Canada Markets

Durum Exports Slow, but Hopeful Signs Exist

The Canadian Grain Commission reported 130,900 metric tons of durum exported in week 11, or the week ending Oct. 16. This is the largest weekly volume shipped in the 11 weeks of this crop year, while also the largest weekly volume shipped since week 5 of the 2021-22 crop year.

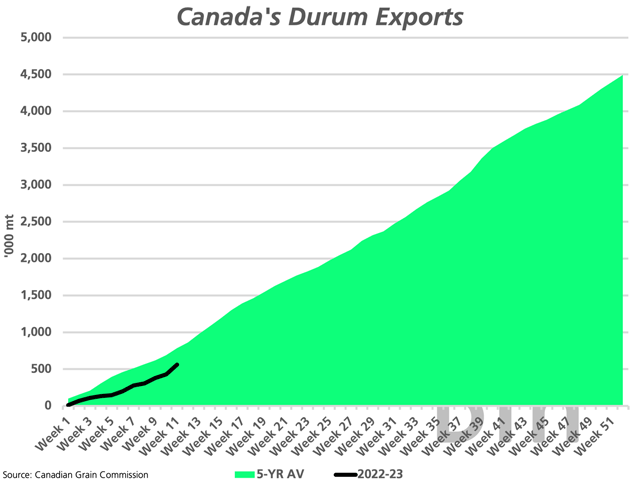

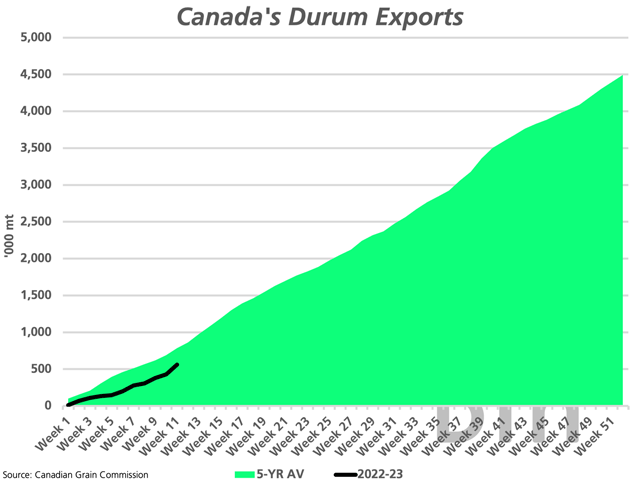

As seen by the path of the black line on the attached chart, cumulative exports of 560,200 mt are down 224,540 mt, or 28.6%, from the five-year average, while even down 23.8% from the pace set in 2021-22 despite sharply reduced production.

During the past five years, an average of 18.4% of the crop year's total exports have been achieved in CGC data as of week 11, a pace that projects forward to 2022-23 exports of 3.045 million metric tons, well-below the 5 mmt forecast released by Agriculture and Agri-Food Canada.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

While early data appears troubling, a further look does show some positive signals. Producer deliveries into licensed facilities of 1.0845 mmt are well above the 821,900 mt delivered over the same period in 2021-22 and 25% higher than the five-year average.

Commercial stocks of durum in licensed facilities of 834,700 mt are up from 659,300 mt reported one year ago and 17.3% higher than the five-year average. When the location of the stocks is taken into account, 53% of the reported commercial stocks are reported in primary elevators in the country, which is the lowest percentage calculated for this week over the past four years, while slightly below the five-year average of 53.9%.

PDQinfo.ca cash bids show prices stabilizing this week. A look at the southeast Saskatchewan average of $480.73/mt as of Oct. 20 is $95.44/mt higher than the September low, while near the highest reported since early July. Despite the rising bids, week 11 deliveries fell by 24,700 mt from the previous week as harvest deliveries come to an end, which may force buyers to sharpen their pencils.

It is interesting to note the spread between DTN's cash durum index and cash spring wheat index. This spread closed at a modest $0.02/bushel USD on Oct. 20, which compares to the five-year average on this date at $1.24/bu USD (durum over spring wheat) and the 10-year average of $1.38/bu. Focus will soon shift to 2023 acres and this relationship may need to improve in order to buy durum acres.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .