Canada Markets

AAFC's Estimated Grain Stocks for 2023-24

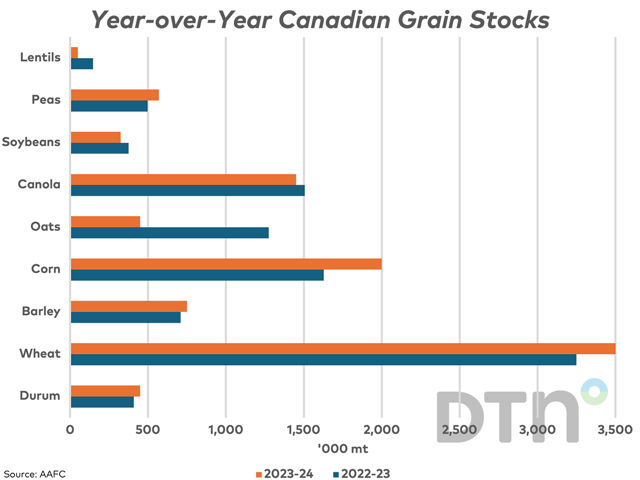

Agriculture and Agri-Food Canada's (AAFC) December edition of the Canada: Outlook for Principal Field Crops includes a 5.030 million metric ton (mmt)increase in the estimated 2023 production of all principal field crops, based on Statistics Canada's November estimates. This is the first survey-based report released by Statistics Canada for the season but it's the government's third stab at estimating demand based on available supplies from the three production reports released, based on July model data, August model data and November producer surveys.

The increase in production is only partially reduced by a 420,000 metric tons (mt) drop in crop imports in the calculation for crop year supplies, largely due to a 300,000 mt drop in forecast corn imports. At the same time, Canada's export demand and domestic use have been revised higher this month due to increased supplies. The end result is a modest 1.450 mmt increase in ending stocks of all principal field crops combined to 10.130 mmt, down just 346,000 mt from 2022-23 and 20,000 mt higher than 2021-22.

Of course, nothing is ever finalized when it comes to this data. Statistics Canada states that data is subject to revision for two years.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Two estimates that bear watching are found in the two largest crops: wheat and canola. This month's forecast includes an upward revision in the forecast for wheat exports (excluding durum) from 18 mmt to 20 mmt, consistent with the upward revision in the production estimate for wheat. At the same time, the current pace of wheat exports is close to 600,000 mt ahead of the steady pace needed to reach the 20 mmt forecast.

As well, as of week 19, the pace of canola exports is close to 600,000 mt behind the steady pace needed to reach the current 7.7 mmt forecast, which was left unchanged in December's report.

The largest year-over-year change in estimated stocks for the crops shown is seen for oats, as a combination of sharply lower acres and lower yield has resulted in production estimated down 50% from the previous crop year. Estimated stocks of 450,000 mt remain relatively close to the 333,000 mt carried out of 2021-2022, which was the tightest stocks seen in Statistics Canada since 1980.

The sharp drop in lentil stocks to 50,000 mt from 147,000 mt in 2022-23 also represents the tightest estimated stocks since 2010, or 14 years.

The next AAFC report to be released in January will include a first look at supply and demand estimates for 2024-25.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com.

Follow him on X, formerly known as Twitter, @CliffJamieson.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .