Technically Speaking

Weekly Analysis: Grain Markets

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.55, up 5 cents for the week. The secondary (intermediate-term) trend remains sideways-to-up with the NCI.X needing a move beyond its triple-top near $3.64 to signal a bullish breakout. Weekly stochastics are bullish indicating momentum could continue to build. Retracement resistance is pegged between $3.67 and $3.80, prices that mark the 50% and 67% levels of the previous downtrend from $4.06 through the low of $3.28. National average basis firmed 2 cents again last week, with Friday's NCI.X coming in 30 cents below the close of the December futures contract.

Corn (Dec futures): The December contract closed 2.25cts higher at $3.82 1/4. Technical indicators show the contract to be in a secondary (intermediate-term) uptrend, with weekly stochastics growing more bullish. However the contract is testing resistance between $3.81 1/4 and $3.86, prices that mark the 33% and 50% retracement levels of the previous downtrend from $3.99 3/4 through the low of $3.72. The 4-week high is at $3.87 1/2. Friday's CFTC Commitments of Traders report showed noncommercial interests adding 4,070 contracts to their net-long futures position.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybeans (Cash): The DTN National Soybean Index (NSI.X, national average cash price) closed at $8.31, down 9 cents for the week. The secondary (intermediate-term) trend is sideways with support at the low of $8.09 and resistance at the high of $8.74. Weekly stochastics are neutral-to-bullish below the oversold level of 20%. National average basis firmed by about 1 cent last week with Friday's NSI.X coming in 54 3/4 cents below the close of the January futures contract.

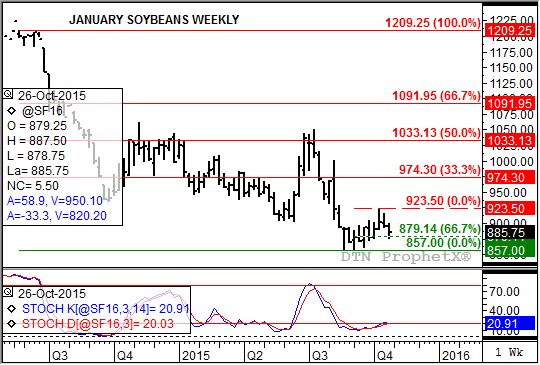

Soybeans (Futures): The January contract closed 10.25cts lower at $8.85 3/4. Technical indicators continue to show the secondary (intermediate-term) trend remains up, despite another lower weekly close. Given the standard that the minor (short-term) downtrend could move three weeks against the secondary uptrend, continued pressure could be seen this coming week. Support remains at $8.79 1/4, the 67% retracement level of the rally from $8.57 through the high of $9.23 1/2. Weekly stochastics remain bullish near the oversold level of 20%.

SRW Wheat (Cash): The DTN SRW Wheat National Index (SR.X, national average cash price) closed at $4.73, up 32 cents for the week. The secondary (intermediate-term) trend is up with the SR.X closing above its previous high of $4.71. Next resistance is at $4.81, a price that marks the 33% retracement level of the downtrend from $6.23 through the low off $4.11. The 50% retracement level is up at $5.52. National average basis firmed by about 1/2 cent with Friday's SR.X coming in about 50 1/4 cents below the close of the December Chicago futures contract.

HRW Wheat (Cash): The DTN HRW Wheat National Index (HW.X, national average cash price) closed at $4.39, up 19 cents for the week. The secondary (intermediate-term) remains sideways with support at the low of $4.06 and resistance pegged at $4.62. This price marks thee 23.6% retracement level of the downtrend from $6.41 through the $4.06 low. Weekly stochastics are bullish indicating the market could continue to work higher. National average basis firmed by about 1/2 cent last week with Friday's HW.X coming in 54 1/2 cents under the close of the Kansas City December futures contract.

HRS Wheat (Cash): The DTN HRS Wheat National Index (SW.X, national average cash price) closed at $4.97, up 20 cents for the week. The secondary (intermediate-term) trend remains up with the SW.X testing resistance at its previous high of $5.01. Weekly stochastics are bullish indicating the market should continue to work higher. Next resistance is at $5.19, the 33% retracement level of the previous downtrend from $6.68 through the low of $4.44. National average basis firmed by about 2 cents last week with Friday's SW.X coming in at 29 cents under the close of the December Minneapolis futures contract.

The weekly Commitments of Traders report showed positions held as of Tuesday, October 27.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .