Market Matters Blog

Divergence and the Rubber-Band Principle

I like the social media site Twitter. It brings a world of people sharing the same interests --though not necessarily the same opinions --to your computer screen opening the door to discussions on an untold number of topics. Recent examples, in my case, have covered behavioral economics in trading, the benefits of climate change and much discussion regarding the flow of money out of (and possibly into) grain and oilseed markets.

It's the latter I want to discuss in this blog post, following a question I received earlier in the week. I was asked, "Why did the (soybean) market not really do anything the day of the (USDA) report (Thursday, November 9) and are now down 20 cents this week?" This question came in Tuesday, when the January soybean contract was near its low for the week (so far) of $9.67, off 20 cents from last Friday's settlement of $9.87. My response was, "I see a collapse in the divergence between commercial and noncommercial traders. Last week's USDA numbers were "carp": Nothing bullish or bearish. However, Jan beans break below 4-week low and sell orders are triggered this week."

Do you see now why I need more than 280 characters for this particular question?

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Let's start with USDA's November numbers. In its monthly round of crop production and supply and demand guesses, USDA decreased 2017 production by 6 mb, despite leaving harvested area and national average yield unchanged, resulting in a 5 mb decrease in ending stocks and no changes made from previous demand guesses. Again, don't try to do the math. USDA's November ending stocks guess of 425 mb was well below its prognostication of 495 mb from last June. This keep the downtrend of USDA guesses in place, and in line with what is normally seen, and could ending with September 2018 quarterly stocks near 310 mb. For the week, January soybeans closed up 1/4 cent, but 21 cents off its weekly high.

That means, using this week's low of $9.67, the January contract is actually down 41 cents from last week's high. In my opinion, it has more to do with the noncommercial side of the market trying to get back in line with a commercial view that has been growing more bearish since August.

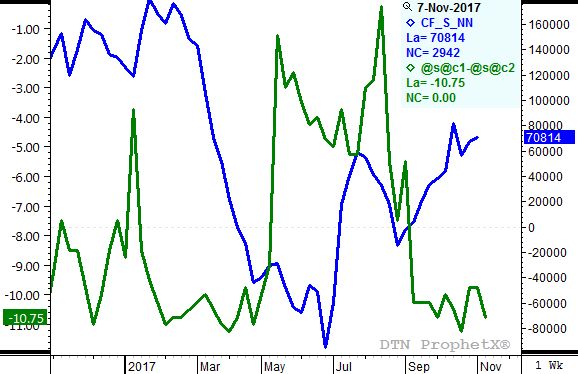

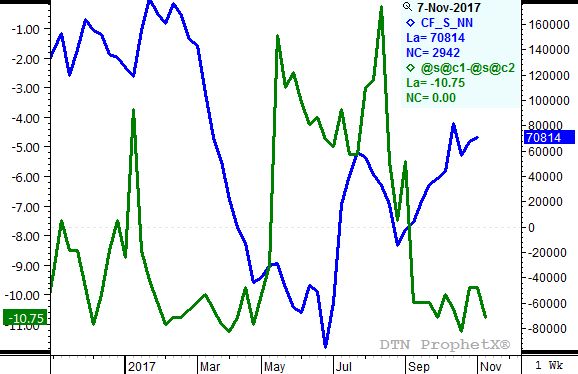

Take a look at the accompanying chart. The blue line represents the noncommercial net-long futures position (long futures minus short futures) reported each week by the CFTC in its Commitment of Traders reports. I use the Legacy reports, futures only. Notice that the latest report showed this group holding net-long futures of 70,814 contracts, an increase of 2,942 contracts from the previous week (these reports run from Tuesday to Tuesday). Meanwhile, as mentioned before, the commercial view continues to grow more bearish. Note the green line representing the nearby futures spread (nearby futures contract minus first deferred contract). Notice that it has been trending down, showing a stronger carry (more bearish view of fundamentals), while the noncommercial position has been trending up (larger net-long futures position).

Given that a market has only two sides, and in this case those sides were moving in opposite direction or diverging, I call this type of situation a "divergence." I've also described it using the Rubber-Band Principle, meaning that you can stretch a rubber-band only so far before it breaks and snaps back. In the case of commodity markets, that break usually means noncommercial traders tend to move, eventually and quickly, back in the direction of commercial traders. In the case of soybeans, that means selling some of their net-long futures position, maybe all before it's said and done, or before commercial traders start buying again.

The key is the commercial side usually (similar to the old four out of five dentists) doesn't change its mind based on silly USDA reports. Commercial traders leave that for noncommercials to do. Therefore, with the carry in the nearby futures spread bearish for quite some time, it was no surprise when noncommercial selling began, then accelerated as January soybeans moved through technical (chart based) price support.

For more information on that development, see the most recently Technically Speaking post on DTN.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

(BE)

© Copyright 2017 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .