Fundamentally Speaking

Soybean Oil Seasonality

In a recent post, we noted that soybean oil’s share of the combined crush value was approaching historic lows.

Both the cash figures basis Central Illinois and using soybean meal and soybean oil futures shows the contribution that soybean oil is making to the combined soybean crush value has recently fallen below the 29% level vs. the more normal 36-37%.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The recent surge in soybean meal to levels approaching the all-time highs near $550 per ton due to critically tight soybean supplies and the large amount of soybean meal export commitments still on the books has sent soybean oil’s share of the combined crush value to new four-year lows.

With South America harvesting a record soybean crop this past spring and the U.S. planting a record large amount of soybeans, there are hopes that U.S. and world soybean stocks will increase rather substantially and that could lead to a retrenchment in soybean meal values and allow soybean oil to regain a larger percent of the combined crush value.

If that is the case, then this should happen rather soon for this is the time of year when soybean oil does tend to gain on soybean meal.

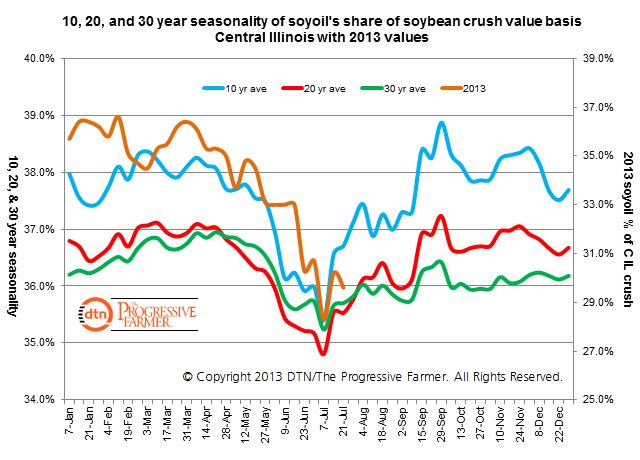

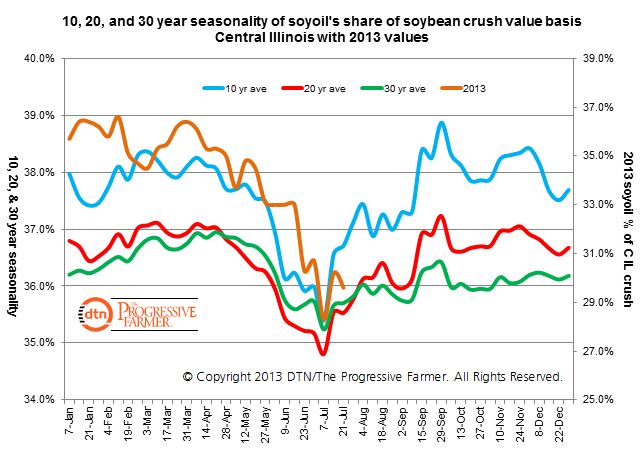

This graphic shows the 10, 20, and 30 year seasonality of soybean oil’s percent of the combined soybean crush value along with action so far in 2013.

So far this year, action has mirrored the seasonality almost perfectly though 2013 values are quite a bit lower than where the percent usually trades at.

Nonetheless, the share appears to have hit a major low around July 7 and that is the time when the 10, 20, and 30 year seasonal show is the low point of the year with a gradual recovery before soy oil’s share of the crush value peaks in late September.

(KA)

Comments

To comment, please Log In or Join our Community .