Sort & Cull

When Emotions Surpass All Other Factors in Cattle Market

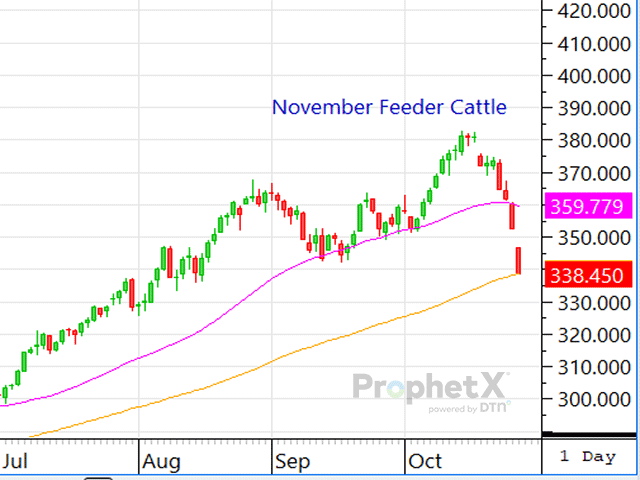

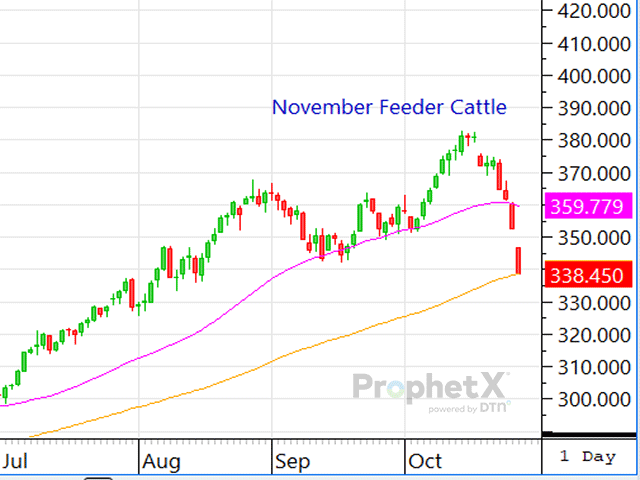

Right from the day's get-go, the cattle complex trembled, panicked and ultimately let fear and other emotions be the driving force that sent both the live cattle and feeder cattle contracts to close below their 100-day moving averages Monday afternoon.

Since Oct. 17, when all chaos ensued because President Donald Trump made statements about beef prices being too high, the spot November feeder cattle contract has fallen $36.55, and the spot December live cattle contract has fallen $17.20, all in the matter of seven trading days.

Nothing has changed fundamentally, but sheer mayhem hit the technical side of the marketplace as traders have become unraveled by Trump's comments. Cattlemen now question where the market is headed next. Some market commentary today has even been titled, "The High is In" or "It's All Done and Over" -- all of which continues to add yet another level of panic to the marketplace.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Let me help outline a couple of things clearly in this fear-driven market.

1) The recent events: President Trump said beef prices are too high, hinted Argentina is going to export more beef to the United States, and we don't know what will come of the planned meeting between U.S. Ag Secretary Brooke Rollins and Mexican officials sometime this week. This clearly shows why the futures complex shouldn't be allowed to have such large daily trading limits. They're costly, they're dangerous and they provoke more volatility in the market than what's necessary.

Should the markets really be driven by traders' reactions to news headlines as opposed to tangible fundamental developments? I thought high prices were supposed to cure high prices? But, oddly enough, while the cattle complex has been losing rapidly during the last seven trading days, boxed beef prices have continued to trade higher, seeming to indicate that consumers don't think prices are too high just yet.

2) What do you think ranchers are going to do with their replacement heifers if they continue to see the market plummet? I think there is a fair argument to be had that many of them will elect to sell their young females now when they can get anywhere from $1,800 to $2,200 for them, as opposed to waiting an additional two years for those heifers to finally have a calf able to be marketed. All of that will only push building back herds that much further into the future.

3) No one knows what this "turn of events" will be in the cattle market's big picture. Sixty days from now, the market could still be trading lower, as the market was never able to regain confidence from traders. But there's just as likely of a chance that 60 days from now, the market will have moved past the chaos that the technical sector endured and will once again be challenging its resistance levels because (once again) nothing has changed fundamentally.

We live in a world where news and information flow fast, and we're expected to react to everything immediately. And, while I know it's hard not to react to headlines when you're constantly being bombarded, I also believe sound decision-making is done in a calculated (not emotional) manner.

ShayLe Stewart can be reached at shayle.stewart@dtn.com

(c) Copyright 2025 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .