Minding Ag's Business

Farm Banks Issued More Loans, Built Equity in 2023

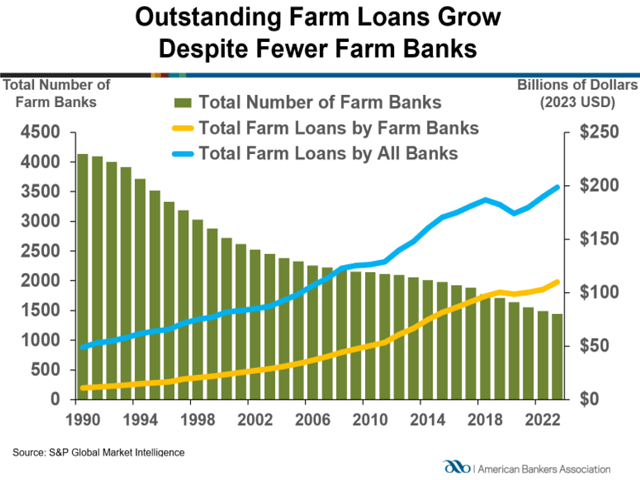

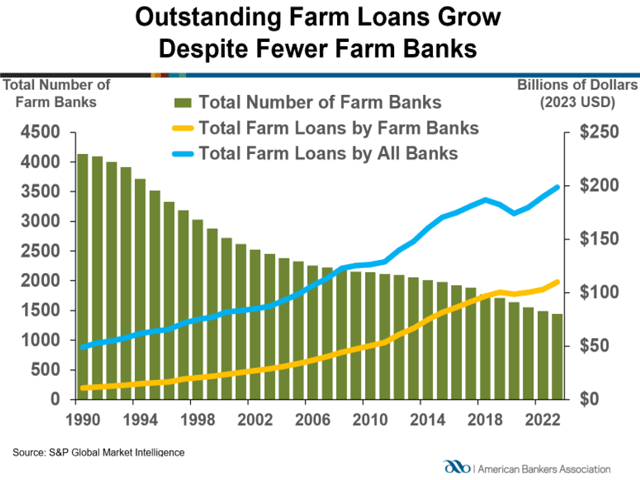

Banks held $199 billion in outstanding loans in 2023, about 38% of total agricultural lending, according to an analysis by the American Bankers Association (ABA).

The association's annual Farm Bank Performance Report examines the health of the nation's 1,442 farm banks that specialize in agricultural lending. ABA defines a farm bank as one whose ratio of farm loans to total loans is higher than the industry average.

"Farm banks continued to enjoy solid performance in 2023 with robust loan growth and historically low delinquency rates," ABA's Chief Economist Sayee Srinivasan said in a news release. "Moving forward in 2024, the agricultural sector will continue to face challenges due to monetary policy actions targeting persistent inflation in the U.S., as well as reduced federal support. Nevertheless, farm banks maintained their strong asset quality and consistent growth in high-quality capital, and they remain well-positioned to continue serving the needs of their customers and communities."

Most farm banks are small institutions with a median farm bank having $189 million in assets. Only 86 banks had assets over $1 billion. More than 98% of farm banks are profitable.

They remain a major source of credit to small farmers, the report states. More than two-thirds of small farm loans, which are $500,000 or less, are held by farm banks. Nearly half of those loans are considered micro-loans of $100,000 or less.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Farm banks experienced strong loan growth in 2023, with agricultural lending increasing 6.7% to $110 billion. That's up from $103.1 billion in 2022. Production loans climbed 10%.

The median noncurrent rate at farm banks, which reflects loans 90 days or more past due and loans in nonaccrual status, edged up by just 3 basis points to 0.23%. The broader banking sector, by comparison, has a noncurrent loan ratio of 0.27%.

"Government support during the pandemic enabled agricultural producers to pay down existing debt, which depressed loan demand in 2021," the report states. Fewer farmers need loans in 2022 amid record-setting net-farm incomes.

Deposits grew by 3% in 2023, but declined by 2.5% in the overall banking industry.

Farm banks also have strong, high-quality capital reserves, which make them well-prepared to manage potential economic headwinds. Equity capital climbed 14% in 2023 to $47.2 billion.

"Banks provide much-needed access to credit throughout rural America, but the industry can do even more with the help of Congress," said Ed Elfmann, ABA senior vice president, agricultural and rural banking policy.

The ABA has been lobbying Congress to pass the Access to Credit for our Rural Economy (ACRE) Act for nearly a decade. The bill would give rural bankers a tax exemption for interest income generated from loans secured with farm real estate like the tax exemption given to farm credit institutions and would allow them to lower interest rates for borrowers by about 0.5% to 1.5%. You can find more details on the bill here: https://www.dtnpf.com/….

"If enacted, ACRE would free up more capital to help farmers and ranchers directly, and it would encourage local farm banks to provide even more sound and productive credit in support of rural communities across the country," Elfman said.

You can find ABA's Farm Bank Performance Report here: https://www.aba.com/…

Katie Dehlinger can be reached at katie.dehlinger@dtn.com.

Follow her on X, formerly known as Twitter, at @KatieD_DTN.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .