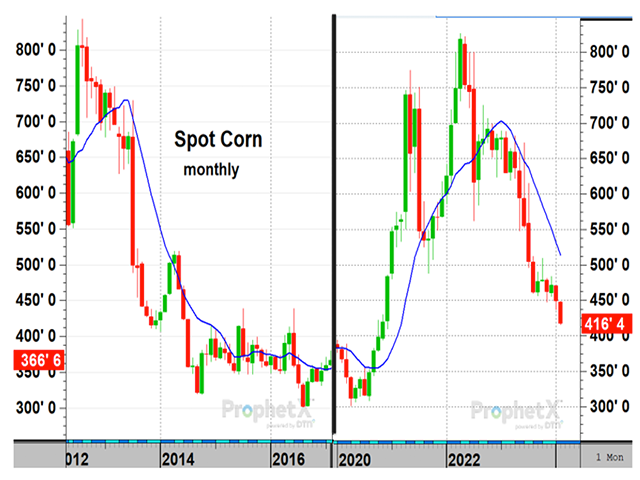

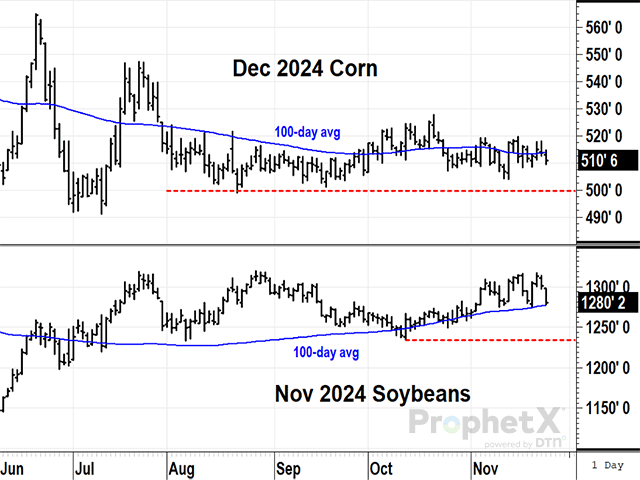

December 2023 corn bounced up from a low of $4.47 on Nov. 29, 2023, and December 2024 corn bounced up from a low of $4.46 on Feb. 26, 2024. I discuss the possibility of a double-bottom in new-crop corn.

December 2023 corn bounced up from a low of $4.47 on Nov. 29, 2023, and December 2024 corn bounced up from a low of $4.46 on Feb. 26, 2024. I discuss the possibility of a double-bottom in new-crop corn.

May soybeans made a nice move to end last week. Following a mostly neutral March WASDE report with respect to U.S. soybeans, May soybeans rose sharply to end the week, rising above the 20-day moving average for the first time since December. Given credit for the strength...

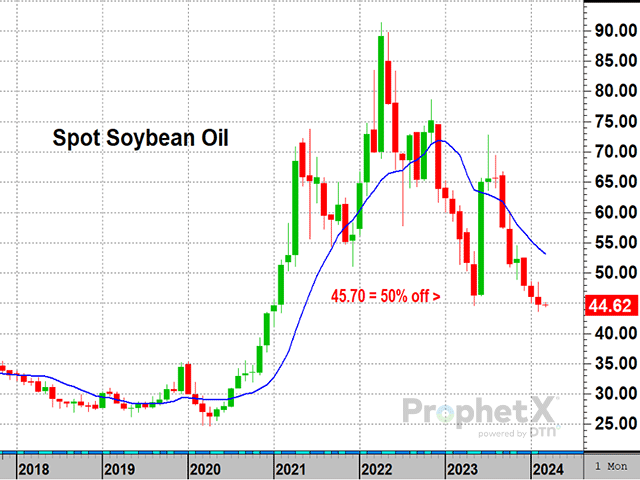

Spot soybean oil prices are testing long-term support near 45 cents at a time when the moods for corn, soybean and wheat prices remain bearish. Can the half-off sale in bean oil generate demand a second time?

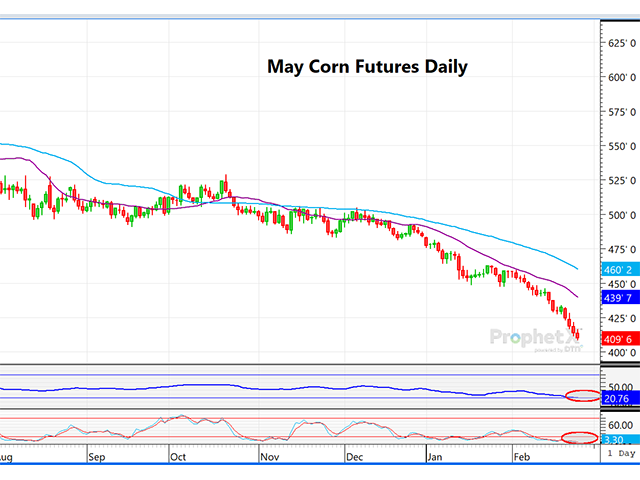

Corn has plummeted in the last several weeks with speculative funds adding to what is already a record net-short position in corn. Even as corn export sales are running ahead of USDA's projection and South American production estimates are falling below those of the USDA...

Spot corn prices experienced a similar sharp drop in 2013 and 2014, giving us a hint of what to look for in 2024.

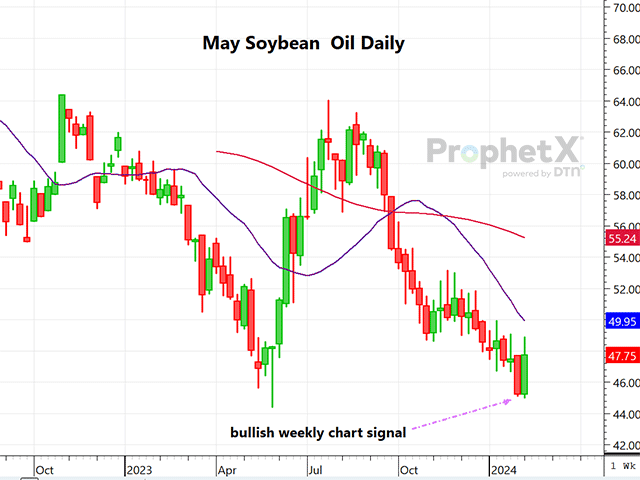

Soybean oil, along with soybeans and soymeal, has been in a downtrending pattern since July 2023. In the past week, nearby bean oil futures closed higher Monday through Thursday before ending the streak with a setback Friday. However, for the week, both March and May bean oil...

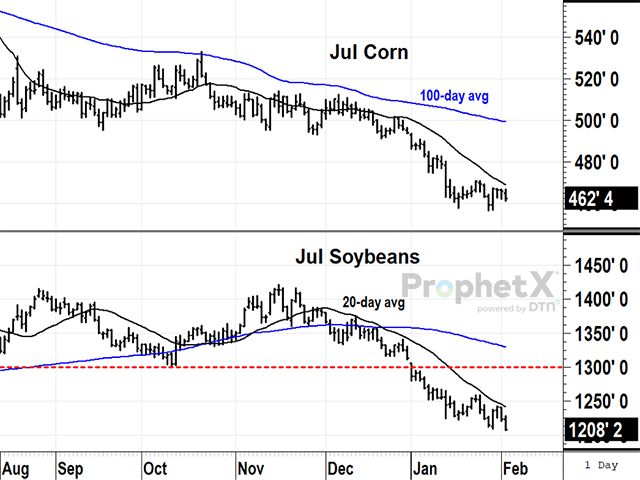

July contracts of corn and soybeans are off to a bearish start in 2024 and, although cheap, have yet to find support.

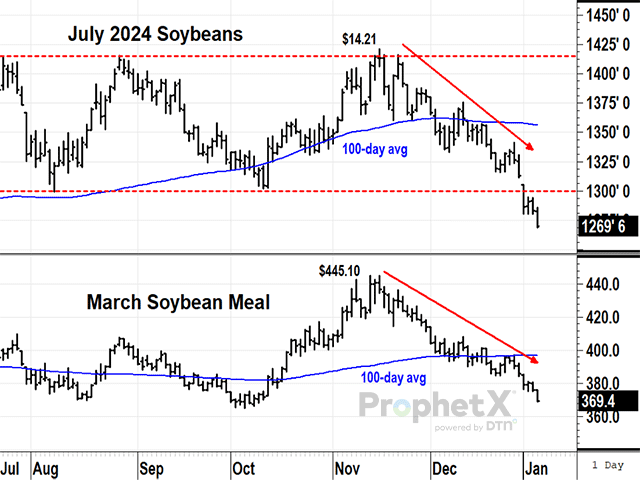

For the first time since June, March soybean futures broke under the $12.00 level. Even though there is plenty of growing weather yet to endure in Argentina, the Brazilian soy harvest is likely 10% to 11% done as of Monday. Although early yields have disappointed, Brazil's soybean...

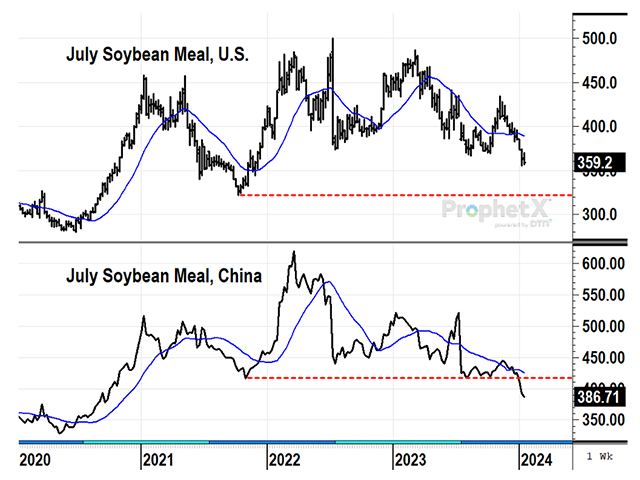

The recent drop in U.S. soybean meal prices is one view of a market that looks more bearish worldwide.

With the change in Brazil's weather pattern and the prospect for an Argentine soybean crop to be twice as large as a year ago, we have seen March soybean meal plunge as much as $92 per ton in 60 days. At the end of the week, we saw March soymeal match the season low, and...

For six months, bulls and bears in soybeans have been in a standoff, weighing the anticipation of tight U.S. supplies in 2023-24 versus another year of big production from South America. In the first days of January, the bears won.

After a weekend which saw good rains fall over some of the driest, major-producing regions of Brazil, spot March soybeans gapped more than 6 cents from the Friday low, plunging on ideas that weekend rains and the projection of more to come could still result in another...

On Monday, Dec. 18, U.S. Customs closed two rail lines into Mexico and markets took note. The prices of two important feeds for Mexico's livestock industry were briefly affected in different ways.

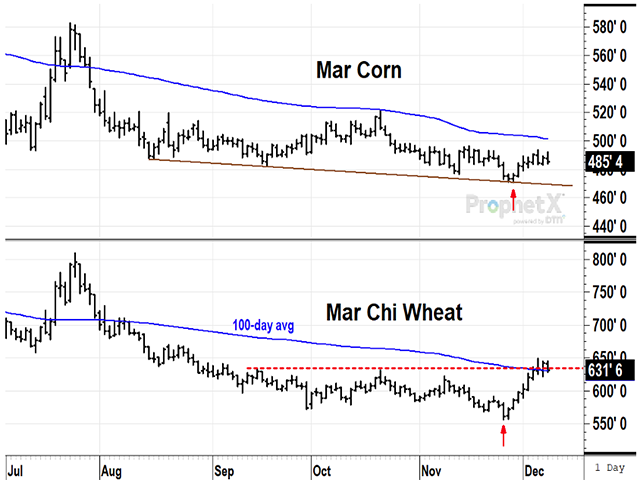

In the past few weeks, Chicago wheat has reacted to the purchase of over 41 mb of U.S. soft red winter wheat, rising for eight straight days before correcting. The last two days of the week, Chicago March finished strong, with some subtle signs the trend might continue.

Corn has plenty of supply and good demand. Chicago wheat supplies are lower than usual but have lacked demand. Both markets are looking for support.

Chicago wheat, with managed money funds as of November 28 reported to still be short a position of 124,000 contracts, got some good news with a new sale of 16 million bushels of soft red wheat, surged to big gains on Monday.

It's not too early to think about making sales in 2024, but so far prices show no hurry to head in either direction.

From the middle of October to the middle of November, January soybeans were on a march higher, rising $1.30 per bushel on concerning weather in Brazil and a pick-up in U.S. export demand. When the forecast for Brazil turned wetter, traders took that as a cue to sell soybeans...

After what appeared to be an overreaction to last week's subtly bearish soybean data on the November WASDE, soybeans have bounced back, gapping higher on Monday on the still bullish Brazilian weather, more U.S. soy sales to China and a soaring soymeal market, which again...

January soybean oil futures have plunged 16 cents just since August and are the short leg of product spreading. The weakness has come despite a still bullish outlook for soybean crush, soybean stocks and increasing capacity for renewable biodiesel. A potential positive sign is...

DIM[2x3] LBL[blogs-technically-speaking-list] SEL[[data-native-ad-target=articleList]] IDX[2] TMPL[news] T[]

DIM[2x3] LBL[blogs-technically-speaking-list-2] SEL[[data-native-ad-target=articleList]] IDX[5] TMPL[news] T[]