Minding Ag's Business

Fertilizer Price Risk Would Grow if Israel-Hamas War Expands in Middle East

MT. JULIET, Tenn. (DTN) -- The Israel-Hamas war poses small direct risks to global fertilizer supply and demand, but should the conflict escalate, higher oil and natural gas prices could push prices higher.

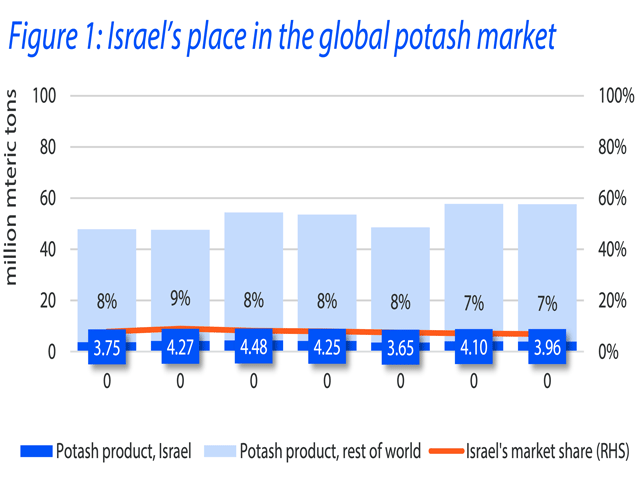

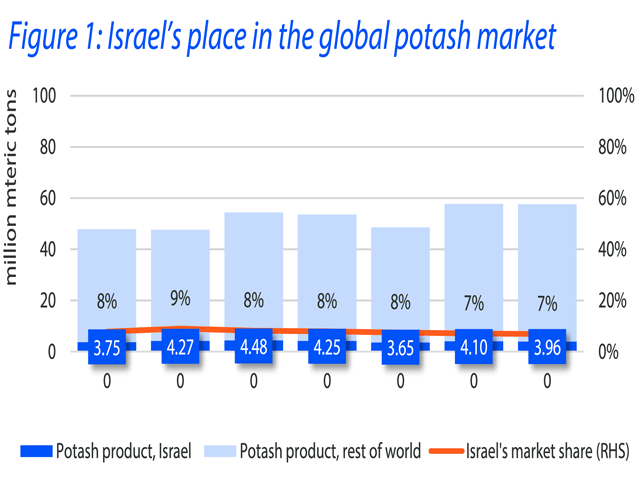

Rabobank farm inputs analyst Sam Taylor said Israel accounts for about 7% of global potash exports and 3% of phosphate exports. The potash and phosphate rock resources are mostly located in the Negev desert, more than 60 miles from the Gaza Strip, where most of the fighting is taking place.

"Everything seems to be functioning and flowing," Taylor said. "However, within the context of a broader mobilization, there is risk in the future that there could be some disruptions to logistics to manufacturing, but there's nothing to report now."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

An accompanying Rabobank research report notes that half of the country's potash exports depart from the Mediterranean port of Ashdod, which is much closer to the heart of the conflict, but that there is also another shipping option available on the Red Sea.

Global fertilizer markets also have sufficient supplies in other major producers like Russia, Belarus and Germany to fill any gaps that could arise from the Israel conflict. You can find the full report here: https://research.rabobank.com/….

"Where that does run the risk of impacting the sphere of global fertilizer prices is any broader proliferation of, or spreading of, the conflict," Taylor said. "Nitrogen prices are intrinsically linked with the hydrocarbon sphere. So, if we do start to see some broader disruptions in the Middle East -- other actors starting to be brought into this and the hydrocarbon sphere reacting as a result of that -- then there's probably some risk to nitrogen pricing."

For the upcoming 2024 season, Taylor pointed to nitrogen prices that are significantly lower than in 2023, and that's going to increase demand.

"I think we're penciling in a 4.85% increase in fertilizer demand volume in the 2023 season as farmers look to replenish their soil and adjust," he said.

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on X, formerly known as Twitter, at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .