Technically Speaking

Weekly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed $3.93 lower at $51.96. The market remains in a secondary (intermediate-term) downtrend. Initial support is at $50.99, a price that marks the 23.6% retracement level of the previous uptrend from $27.10 through the high of $58.37. The 38.2% retracement level is down at $46.42.

Crude Oil: The spot-month contract closed $3.56 lower at $49.62. Similar to Brent, WTI remains in a secondary (intermediate-term) downtrend. Initial support is at $48.35, a price that marks the 23.6% retracement level of the previous uptrend from $26.05 through the high of $55.24. The 38.2% retracement level is down at $44.09.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 9.62cts lower at $1.5427. The market remains in a 3-wave secondary (intermediate-term) downtrend. Wave C could now target initial support at $1.4148, the 38.2% retracement level of the previous uptrend from $0.8487 through the high of $1.7647. Given weekly stochastics are well above the oversold mark of 20% the spot-month contract could test the 50% retracement level of $1.3067.

Gasoline: The spot-month RBOB gasoline contract closed 9.04cts lower at $1.6445. Gasoline continues to show a secondary (intermediate-term) sideways trend on its weekly bar chart. Secondary resistance remains at $1.7587 with support at $1.5179.

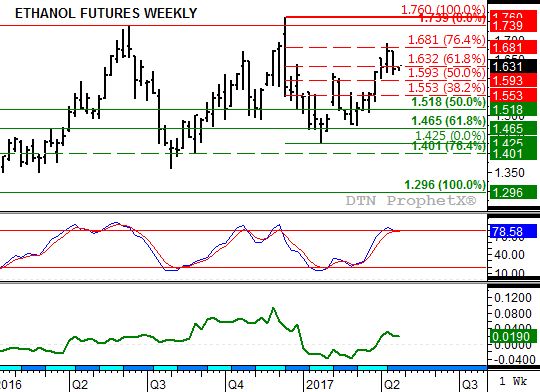

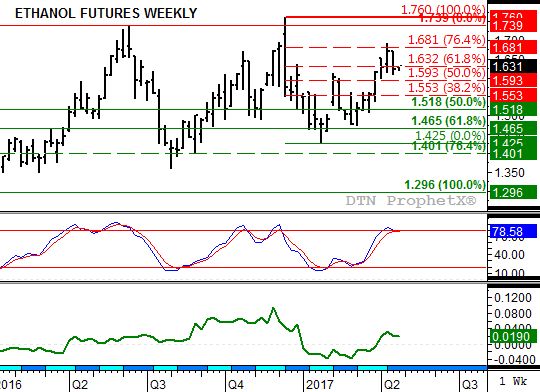

Ethanol: The spot-month contract closed 4.7cts lower at $1.624. Despite the lower close the market remains in a secondary (intermediate-term) uptrend. Resistance at $1.681, a price that marks the 76.4% retracement level of the previous downtrend from $1.76 through the low of $1.425, continues to hold. Weekly stochastics are near the overbought level of 80%, in position for a bearish crossover marking the end of the uptrend.

Natural Gas: The spot-month contract closed 12.6cts lower at $3.101. The market remains in a 3-wave secondary (intermediate-term) downtrend. With weekly stochastics still well above the oversold 20% mark, Wave C (third wave) is expected to extend beyond the Wave A low of $2.522.

Propane (Conway cash price): Conway propane closed 5.63cts lower at $0.5875. The secondary (intermediate-term) trend is up, though initial resistance at $0.6537 continues to hold. This price marks the 33% retracement level of the previous downtrend from $0.9100 through the recent low of $0.5275. The 50% retracement level is up at $0.7188.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .