Canada Markets

Licensed Canadian Exports as of Week 8

Tight grain stocks as of July 31 and a slower pace of harvest in the eastern prairies have contributed to a slow start to Canada's grain exports as of week 8, or the week ending Sept. 25. Total exports through licensed facilities total 4.2221 million metric tons, down 10.4% from last year while down 27% from the five-year average for this period.

When this eight-week period is compared to last year, wheat exports (excluding durum) are .7% higher, dry pea exports are 1.3% higher and lentils through bulk channels are up 37.3%. Canola exports are down 52.6% from the same period in 2021-22, durum is down 47.1%, oats are down 39.1%, flax is down 34.8% and barley is down 24.8%.

When compared to the five-year average for this period, wheat is relatively close at 11.2% lower, while barley exports are down 2.2%. Durum exports are down 46.1% and canola is showing the largest percentage drop, down 79.3%. Of the selected crops, bulk lentil exports are the only crop where exports are higher than average, up 112% from the five-year average.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

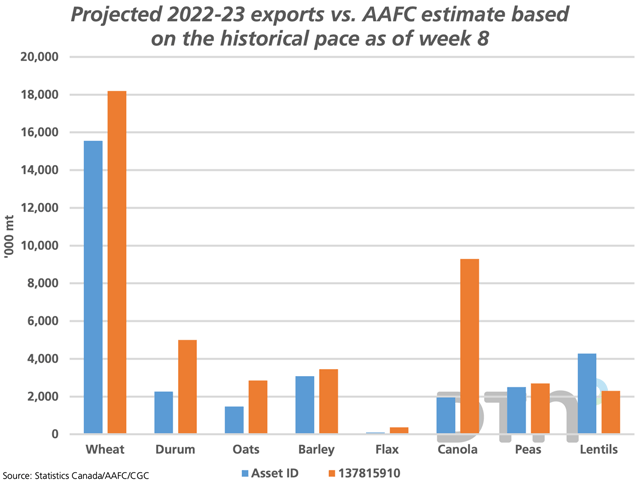

The blue bars on the attached chart show hypothetical exports for these crops based on exports over the first eight weeks of 2022-23 which are projected forward based on the five-year average pace, or the relationship between exports over the first eight weeks as a percentage of total crop year exports.

It is early days in the crop year and demand is expected to rebound sharply following the reduced harvest of 2021-22, with added help from the ongoing slide in the Canadian dollar. The wheat projection of 15.6 mmt is not far from the current AAFC forecast of 18.2 mmt. This can change fast, especially if movement as seen in week 8 continues; Canada exported 627,800 metric tons of wheat in week 8, which may be the largest volume ever shipped in a single week. Over the past five years, an average of 15.2% of total crop year exports of wheat were achieved in the first eight weeks, a pace used to calculate the 15.6 mmt forecast.

Canola exports are off to an extremely slow start. Over the past five years, an average of 11.3% of crop year exports are achieved in the first eight weeks of the crop year, while this pace is used to project forward to a hypothetical volume for 2022-23 of 1.9 mmt, which compares to the 9.3 mmt forecast released by AAFC this month. Clearly, movement is expected to pick up and will far exceed this forecast. Commercial stocks as of week 8 increased to 1.0427 mmt but is still the lowest volume reported in three years and down 19.7% from the five-year average.

It is interesting to note that as of week 8, cumulative movement of durum, barley, peas and lentils, all much smaller crops, have surpassed the volume of canola exports, although this will not last long.

Another crop that bears watching is lentils. Over the past five years, an average of 6.6% of total crop year exports are moved through the bulk handling system as of week 8. This pace is used to project total crop year exports at 4.3 mmt, well above the current AAFC forecast of 2.3 mmt, while the availability of stocks makes this forecast an impossibility.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow Cliff Jamieson on Twitter @CliffJamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .