Sort & Cull

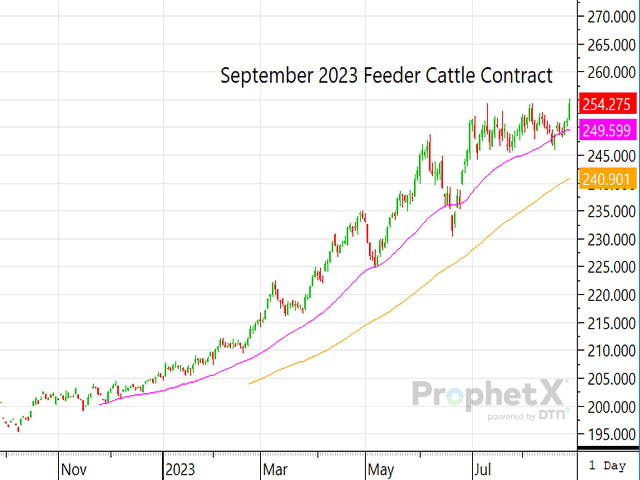

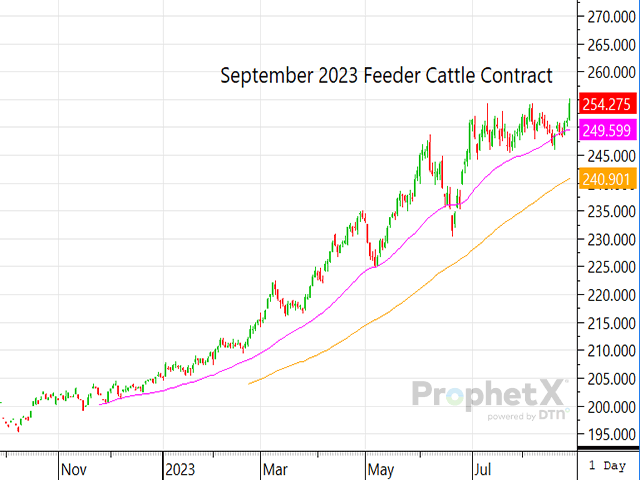

Feeder Cattle Scores New Life of Contract Highs Monday

Between sweltering temperatures, the unknown of what this year's corn crop is really going to amount to, and the hope that consumer demand holds strong -- cattlemen have been holding their breath through the final dog days of summer. However, over the last week, the cattle complex has seemed to grow more confident in its fundamental position, as traders are fully acknowledging that cattle supplies are going to remain alarmingly thin well into 2024.

Late last week, both the live cattle and feeder cattle contracts were well supported through the week's end, but it wasn't until Monday that traders boldly supported the feeder cattle complex. That's when several of the nearby contracts closed at new life of contract highs by the day's end.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

That begs the obvious question: Why?

Why, all of a sudden, have traders accepted, or are again acknowledging the strength behind the cattle complex?

The biggest reason why I believe the cattle complex is seeing greater technical support as of late is that the buildback of the U.S. cowherd hasn't started yet, which likely means that the duration of the market's strength will continue for at least another year if not more.

Whenever the cattle complex begins to see support, or begins to hold the upper hand of the market's leverage, producers immediately want to know how long it's going to last. The rally in 2014-15 lasted a year and a half, but this rally, the one we are currently witnessing, doesn't mirror the last. We have greater challenges ahead with higher interest rates, a compromised economy, and an election year looming. All of this will likely keep some producers from buying more cows in the immediate future and mean that the buildback from the liquidation endured over the last three years is going to be slowly recovered from.

I remain optimistic for the market and what lies ahead. Sure, there will be days of lower closes and weaker tones seen throughout this rallying market, but I truly believe that the market has more in store for producers before it waves its white flag and begins to traipse lower.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .