Sort & Cull

Live Cattle Prices Suffer Sharp Drop in Latest Week

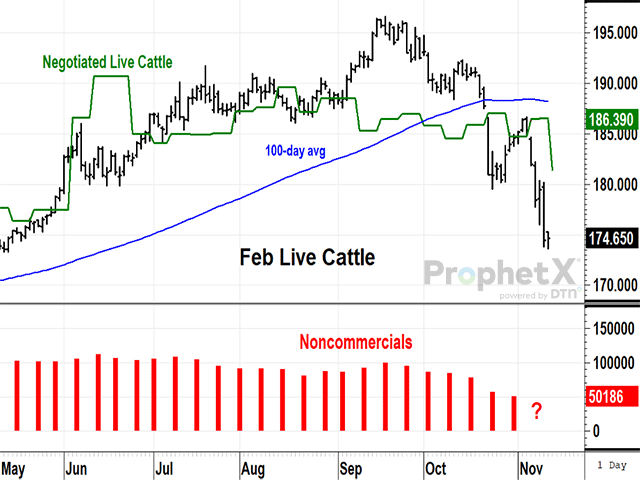

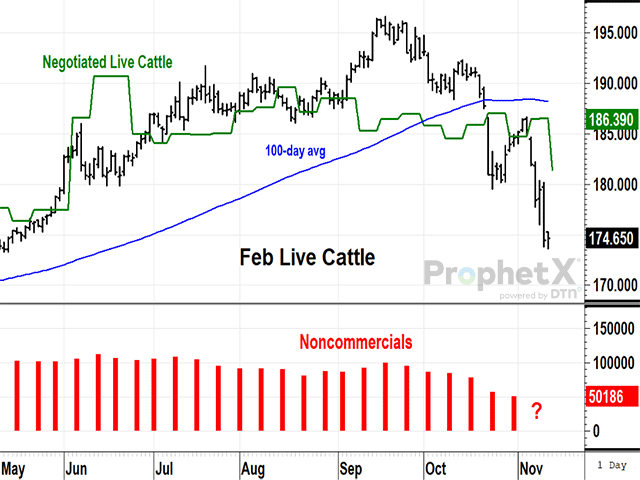

February live cattle fell $10.57 to $174.65 in the week ending Nov. 10, 2023, the lowest weekly close in six months and the first significant correction in cattle price since COVID-19 first appeared in 2020. We'll know more about cash trade from Monday's USDA reports of weighted averages, but DTN reports southern live trade at mostly $180 to $181, $4 to $5 lower on the week, while northern dressed trade was $5 to $7 lower at mostly $285 to $287.

Even with the week's lower cash trade, February futures prices are well below cattle's cash prices, a possible case of noncommercials panicking out of their long positions. It has been over a year and a half since specs had a more neutral position in the live cattle market and some shaking out of positions is not unusual. Due to an observance of Veterans Day on Friday, CFTC data on the most recent noncommercial positions won't be out until Monday afternoon.

The latest bearish influence on cattle prices started with higher-than-expected placements in the Oct. 20 on-feed report. This number showed up in Thursday's World Agricultural Supply and Demand Estimates (WASDE) report as a 235-million-pound increase in beef production in the first quarter of 2024. The week ending Nov. 10 also saw a reduction in weekly slaughter to an estimated 618,000 head, down 14,000 from the previous week. The price of choice boxed beef ended the week down $1.88, staying slightly above $300, while selects fell $4.59 to $267.42.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The lower pace of this week's slaughter also added to concerns on the demand side of the market as Federal Reserve Chairman Jerome Powell repeated the Fed's commitment to fighting inflation on Thursday, suggesting again another rate hike may be needed.

Technically speaking, the next likely spot for support in February cattle is around $160, where prices broke above resistance in February 2023, but there is no guarantee prices will be able to fall that far. A swing lower near $172 in May and another near $168 in March are two more likely candidates for support. In USDA's long-term baseline projections, USDA expects cattle inventory at 89.274 million head in 2023 to fall to 87.600 million head in 2024. Beef cow inventory is expected to drop from 28.918 million head in 2023 to 28.220 million head in 2024.

The next cattle on-feed report for Nov. 1 is due Friday, Nov. 17, and will probably also show higher placements than a year ago. More specific estimates will be released and reported on DTN later this week.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .