Canada Markets

Producer Deliveries vs. the Forecast Change in Demand

The DTN Canada site's Nov. 3 Winnipeg Pit Talk column focused on a lack of feed barley coming to market despite a sharp rise in 2022 production, currently forecast at close to 2.5 million metric tons (mmt) above the volume achieved in 2021. A number of reasons were listed, including poor logistics needed to move grain across the Prairies, as well as a lack of producer selling.

One could perhaps also question whether the crop is as large as anticipated, with Statistics Canada to release its next estimates based on producer surveys on Dec. 2. In addition, railway failures during the first 13 weeks may have played a role in backing up grain on the Prairies, with the AG Transport Coalition's Weekly Performance Update for week 12 pointing to railway cancellations of 2,666 hopper cars while outstanding orders as of week 12 totaled 2,338 cars. One last factor that should be considered is the late harvest across the eastern Prairies that may have led to a cautious approach to sales in front-end positions.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

DTN commentary on Nov. 3 pointed to a Twitter post by an Alberta grain broker noting that approximately 40,000 mt of U.S. corn has just traded into southern Alberta, indicating "the demand for U.S. corn will continue to increase as barley becomes more difficult to buy."

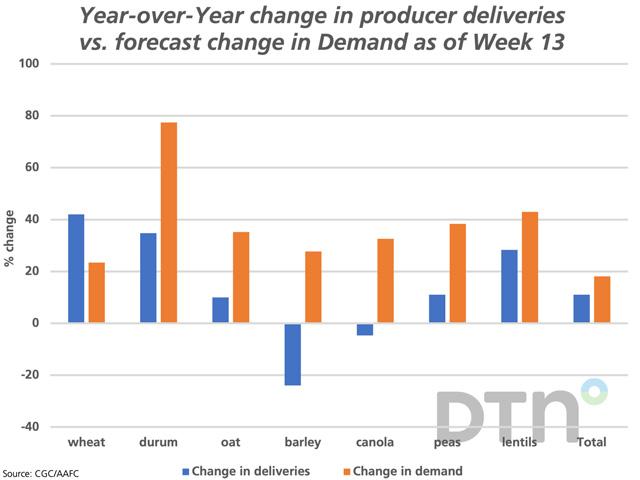

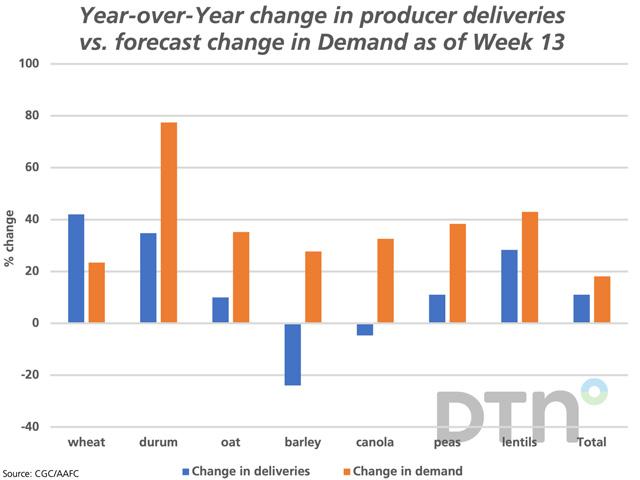

The attached chart compares the percent change in year-over-year deliveries into licensed facilities as of week 13, or the first quarter of the crop year (blue bars) which are compared to the year-over-year change in demand, as forecast in Agriculture and Agri-Food Canada's October estimates.

Across all crops, licensed producer deliveries or all crops have totaled 16.914 mmt over 13 weeks, up 11% or 1.673 mmt from the same period last crop year while up 869,840 mt from the five-year average. At the same time, AAFC is forecasting total demand for all principal field crops to rise by 18.1% in 2022-23.

It is interesting to see the data for wheat that shows cumulative wheat deliveries up 42% during the same period in 2021-22, while total demand is forecast to rise by 23.4%. Canola deliveries are down 4.7% from last year while AAFC is forecasting total demand (exports plus crush) to increase by 38.3%.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .