Technically Speaking

Weekly Analysis: Wheat Markets

SRW Wheat (Cash): The DTN National SRW Wheat Index (SR.X, national average cash price) closed at $3.84, up 18 1/4 cents for the week. Despite the higher price technical indicators continue to show the secondary (intermediate-term) trend is down on the weekly close only chart. Weekly stochastics remain bearish, above the oversold level of 20%.

SRW Wheat (New-crop Futures): The Chicago July 2017 contract closed at $4.32 1/4, up 11 1/4 cents for the week. The contract looks to be transitioning from a secondary (intermediate-term) downtrend. However, the contract did post a new low of $4.16 before rallying last week. Weekly stochastics are below the oversold level of 20%, but may need to retest its low to set up a possible bullish crossover below this level.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

HRW Wheat (Cash): The DTN National HRW Wheat Index (HW.X, national average cash price) closed at $3.41 3/4, up 25 1/4 cents for the week. The cash HRW market is showing conflicting signals, though last week's strong rally off its test of support near $3.18 1/4 (the previous week's price was $3.16 1/2) led to a new 4-week high (weekly close). This would suggest the secondary (intermediate-term) trend hast turned up, despite weekly stochastics not posting a bullish crossover below the oversold level of 20%.

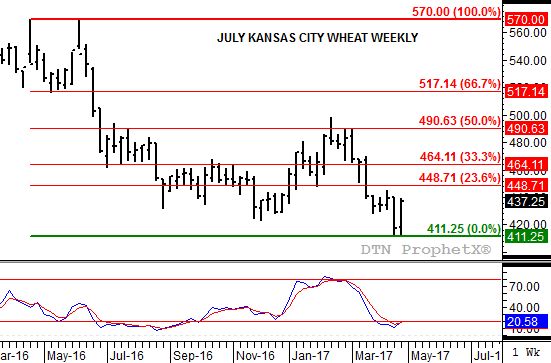

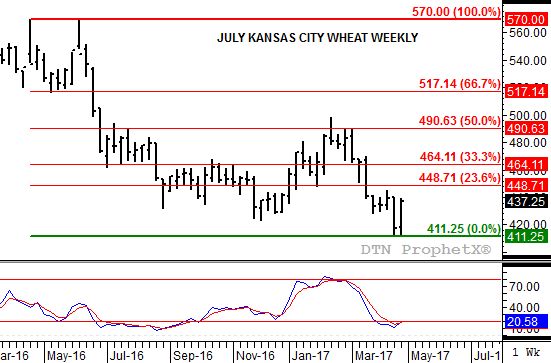

HRW Wheat (New-crop Futures): The Kansas City July 2017 contract closed at $4.37 1/4, up 20 cents for the week. The secondary (intermediate-term) trend turned up last week as the contract completed a 2-week reversal on its weekly chart. Confirmation of this change in trend would be a move to a new 4-week high beyond $4.45 1/4. Buying interest could come from noncommercial short-covering as Friday's CFTC Commitments of Traders report showed this group moving to a net-short futures position of 2,251 contracts ahead of a spring blizzard/freeze across the U.S. Southern Plains that may have caused extensive damage to the HRW crop.

HRS Wheat (Cash): The DTN HRS Wheat Index (SW.X, national average cash price) closed at $5.09 1/2, up 22 1/4 cents for the week. The market's secondary (intermediate-term) uptrend strengthened last week with rally resulting in a test of resistance between $5.07 and $5.14 1/4, prices that mark the 50% and 61.8% retracement levels of the previous downtrend from $5.36 3/4 through the low of $4.77 1/2.

HRS Wheat (New-crop Futures): The Minneapolis September 2017 contract closed at $5.61 up 18 3/4 cents for the week. The secondary (intermediate-term) trend remains up based on the contract posting a bullish reversal the week of April 10. The contract also posted a new 4-week high of $5.64 as it posted another bullish outside price range.

The weekly Commitments of Traders report showed positions held as of Tuesday, April 25.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .