Technically Speaking

Monthly Analysis: Grain Markets

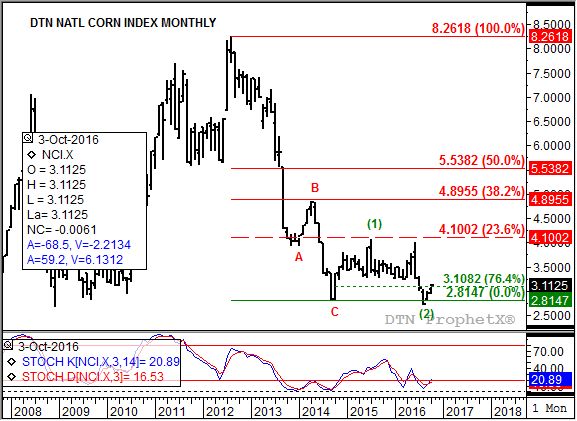

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.11 1/4, up 16 cents for the month. Monthly stochastics posted another bullish crossover, again indicating the major (long-term) trend has turned up. However, confirmation of this change in trend would occur with a move to a new 4-month high, beyond thee July peak of $3.29 3/4.

Corn (Futures): The December contract closed at $3.54 3/4, up 18 cents on the monthly chart. The establishment of a bullish crossover by monthly stochastics below the oversold level of 20% gives weight to the idea that the major (long-term) trend has turned up. However confirmation needs to come in the form of a new 4-month high, above July's peak of $3.80. Until then the major trend can be classified as sideways with support at the August low of $3.14 3/4.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $9.27 3/4, up 36 3/4 cents for the month. The NSI.X came within a 1/4 cent of establish a bullish key reversal on its monthly chart, what would have been a clear confirmation that Wave 2 of its 5-Wave uptrend had bottomed. Still, the monthly low of $8.77 1/2 was a solid test of support at that same price, the 76.4% retracement level of the Wave 1 rally from $8.05 (March 2016) through $11.12 (June 2016). Monthly stochastics remain neutral near 40%.

Soybeans (Futures): The January contract closed at $10.11 3/4, up 57 3/4 cents on the monthly chart. The market remains in a major (long-term) 5-Wave uptrend, holding above support near $9.30 1/4. This price marks the 76.4% retracement level of the Wave 1 rally from $8.44 1/4 (November 2015) through the high of $12.08 1/2 (June 2016). The September low of $9.34 continues to look like a Wave 2 bottom.

SRW Wheat (Cash): The DTN National SRW Wheat Index (SR.X, national average cash price) closed at $3.70 1/4, up 18 1/4 cents for the month. Monthly stochastics continue to indicate the major (long-term) trend has turned up. However, the SR.X needs to post a new 4-month high above the July peak of $4.11 1/2 to confirm this change in trend.

SRW Wheat (Futures): The December Chicago contract closed at $4.16 1/4, up 14 1/4 cents for the month. As discussed last month, the major (long-term) trend now looks to be up. The October rally established a bullish crossover by monthly stochastics below the oversold level of 20%. Confirmation of this new uptrend would be a move to a new 4-month high above the July peak of $4.51 3/4.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .