hogs: The April contract closed at $72.25, up $0.475 on the monthly chart. The market still looks to be in a major (long-term) uptrend, though consolidating below the high of $85.375 and retracement resistance near $87.05. This leaves the market vulnerable to a bearish breakdown.

Corn (Cash): The DTN National Corn Index (NCI, national average cash price) closed at $3.30 1/4, up 14 3/4 cents for the month. The monthly close-only chart shows the NCI near trendline resistance at $3.33, with resistance in February coming in at $3.31 1/4. The major (long-term) trend remains down while the NCI's secondary (intermediate-term) uptrend looks to be nearing its end.

Soybean meal: The March contract closed at $337.80, up $21 on the continuous monthly chart. The nearby futures contract posted a bullish outside month in January, signaling the return to a major (long-term) uptrend. Initial resistance is at the January high of $348.50. The next target is $367, a price that marks the 38.2% retracement level of the previous major downtrend from $541.80 through the low of $258.90.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .