Canada Markets

Large Canola Exports Seen for a Fourth Week

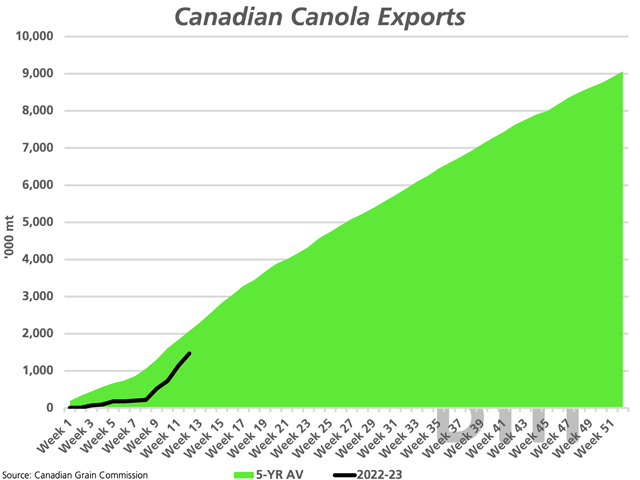

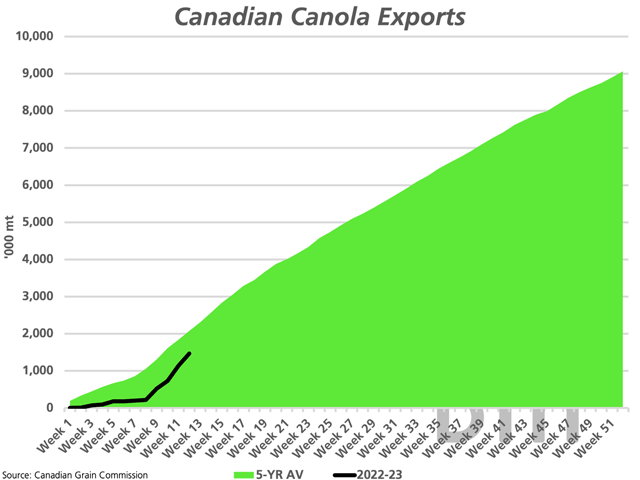

After a slow start to Canada's 2022-23 crop year canola exports, week 12 shows a fourth week of elevated activity with 332,000 mt shipped through licensed facilities in the week ending Oct. 23. Over four consecutive weeks (week 9-12), a total of 1.2484 million metric tons (mmt)have been exported, accounting for 85% of the 1.4702 mmt exported during the first 12 weeks. Volume during these four weeks ranges from 208,600 metric tons (mt) to 407,300 mt, while averaging 312,100 mt. For the first time in 12 weeks or the first 23% of the crop year, cumulative exports have moved ahead of the pace reported for the 2021-22 crop year.

This may seem disappointing, with 2021 production of 13.757 mmt down 32% from the previous five-year average (2016-2020) and exports falling by 50% from the previous 2020-21 crop year. At the average pace of movement seen over the past four weeks of 312,100 mt, it will take eight more weeks or until week 20 to move ahead of the five-year average pace, shown on the attached graphic by the green shaded area.

An unconfirmed Twitter post on Friday stated that China has purchased 1.8 mmt of canola for the November through January period, which bears watching.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A reported 273,200 mt of canola was unloaded at licensed terminals in week 12, which is the lowest weekly volume unloaded in four weeks. Cumulative unloads of 1.7355 mmt are down from 1.9049 mmt in the same period in 2021-22 while is the lowest volume unloaded over the first 12 weeks in at least the last 11 years.

Commercial stocks of 1.3483 mmt are down 17.3% from one year ago, while 12.4% below the five-year average. A reported 63.6% of this volume is situated in store primary elevators in the country.

It is also interesting to note that producer deliveries during the first 12 weeks of 4.3364 mmt are down 246,300 mt or 5.4% from one year ago although volumes may increase sharply as November delivery contracts are called in.

Pressure on railways to perform over the weeks and months ahead will be crucial.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .