Canada Markets

Projected Crop Year Exports Based on the Historical Pace

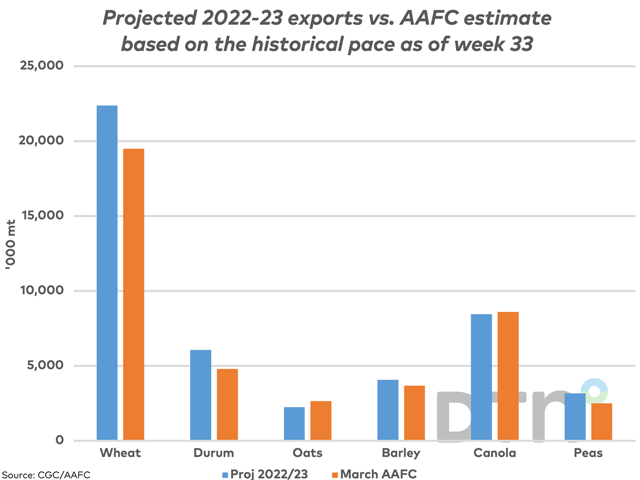

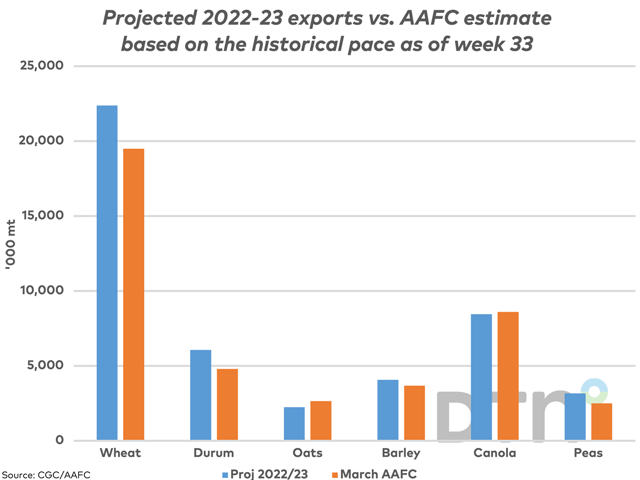

As of week 33, or the week ending March 19, cumulative wheat exports (excluding durum) through licensed facilities in Canada totaled 12.8025 million metric tons (mmt). This volume is up 71.3% from the same period in 2021-22 and is 26.1% higher than the five-year average. During the past five years, an average of 57.2% of total crop year exports was shipped through licensed facilities during the first 33 weeks, while this historical pace projects forward to 23.380 mmt of wheat exports, well-above the current 19.5 mmt AAFC forecast. Of course, supplies may be a limiting factor; while AAFC has repeatedly revised higher their wheat forecast since their first forecast in January 2022, the historical pace of movement would suggest that they will continue to do so.

Durum exports as of week 33 are reported at 3.5427 mmt, up 127.5% from the same period in 2021-22 and 32.6% higher than the five-year average for this period. Week 33 saw durum exports of 196,300 metric tons (mt), the largest volume shipped in 17 weeks and the second-largest weekly volume shipped this crop year. During the past five-years, an average of 58.5% of crop year exports were achieved as of the CGC's week 33 data, a pace that projects forward to crop year exports of 6 mmt, a volume that is not possible given Statistics Canada's current estimate of supplies. Licensed exports as of week 33 are ahead of the steady pace needed to reach this forecast.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Cumulative canola futures as of week 33 are up 41.7% from a year ago and 6.5% below the five-year average at 5.6948 mmt. During the past five years, an average of 67.3% of crop year exports were achieved as of the CGC's week 33 data, which projects forward to crop year exports of 8.456 mmt, very close to the current 8.6 mmt forecast. At the same time, a calculation made that assumes a steady pace of exports throughout the crop year would indicate that the current volume shipped is 237,110 mt ahead of the steady pace needed to reach the current forecast.

Looking at the smaller crops shown, the current pace of exports would point to oat exports that will struggle to reach the current forecast while exports of both barley and peas could exceed the current government demand forecast although supplies may be a limiting factor.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .