Technically Speaking

Crude, Heating Oil Maintain Weakness

Crude oil futures continue to labor under intense downward momentum, pushing to the lowest overnight since December of 2021. Spot crude oil futures are sharply below all long-term moving averages and now have bulls searching for the next area of support. From a pure price standpoint, crude oil futures don't have any major support candidates until the December 2021 highs around $72.50 to $73.00 or the corrective lows from late December around $66.04 if those do not hold. The January contract has already pushed through major Fibonacci retracement targets, so we're left with progression assumptions which can be suspect. The 100% progression of the $90.89 to $80.49 selloff snapped from the $92.53 corrective high on Nov. 7 would be $82.24, a level we smashed through last week. The 138.2% progression of that initial selloff is $78.27 which we are already trading through as well. Simply put, the trends are down and momentum is firmly on the side of the bears. In order to stem the tide, prices have to slow their rate of descent and recover above a level of merit to warrant lightening bearish exposure. At an absolute minimum, we would want to see trade above the $79.90 corrective high from Friday, but preferably, the $82.36 corrective high from Nov. 22.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In similar fashion to crude oil, heating oil futures have been under intense pressure of late. However, heating oil has not yet taken out the bottom end of its three- to four-month trading range. Momentum indicators are pointed sharply lower and have not yet begun to even slow, let alone bottom or reverse. This should not be confused with being "oversold," which has no useful application in technical analysis. Until momentum slows and begins to diverge with price, all these indicators tell us is how strong the current downtrend is. Fortunately for heating oil, the September lows around $3.02 to $3.04 are still intact, and would be expected to act as support should prices continue lower. From a pure value standpoint, prices at those levels would represent some of the "cheapest" of 2022. If they do not hold, however, additional downside would be expected as the next serious level of support would be either the $2.67 to $2.96 consolidation period in February, or further down at $2.60 from October 2021. These issues considered, a downward bias in heating oil should be maintained with the September lows being looked to for support if the bulls are to regain control.

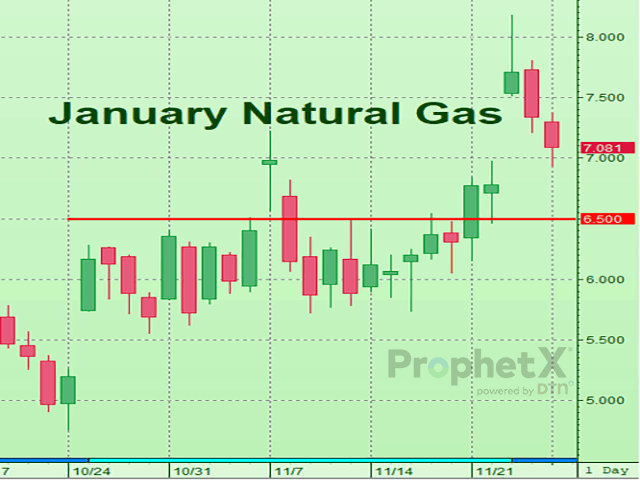

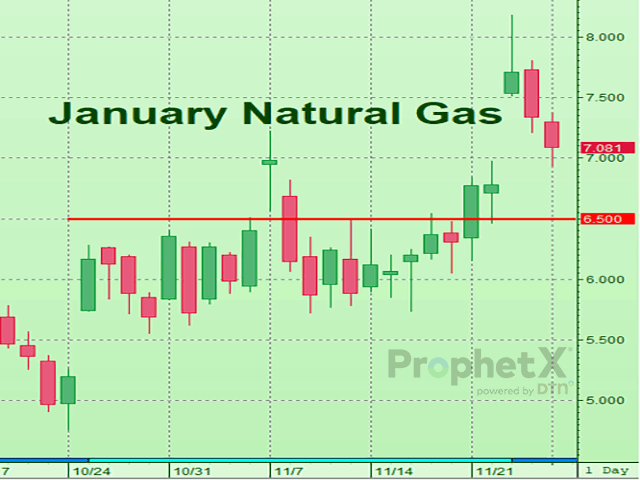

JANUARY NATURAL GAS:On the other end of the spectrum, natural gas futures have been enjoying a strong, albeit erratic, uptrend stemming from the late October lows. Several gaps and reversals have been notched the last 60 days with more expected as we move through winter. The indicator which has caught our eye of late has been stochastics, which seems to be featuring a bearish divergence with price. As prices made new highs on Nov. 23, momentum failed to score new highs, producing the divergence. That said, the fact natural gas has produced so many gaps could be throwing off the indicator slightly. In the overnight session, natural gas closed the gap from 11/22 to 11/23, which could allow a bit of support to enter following Friday and overnight's selloff. Holding the top end of the consolidation range from late October and early November would be a technical positive for bulls. These issues considered, a cautiously bullish policy is advised with understanding that momentum has slowed on the most recent rally higher in price.

**

Comments above are for educational purposes and are not meant to be specific trade recommendations. The buying and selling of grain and soybean futures involve substantial risk and are not suitable for everyone.

Tregg Cronin can be reached at tmcronin31@gmail.com

Follow Tregg on Twitter @5thWave_tcronin

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .