Canada Markets

Barley Exports Behind Forecast Pace

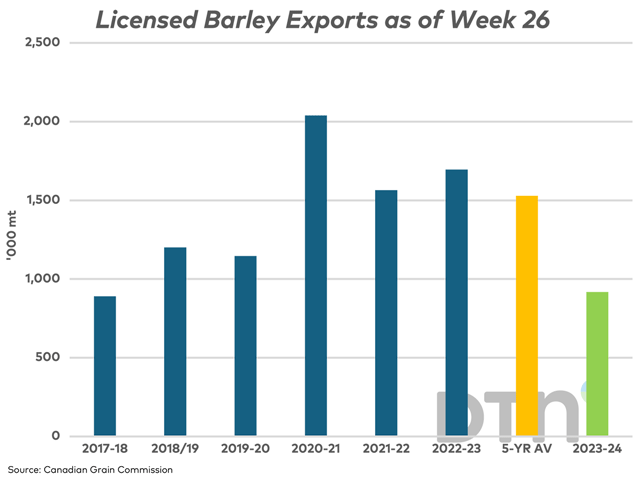

As of week 26, or the first half of the crop year, Canada's licensed barley exports were reported at 918,700 metric tons (mt), the smallest volume shipped over this period in six years or since 2017-18. This volume is down 45.8% from the same period last crop year and 40% below the five-year average for this period of 1.530 million metric tons (mmt).

The Canadian Grain Commission reported week 26 exports at 900 mt, down from 3,200 mt reported for the previous week, while the lowest weekly volume shipped in 20 weeks or since week 6, assuming the week 20/21 volume of 2,000 mt was shipped equally over the two weeks.

The plunge in exports is no surprise, with fresh competition from Australia this crop year after China opened the doors to allow for Australian imports in August. As of December, CGC data shows 868,600 mt of barley exports, with 91% of this volume destined for China, a volume that is down 656,300 mt or 45.4% from the same period in 2022-23.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

At the same time, the government's current export forecast points to crop year exports of 2.780 mmt (including products) for 2023-24, down 1.1 mmt or 28% from the previous crop year.

Over the past five years, grain exports as of week 26 or the first half of the crop year have averaged 45.6% of total crop year exports (including products). Over these years (2018-19 through 2022-23), this has ranged from a low of 39.3% of exports to a high of 58.6% as of week 26.

Based on the five-year average pace of movement over the first half of the crop year, total exports (including products) would indicate a forecast to 2 mmt, below the current 2.780 mmt government forecast.

Watch for further bearish revisions in this forecast, while price will be influenced by increasing stocks as well as price moves seen in the corn market. Trade is likely to remain quiet ahead of the Feb. 8 USDA WASDE report, with an updated view of South America's corn output potential.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2024 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .