Fundamentally Speaking

USDA Outlook Forum Wheat Projections

Wheat futures have surged over the past two weeks fueled by super strong domestic demand by the nation's flour mills as U.S. consumers stock up on flour, bread, pasta, noodles and a host of other wheat based foods that have increasingly been shunned over the past number of years linked to concerns about carbohydrates and gluten.

This price increase combined with a dollar whose foreign exchange value is close to 17-year highs will do nothing to enhance our export sales especially with more than adequate supplies in many competing countries.

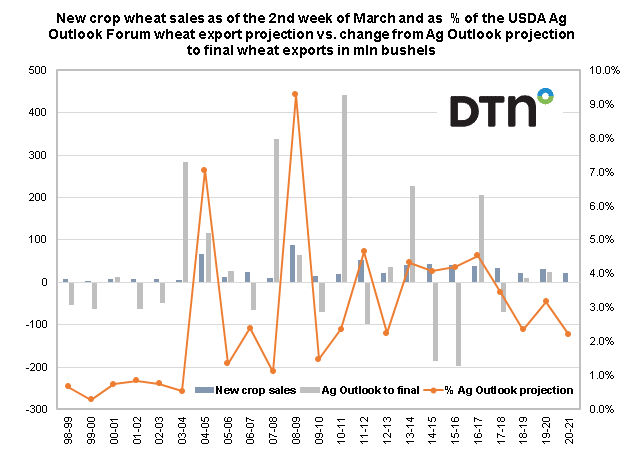

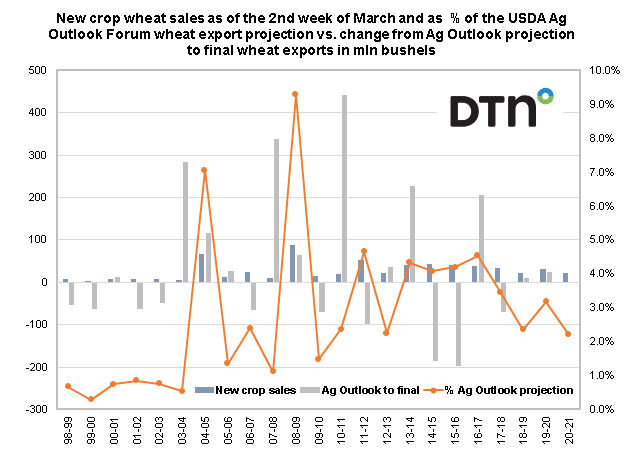

This graphic shows new crop wheat sales for the marketing year starting June 1 as of the second week of March in million bushels on the left hand axis and as percent of the USDA Ag Outlook Forum wheat export projection given in late February on the right hand axis.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

We also report the change from the Ag Outlook projection to what final wheat exports were for that marketing year in million bushels also on the left hand axis.

Current new crop wheat sales on the books as of the second week of March total 22.0 million bushels (mb) and other than the 21.8 mb sold as of this point in the year seen in the 2018/19 season and 2012/13 year, would be the lowest in ten years.

Given the USDA late last month pegged 2020/21 U.S. wheat exports at 1.00 billion bushels this is only 2.2% of the Ag Outlook projection, the lowest in that regard since the 2009/10 marketing year.

Still we note that the past two years the USDA has been right on the money with its Outlook Forum wheat export projection pegging it at 925 million in 2018/19 with the final figure 936 million.

Last February, USDA projected U.S. exports at 975 million while the USDA WASDE report earlier this month has projected final sales just 25 million higher at 1.0 billion bushels.

(KLM)

© Copyright 2020 DTN/The Progressive Farmer. All rights reserved.

Comments

To comment, please Log In or Join our Community .