Canada Markets

Statistics Canada Revises Acreage Estimates

Statistics Canada released their Principal field crop areas, June 2023 report today, with seeded acre estimates revised based on producer surveys conducted from May 15 to June 12.

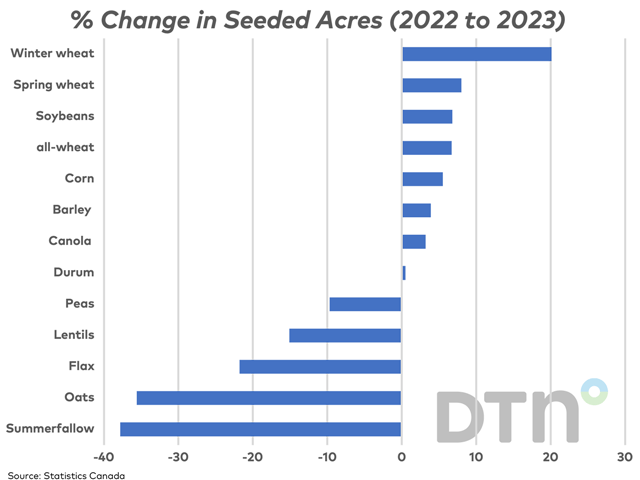

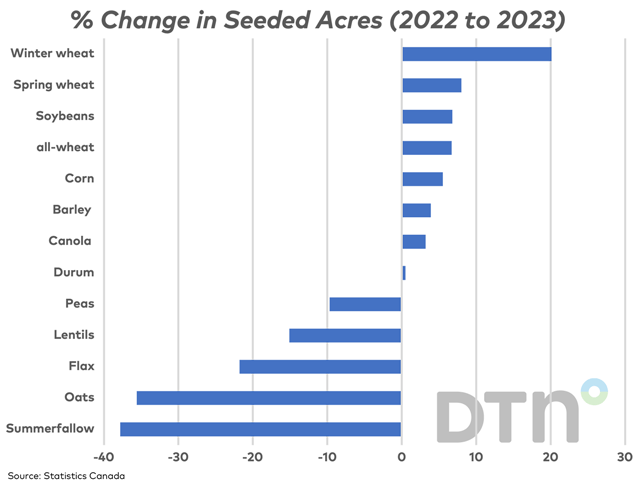

Canada's all-wheat acres were revised 45,900 acres lower from the estimate released in April to 26.922 million acres, up 6.7% from 2022 and 9.6% higher than the five-year average. This estimate falls at the upper end of the range of pre-report estimates, shown from 26.420 to 27 million acres. If achieved, this would be the largest all-wheat acres planted since 2001, or 22 years.

Spring wheat acres were revised 84,700 acres higher to 19.4746 million acres, also the highest area seeded since 2001. This is up 8% from 2022 and 10.6% higher than the five-year average. Of this area, 16.4321 million acres are estimated to be hard red spring wheat, accounting for 84.4% of the total spring wheat acres. This percentage has increased for a second year and is slightly lower than the five-year average of 85.1%.

Durum acres were tweaked lower by 28,100 acres to 6.034 million acres, up 0.5% from last year and 5.8% higher than the five-year average. This area falls close to the upper end of pre-report estimates.

Canada's winter wheat acres remaining are estimated at 1.414 million acres, up 236,200 acres or 20.1% from 2022. An estimated 75% of these acres are situated in Ontario, where 91% of the year-over-year increase is reported.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Statistics Canada estimates canola acres at 22.082 million acres, up 3.2% from last year and 1.8% higher than the five-year average. Pre-report estimates pointed to a range of 21.6 to 21.9 million acres, with today's estimate slightly higher than expectations. It is interesting to note that a 1 million year-over-year increase in acres in Saskatchewan offset a year-over-year drop in acres seen in both Manitoba and Alberta. At the time of writing, November canola is down $14.20/metric ton, following the lead of the soy complex, while continues to challenge psychological support at $700/mt.

Disappointing export opportunities along with a forecast increase in stocks led to flax acres revised lower to 609,000 acres, down 21.8% from 2022 and 32.4% below the five-year average. This would be the lowest flax acres seen since 1950; as recently as 2017, over 1 million acres were seeded while in 1999, 2 million acres were planted.

A similar situation exists for oats, with AAFC currently forecasting ending stocks to grow by 275% to 1.250 million metric tons in 2022-23. Oat acres were revised 519,300 acres below their initial estimate to 2.537 million acres, the largest revision made for any crop while to the lower end of pre-report estimates. This would be the smallest area dedicated to oats in Statistics Canada records that span back to 1908.

Barley acres were revised 236,200 acres higher this month to 7.321 million acres, up 3.9% from 2022 while 0.6% below the five-year average. The increase in acres is almost entirely due to increased acres in Alberta, which will be viewed as favorable for the western feed industry given the proximity of the crop.

Dry pea and lentil acres were revised lower this month, partially in response to growing disease concerns. Dry pea acres were revised 171,800 acres lower this month to 3.040 mmt, 9.7% below the 2022 acres and 21.8% below the five-year average. This area lands in the lower end of the range of pre-report estimates and would be the smallest area seeded since 2011, or 12 years.

Lentil acres were revised 306,600 acres lower to 3.669 million acres, 15.1% lower than seeded in 2022 and 9.6% below the five-year average. This area is below the range of pre-report estimates, while the smallest area seeded since 2014 or nine years.

Soybean acres were revised 119,500 acres higher by Statistics Canada this month to 5.631 million acres, slightly higher than the range of pre-report estimates, up 6.8% from 2022 and 2.2% higher than the five-year average. This would be the largest area seeded in four years. Ontario is estimated to seed slightly more than 50% of the nation's soybean acres, although faced a 5.4% drop in acres from 2022. The largest expansion in acres is seen in Manitoba, where acres increased by 460,600 acres or 40.6% in 2023 to 1.595 million acres, the highest seen in five years.

Canada's corn acres were revised modestly higher by 100,200 acres to 3.825 million acres, up 5.6% from 2022 and 5.2% higher than the five-year average. This is a record corn area for the country; while Ontario is estimated to seed 59% of the corn acres, the province's producers are forecast to seed slightly fewer than in 2022, while 87% of the year-over-year national increase is seen in the estimate for Manitoba.

Also driving an increase in planted area is a lower revision in summer fallow acres for 2023, down 37.7% from 2022 at 1.239 million acres, which is a record low.

Attention will quickly shift to weather, with southern and western areas of the province to potentially miss out on forecast precipitation over the next seven days, while most of the prairies are to experience daytime highs that are 4-6 C above normal over the next five days. Environment Canada heat warnings are currently seen for areas of northern Alberta along with central and southern Alberta, poised to continue over the next 3-5 days.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .