Fundamentally Speaking

U.S. Soybean Export Projection Still Looks High

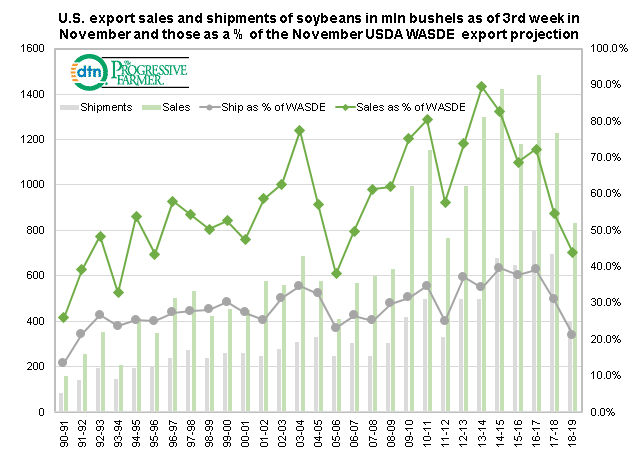

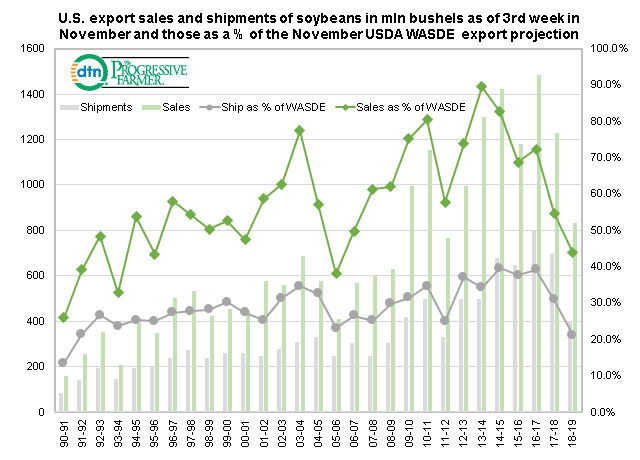

The accompanying graphic here helps illustrate the impact on the farm sector from the current trade disputes the U.S. is engaged in.

This is no small consideration as attention turns to the upcoming meetings between the leaders of the two most powerful economic nations in the world in Argentina this week.

We are just focusing on soybeans and the devastating impact that the boycott by China, the world's top oilseed importer on U.S. soybeans, has had on our sales and shipment pace since the new marketing year started September 1.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Through the third week of November, we have sold 831.4 million bushels of soybeans, the lowest total since the 2011/12 marketing year and the second lowest total in the past decade.

The 400.2 million bushels shipped as of the third week of November is also the least for this point in the marketing year since the 2011/12 marketing year and again the second lowest total in the past decade.

When looking at these figures as a percent of the November WASDE export projection, which was pegged at 1.90 billion bushels, current sales are even more alarming with 2018/19 exports as a percent of the November WASDE at 43.8%, the lowest percent since the 2005/06 season while total shipments as a percent of the November WASDE is 21.1%, the smallest since the 1990/91 season.

It appears that unless sort of breakthrough is achieved this week in Buenos Aires, the USDA's current soybean export forecast will have to be revised lower in subsequent WASDE reports.

This along with what appears to be the makings of a monstrous South American soybean crop continues to weigh on our soybean prices.

(KLM)

© Copyright 2018 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .