Technically Speaking

Monthly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed at $55.59, down $0.11 on the monthly chart. The major (long-term) trend looks to be sideways as it transitions from an uptrend to downtrend. The range is between $58.37 and $53.58 (the range posted during January) as monthly stochastics approach a bearish crossover above the overbought level of 80%.

Crude Oil: The spot-month contract closed at $54.01, up $1.20 on the monthly chart. The major (long-term) trend has turned sideways within January's range of $55.24 and $50.71. As with Brent, the market looks to be in transition from an uptrend to downtrend with monthly stochastics nearing a bearish crossover well above the overbought level of 80%. The spot-month contract continues to sit below resistance at $55.61, a price that marks the 33% retracement level of the previous downtrend from $114.83 through the low of $26.05.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

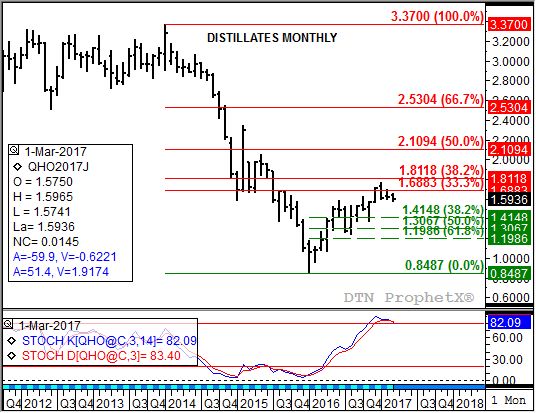

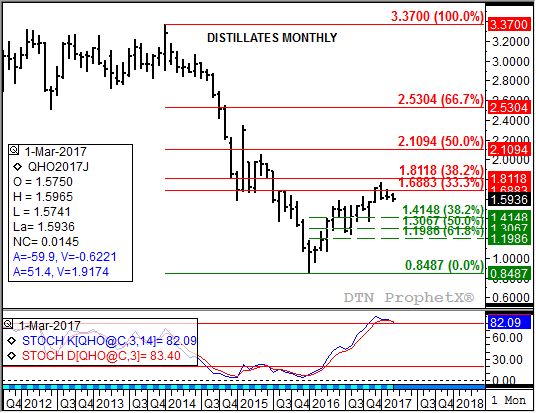

Distillates: The spot-month contract closed at $1.6208, up 0.91ct on the monthly chart. The market's major (long-term) uptrend still looks to be nearing its end as the spot-month contract pulls back from resistance between $1.6883 and $1.8118. These prices mark the 33% and 38.2% retracement levels of the previous downtrend from $3.3700 through the low of $0.8487. Monthly stochastics are in position to establish a bearish crossover above the overbought level of 80%.

Gasoline: The spot-month contract closed at $1.5120, down 1.36cts on the monthly chart. Despite the lower monthly close the major (long-term) trend remains up. The market remains in a relatively stagnant uptrend, though the strong contango between the March and April futures contracts should lead to a test of resistance at $1.7571 on the monthly chart in early March. This price marks the 33% retracement level of the previous downtrend from $3.4789 through the low of $0.8975. Monthly stochastics are nearing the overbought level of 80%.

Ethanol: The spot-month contract closed at $1.525, up 3.2cts on the monthly chart. The major (long-term) trend remains sideways. Resistance is at $1.712, a price that marks the 23.6% retracement level of the previous downtrend from $3.07 (July 2011) through the double-bottom low of $1.292 (January 2015 and January 2016). Support is at the double-bottom low.

Natural Gas: The spot-month contract closed at $2.774, down 34.3cts on the monthly chart. The major (long-term) trend looks to be down as the spot-month contract posted a new 4-month low of $2.522 during February. This was a test of support at $2.521, a price that marks the 61.8% retracement level of the previous uptrend from $1.6111 through the high of $3.994. However, monthly stochastics are bearish meaning the spot-month contract could fall back to the 76.4% retracement level of $2.173.

Propane (Conway cash price): Conway propane closed at $0.5775, down 23.00cts on its monthly chart. The major (long-term) trend abruptly turned down during February, posting a bearish key reversal on its monthly chart. Cash propane immediately moved below support at $0.5813, a price that marks the 50% retracement level of the previous uptrend from $0.2525 through the February high of $0.9100. The 67% retracement level is down at $0.4714.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .