Ag Weather Forum

Can Argentina's Weather Help Pick Up Potential Slack from Brazil's Crop Production?

Weather conditions in Brazil have not been good so far this season with too little rain in central and northern growing areas and too much rain across the south. Production concerns in this part of the world are still around, even though central areas have found more rain recently and more is forecast going into December.

Argentina, on the other hand, has been quietly having a run of much better weather.

It did not start that way, as early corn plantings were delayed by dry soils coming off last season's historic drought and cold temperatures. Corn planting is still only at 32% complete while soybeans lag at 44% complete, according to the Buenos Aires Grain Exchange. Both numbers are slightly behind the five-year average, but better than last year's pace (25% and 30%, respectively). And the weather over the last several weeks has been overall favorable. Rapid progress is being made after a slow start to both.

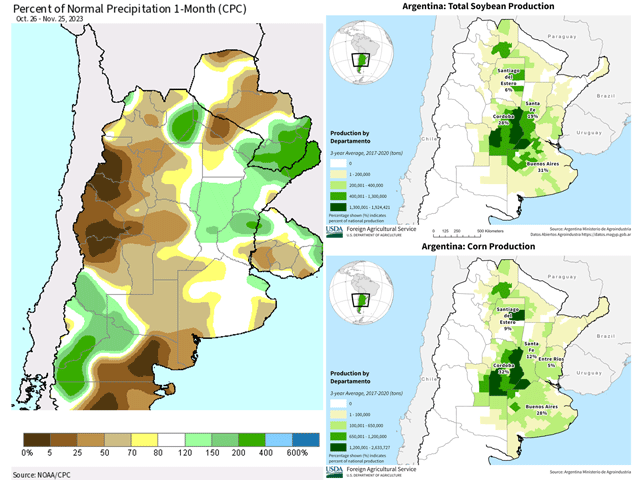

Since coming off the historic drought, soil moisture is almost back up to normal in several key growing areas. Precipitation over the last month, as seen in the attached graphic, is relatively close to or above normal for many parts of the Pampas region ranging from northern La Pampa and Buenos Aires up through Santa Fe and Entre Rios states.

Eastern and northern growing areas in this region have seen much better rain in recent weeks. The areas yet to see beneficial rain are in the western end of the country, which includes a large portion of Cordoba, another primary state in the Pampas region and overall production leader for corn and soybeans.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

However, when compared to this time last year, conditions for growth are much improved region-wide.

The same Buenos Aires Grain Exchange report notes that 26% of corn is in excellent condition compared to just 15% at this point last season. But the real takeaway is that just 2% of corn is currently in poor condition compared with 25% last year. The difference between the two years is likely to expand as the dryness in Argentina only got worse in 2023 but is forecast to remain favorable for 2024.

Precipitation this week has been good in the drier western areas with many spots hitting over 20 millimeters (about 0.8 inches) in Cordoba and northern La Pampa. And the rain is not done.

There is another system moving through the entire growing area with scattered showers on Nov. 30 and Dec. 1 that will add to totals, and showers are likely to continue over the weekend as well. And though drier conditions are likely next week, there are still some indications for scattered showers at various points, culminating in a higher potential for widespread moderate to heavy coverage next weekend.

Looking beyond the next week, long-range forecasts from all major weather models point toward near- or above-normal precipitation for December, January and February, filling out a good portion of the growing season with needed rainfall. Of course, there are bound to be stretches of hot and dry conditions as there are every summer, but the overall outlook is favorable for a rebound in crop production out of Argentina this year.

In the 2022-23 marketing year, USDA estimated that Argentina produced just 34 million metric tons (mmt) of corn and 25 mmt of soybeans. This marketing year, the agency predicts the production of 55 mmt of corn and 48 mmt of soybeans, close to double last year's production and a return of near-trend-line production. If Argentina does indeed come close to that level of production, it would bolster supplies of both commodities at a time when production estimates are falling in neighboring Brazil due to the harsh weather conditions early this season. However, this was already factored in at the start of the crop year and Argentina would have to find additional production to make up for the potential losses in Brazil.

Still, the large increase in this season's crop out of Argentina is holding, and keeping markets from getting too tight, especially when it comes to soybeans.

**

To find more international weather conditions and your local forecast from DTN, visit https://www.dtnpf.com/….

John Baranick can be reached at john.baranick@dtn.com.

(c) Copyright 2023 DTN, LLC. All rights reserved.

Comments

To comment, please Log In or Join our Community .