Sort & Cull

Cattle, Hog Prices in Different Worlds, Take Different Paths

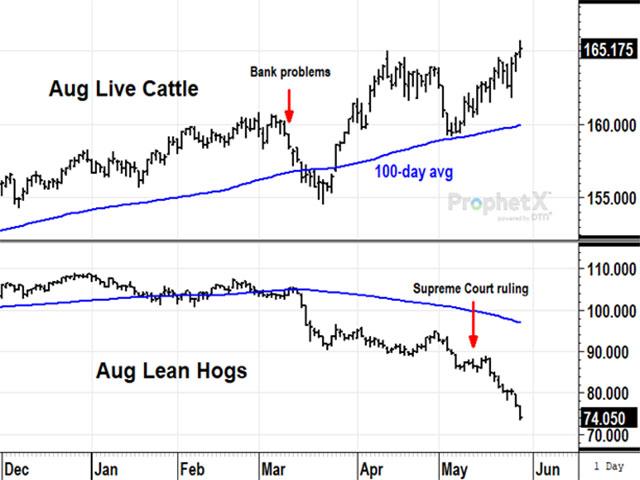

August live cattle futures closed up $0.87 at a new contract high of $165.17 in the week ended May 26. After four years of declining cattle numbers and a year of especially painful herd liquidation in 2022, packers are in an unusual predicament of having to bid up to secure enough beef to meet demand and that situation seems unlikely to change anytime soon. Spot cattle prices have traded above the 100-day average for over a year and, other than a brief scare from U.S. bank failures in March, the upward trend continues. The 100-day average is currently near $160, well below the latest cash trade near $171 in the South. If cattle prices do get hit by selling, it would likely come from an outside scare, like we saw in March, but significant herd expansion is more than a year away with beef cow numbers at their lowest in over 60 years.

LEAN HOGS:August lean hogs futures fell $7.45 in the week ended May 26, ending at $74.05, the lowest close for an August contract since the initial pandemic year of 2020. Unlike cattle, packers have had no problem finding hogs available for slaughter in 2023 and prices took a downward turn in March when U.S. bank failures spooked traders in all markets. Hog prices took a second bearish hit after May 11 when the Supreme Court announced California's Prop 12 referendum had the right to dictate to other states how pork sold in California will be produced. In the short run, the decision has effectively reduced the U.S. market for pork -- similar to losing an important export market -- while the industry tries to figure out how to adapt to California's more expensive requirements. August prices that started the year above $100 per hundredweight are now in the low $70s, their lowest prices in over two years and falling. The ensuing liquidation has driven cash prices of early weaned pigs to $10.03, USDA reported Friday. Hog prices are currently in a one-way downtrend with no sign of support yet.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

**

If you missed DTN's Ag Summit Series event, "Crop Updates From the Field" or were too busy to register, here is a second chance. Register now and you'll be able to access recordings of the event in which we visited with farmers from across the country, talked about the latest dicamba and pesticide news, and discussed DTN's latest weather and market outlooks. This extended registration period will close on June 5 at 5 p.m.

Here's the link to register:

There may be a time delay between when you register and when you can access the recordings.

Todd Hultman can be reached at Todd.Hultman@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Comments

To comment, please Log In or Join our Community .