Fundamentally Speaking

U.S. Corn Feed Use at 12-Year Highs

With regard to the feed grains complex, there has been a lot of focus on exports given the Phase 1 trade deal with China and what are apparently delays in planned expenditures given the ongoing coronavirus.

Trade is expecting corn, ethanol, and sorghum and DDG sales to be announced to the PRC at some point down the road.

So far, neither in the last week's WASDE report or at this week's USDA Agricultural Outlook Forum were enhanced overseas sales projections from the Phase 1 accord unveiled as the coronavirus is complicating the department's analysis.

Less talked about however but perhaps a very bullish development has been burgeoning feed usage of corn.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Recall USDA, in the wake of the surprising low December 1, 2019 quarterly corn stocks figure, boosted feed/residual usage for this marketing year by 250 million bushels to 5.525 billion bushels.

This is the highest figure in 12 years and may actually be too low as a large amount of the 2019 crop is of low quality and test weight due to last year's inclement weather.

We understand that both domestic feeders and ethanol plants are using more corn to offset lower conversion rates.

For the coming year we have seen some feed/residual estimates running as high as 5.750-5.800 billion bushels.

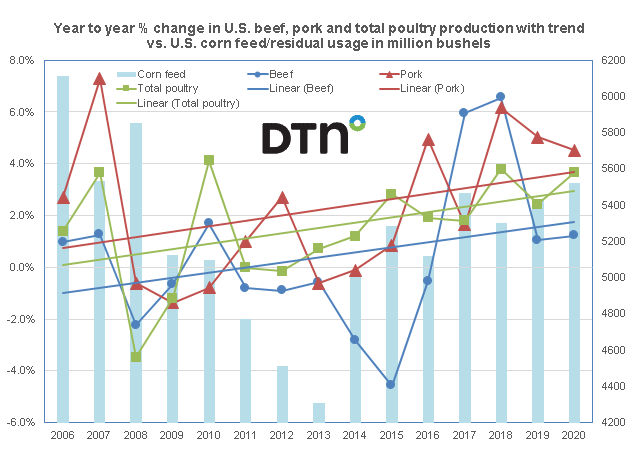

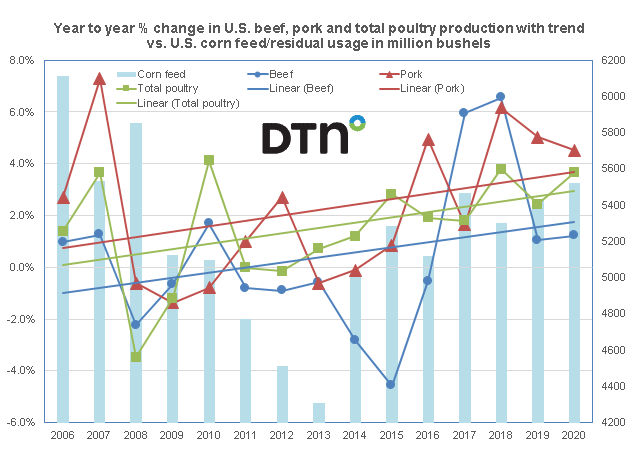

This post shows the year-to-year percent change in U.S. beef, pork and total poultry (broilers and turkey) production along with their respective linear trends on the left hand axis vs. U.S. corn feed/residual usage in million bushels on the right hand axis.

This year USDA is projecting beef production up 1.2% as the U.S. cattle herd has now entered the contractionary part of its cycle though pork output is up 4.5% matching its five-year average as pigs per litter numbers continue to grow.

Meanwhile Americans love affair with poultry continues given its perceived healthier image with combined broiler and turkey output up 2.4%, higher than the five-year average of a 2.2% gain.

All of this is occurring in era of growing plant-based meat and beverage production and consumption and many feel a large part of planned Chinese purchases as stipulated under Phase 1 trade accord could be for meat and poultry, especially with their own production pared by coronavirus, African swine fever and recurring incidents of bird flu.

(KM)

Comments

To comment, please Log In or Join our Community .