Kub's Den

Land Price Conundrum: 4 Considerations from Reader Responses

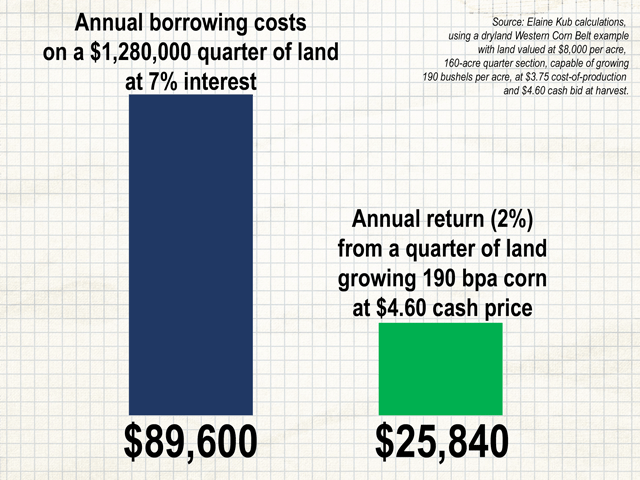

By a wide margin, the highest number of reader responses I have ever received for a Kub's Den column came late last year after "The Insanity of Paying 7% on an Asset (Farmland) That Only Earns 2%" (https://www.dtnpf.com/…) ran here on DTN. Clearly, the topic struck a nerve, and as I learned from going through my email, there are many additional considerations that land purchasers find important beyond the simple math of what it costs to borrow money versus what near-term cash flow a farmer may expect to receive.

Equally clear, the topic deserves a follow-up, but not necessarily from me. Instead, I want to share some of the comments and additional considerations that readers pointed out:

1. People buy land for reasons above and beyond the financial math.

From Roger Sahs, Associate Extension Specialist at Oklahoma State University:

"So, if the price of these income-producing assets aren't determined by a math equation, what is it then? Simply, they're determined by what the market is willing to pay. It could be for a livelihood, the lifestyle or a flip-it purchase for the non-farm investor. People like tangible assets in times of uncertainty. In addition, the pride of ownership and passing the land to the next generation can be a pretty important influencer. I think there will be some correction in the markets given lower commodity prices and potential earnings. I just hope we never see the crash and burn that we experienced back in the 1980s. I lived through that, and it was stressful as a OSU farm management specialist who had to be the messenger of bad news on many fronts."

2. Timing is everything.

From an Illinois banker:

"I have been giving 'bad' advice on buying land for the last 39 years. The reality of my experience, in loaning hundreds of millions of dollars to farmers over the past 39 years, is this: On the day the land is purchased, it has not one time penciled out to buy it. I am serious when I say this. Not one time. And it certainly doesn't today.

"Anyone who owned land in 1991 that was able to hang on to it, had, in most cases, tripled their net worth by 2014. The key was 'being able to hang on to it.' Not everyone could after the droughts of 1983, 1988 and 1991, even with Federal Crop Insurance. Anyone who did hang on could (and some still do) remind me that if they had listened to me and 'sold out,' they wouldn't have anything. Others remind me that I dumped a big bucket of cold water on their 'dream,' as you call it. I am not hurt by this; I did the best I could.

"Right now, my own son-in-law wants to buy land. Three years ago, I talked him out of buying 80 acres in our vicinity that went for around $6,000 because it didn't pencil out. Now, he could have $2,000-plus equity in that same piece. I still can't in good conscience advise him to do this new deal either. But I have to acknowledge once again ... I have been wrong for 39 straight years!

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"The book of Proverbs in the Bible tells us that 'time and chance happeneth to them all.' Timing is everything, and my timing has never been good! However, I still don't want to bury any young farmer up to his eyeballs on the idea that 'it will work out.'"

From John Fischer in Iowa:

"What is really important (but it doesn't seem like it) are the land value corrections of the 1930s & 1980s, which were both around 65% from its high move. Timing is so critical. If you bought the highs of 1927-1929 and 1979-1980, your investment did not work very well. Many lost their farms and were washed out of farming, never to recover. What is happening now seems quite similar to 1980. It just was not going to work as Paul Volker and the Fed raised interest rates to stop the inflation of the 1970s. Same playbook now by the Fed Reserve to combat inflation. Patience was required, and it paid off big time for those of us who waited and bought land at a big discount in the middle and late 1980s. For young people, they just cannot imagine just how fast & how far things can change!"

3. The conundrum calls the whole commodity farming business model into question.

From a reader:

"Land prices are too high to pay their way with production agriculture. If profit is not a motive, that's called a hobby not a business. No sin in this, but real investments don't have to be propped up by income from other sources. Real investments pay a reasonable ROI.

"Land can be a good investment for those willing to sell. The problem is: most farmers/ranchers/timber producers etc. are like me -- they never want to sell. The truth may hurt, but math doesn't lie. The smart money may own the bank or elevator or sawmill or dealership or feedlot or packing plant, but they let me and you own the land for a very low rate of return.

"All this said, I wouldn't trade a farm life for the money."

From a reader in Indiana running a high-margin, direct-to-consumer farm:

"Thank you for your insightful cold, hard, reality-check article. No other industry would ever think of operating the way ag does. As a 68-year-old, fifth-generation farmer in the same township, I went into the business world out of college and learned how to run a business at a Fortune 100 company. Long story short, I could never figure out how the ag community could pencil out the exact issue you addressed. I came to realize that what the established farmers were doing was average costing new property against existing property. That used to work, but there is a limited life to that strategy.

"My neighbors can laugh at me all they want because I am a 'postage stamp' farmer around here, but I have never gone into debt beyond what normal business practices would merit. Meanwhile, I know what their margins and costs are, and even though we raise only a fraction of what my industrial neighbors do, my margins are where we need to be. As I tell my son-in-law, sometimes, smaller is better."

4. Forces beyond agriculture are exacerbating the phenomenon.

From a reader:

"What is driving up land prices in our area is green energy. Solar rents are so large investors are looking at that."

From a former farm appraiser:

"In southern Ontario, farmland has been a very good investment and appreciated rapidly and has been attracting foreign investors for several years. The most recent sale was 200 acres for $32,000 per acre."

There is no question about why this topic triggered these and so many other impassioned comments, whether they're in my email, at your local coffee shop or around your own kitchen table. Land ownership is emotional. It is legacy, lifestyle, self-direction, life's mission, future opportunities, pride and humility all at the same time. For those who go into it with full knowledge and the right timing, it can really work out.

One final word from a reader in Illinois:

"When we settled my dad's estate, he had made one major decision that spring-boarded him financially: he had bought land at $400 per acre in the 60s. In 92 years of hard work, he would have had very little to show for milking cows, walking beans or baling hay or straw ... but for that one decision. timing is everything."

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involves substantial risk isn't suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at analysis@elainekub.com. Follow her on X, formerly known as Twitter, @elainekub

(c) Copyright 2024 DTN, LLC. All rights reserved.