Technically Speaking

Weekly Analysis: Grain Markets

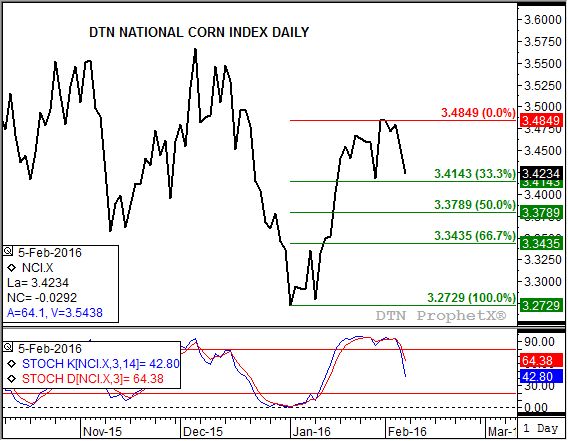

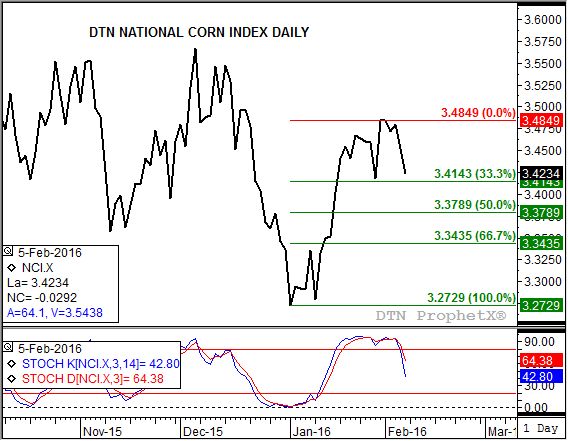

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.42 1/4, down 6 1/4 cents for the week. Despite the lower weekly close the secondary (intermediate-term) trend still looks to be up. However, the minor (short-term) trend has turned down with initial support near $3.41 1/2. This price marks the 33% retracement level of the previous minor uptrend from $3.27 1/4 through the high of $3.48 1/2. The 50% retracement level is down near $3.38. Daily stochastics are bearish.

Corn (Old-crop futures): The March contract closed 6.25cts lower at $3.65 3/4. The futures contract moved back into a secondary (intermediate-term) sideways trend as the minor (short-term) trend turned down. Initial minor support is pegged near $3.65 1/4, the 33% retracement level of the previous uptrend from $3.48 1/2 through last Tuesday's high of $3.73 3/4. A move below this support would signal an extended minor downtrend to the 67% retracement level of $3.56 3/4.

Corn (New-crop futures): The December 2016 contract closed at $3.89 1/4, down 4 cents for the week. Despite the lower weekly close the contract looks to still be in a secondary (intermediate-term) uptrend. However, like the NCI.X and thee March futures contract, the minor (short-term) trend has turned down with daily stochastics now bearish. Initial support is near $3.88 1/4, then $3.84 3/4, and finally $3.81, $3.81 1/4.

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $8.19 1/2, down 16 cents for the week. The secondary (intermediate-term) trend has turned sideways again between resistance near $8.48 and support at the major (long-term) low of $8.08 1/2. Weekly stochastics are neutral-to-bearish above the oversold level of 20%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybeans (Old-crop futures): The March contract closed 14.75cts lower at $8.67 1/2. While the secondary (intermediate-term) trend remains sideways, last week's bearish close could lead to renewed selling. Initial support is at the recent of $8.52, then the contract low of $8.47. Weekly stochastics are neutral-to-bearish above the oversold level of 20%.

Soybeans (New-crop futures): The November 2016 contract closed 9.755cts lower at $8.83 3/4. Despite the lower close it could still be argued, technically, that the secondary (intermediate-term) trend is up. However, bearish weekly stochastics could lead to another test of support near $8.75 1/2. The contract low is down at $8.50.

SRW Wheat (Cash): The DTN SRW Wheat National Index (SR.X, national average cash price) closed at $4.25, down 12 1/4 cents for the week. The SR.X posted a bearish outside week last week, indicating potential selling to continue. If so, initial support could be found at the recent low of $4.18 3/4, then the major low of $4.10 3/4.

SRW Wheat (New-crop futures): The July 2016 Chicago contract closed 14 3/4cts lower at $4.75 3/4. The secondary (intermediate-term) trend looks to have turned sideways following last week's sell-off. Resistance is at the 4-week high of $4.99 while support is at the contract low of $4.69 1/4.

HRW Wheat (Cash): The DTN HRW Wheat National Index (HW.X, national average cash price) closed at $3.97, down 17 1/4 cents for the week. The secondary (intermediate-term) trend turned sideways again with last week's close a test of major (long-term) support at the low near $3.95 1/4. Resistance is at the 4-week high of $4.21 3/4.

HRW Wheat (New-crop futures): The July 2016 Kansas City contract closed 19.25cts lower at $4.73 last week. The secondary (intermediate-term) trend turned down again as the July KC wheat posted a new contract low of $4.71 1/4. Weekly stochastics turned bearish, falling back below the oversold level of 20%.

HRS Wheat (Cash): The DTN HRS Wheat National Index (SW.X, national average cash price) closed at $4.66, down 11 cents for the week. The secondary (intermediate-term) trend is down. Initial support is at the previous low of $4.56, then the major (long-term) low of $4.44.

HRS Wheat (New-crop futures): The September 2016 Minneapolis contract closed 7.50cts lower at $5.14 1/4. The secondary (intermediate-term) trend turned down as Sep Minneapolis wheat posted (and closed at) a new contract low of $5.14 1/4. However, weekly stochastics continue to show the contract is sharply oversold and vulnerable to renewed buying interest.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .