Canada Markets

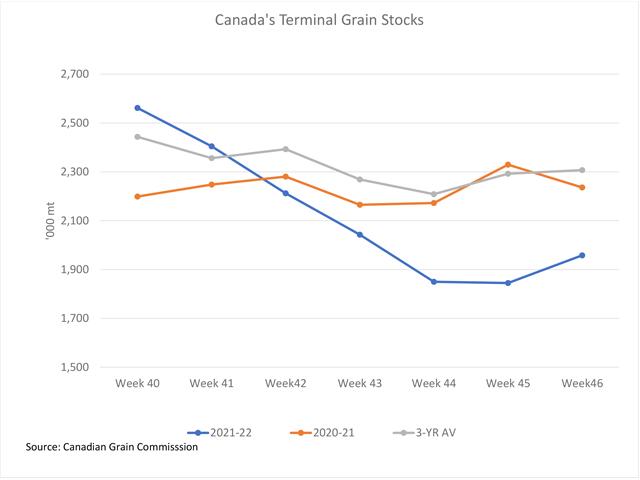

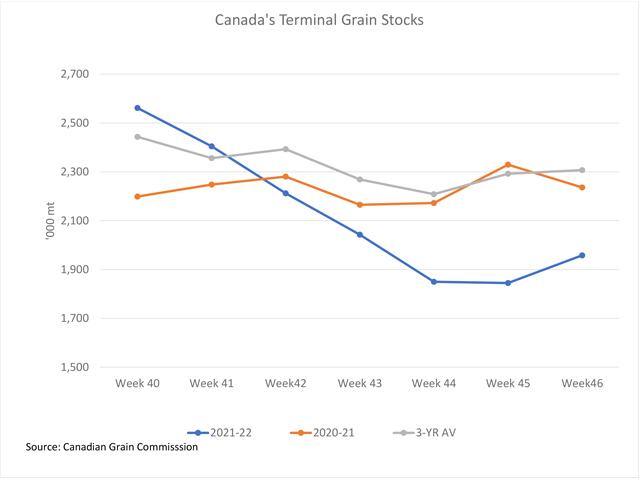

Canada's Terminal Stocks as of Week 46

Despite Canada's sharply reduced grain supplies in 2021-22, with principal field crop supplies estimated down 29.035 million metric tons (mmt)or 24.8% from the previous crop year, terminal inventory (blue line on attached chart) as we near the end of the crop year was reported higher than the same week in 2020-21 and the three-year average as recent as week 41, or five weeks ago.

After falling for five consecutive weeks, from 2.562 mmt in week 40 to 1.845 mmt in week 45, inventory rose modestly to 1.958 mmt in week 46. This volume is down 12.4% from the same week in 2020-21 and down 15.1% from the three-year average for this week.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

It is interesting to note that canola stocks instore terminals s reported at 235,500 mt, down 37.4% from the three-year average as exporters and crushers square off over tight stocks.

At the same time, wheat stocks (excluding durum) of 1.1045 mmt are 6.9% higher than the three-year average. Buyers may be well-positioned for the weeks ahead or may have mis-read the market's potential. As of week 46, cumulative exports of all-wheat through licensed channels are down 47.8% from one year ago, while AAFC has forecast all-wheat exports to fall by 43.7% year-over-year.

Cliff Jamieson can be reached at cliff.jamieson@dtn.com

Follow him on Twitter @Cliff Jamieson

(c) Copyright 2022 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .