Technically Speaking

Weekly Analysis: Wheat Markets

SRW Wheat (Cash): The DTN National SRW Wheat Index (SR.X, national average cash price) closed at $3.86 1/2, up 3 1/2 cents for the week. The secondary (intermediate-term) trend remains up after breaking out if its sideways pattern the previous week. Given the previous range of 29 1/4 cents, the initial upside target is $4.02 1/2.

SRW Wheat (New-crop Futures): The Chicago July 2017 contract closed at $4.54 3/4, up 6 1/2 cents for the week. The contract is in a secondary (intermediate-term) uptrend after posting a new 4-week high of $4.56 1/2. Initial resistance is at $4.59 1/4, a price that marks the 23.6% retracement level of the previous downtrend from $5.86 1/2 through the recent contract low of $4.20. However, with weekly stochastics bullish and well below the overbought level of 80% the contract could extend its rally to 33% or 50%, putting targets at $4.75 1/2 and $5.03 1/4 respectively.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

HRW Wheat (Cash): The DTN National HRW Wheat Index (HW.X, national average cash price) closed at $3.54 1/4, up 16 3/4 cents for the week. The secondary (intermediate-term) trend remains up with next resistance pegged at $4.07. This price is the high weekly close from the week of May 31. However, weekly stochastics are already well above the overbought level of 80%, setting the stage for a possible bearish crossover.

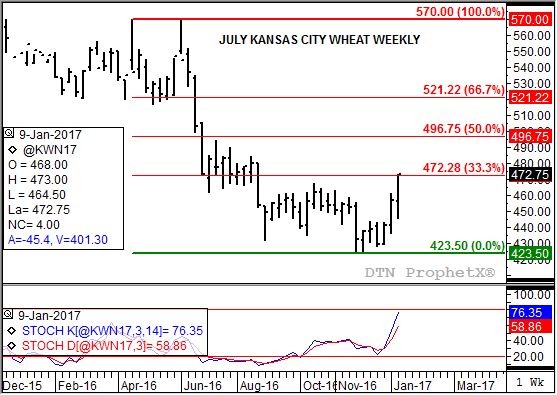

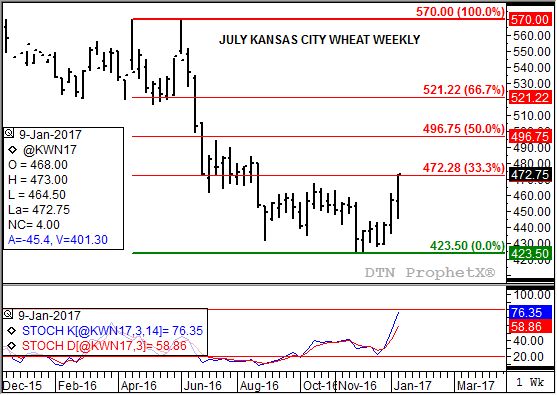

HRW Wheat (New-crop Futures): The Kansas City July 2017 contract closed at $4.72 3/4, up 16 1/4 cents for the week. The contract's secondary (intermediate-term) uptrend continues to strengthen. Last week's rally resulted in a test of initial resistance at $4.72 1/4, a price that marks the 33% retracement level of the previous downtrend from $5.70 through the contract low of $4.23 1/2. With weekly stochastics bullish and below the overbought level of 80%, July KC wheat could see a 50% retracement up to $4.96 3/4.

HRS Wheat (Cash): The DTN HRS Wheat Index (SW.X, national average cash price) closed at $5.36 3/4, up 19 1/2 cents for the week. SW.X remains in a secondary (intermediate-term) uptrend despite weekly stochastics that continue to show a sharply overbought situation. Support continues to come from the major (long-term) uptrend that has a next upside target of $5.89.

HRS Wheat (New-crop Futures): The Minneapolis September 2017 contract closed at $5.61 1/2, up 11 1/4 cents for the week. The contract remains in a secondary (intermediate-term) uptrend with next resistance pegged at $5.64 3/4. This price marks the 50% retracement level of the previous downtrend from $6.09 3/4 through the contract low of $5.20. Given weekly stochastics remain bullish the contract could extend this move to the 67% retracement level of $5.79 3/4.

To track my thoughts on the markets throughout the day, follow me on Twitter:www.twitter.com\Darin Newsom

Comments

To comment, please Log In or Join our Community .