Todd's Take

Wheat Prices Watch as War in Ukraine Takes Dangerous Turn

My hope for this column has always been that readers would gain a better understanding of the markets that affect their lives and have a better chance at making profitable decisions for their farms and families.

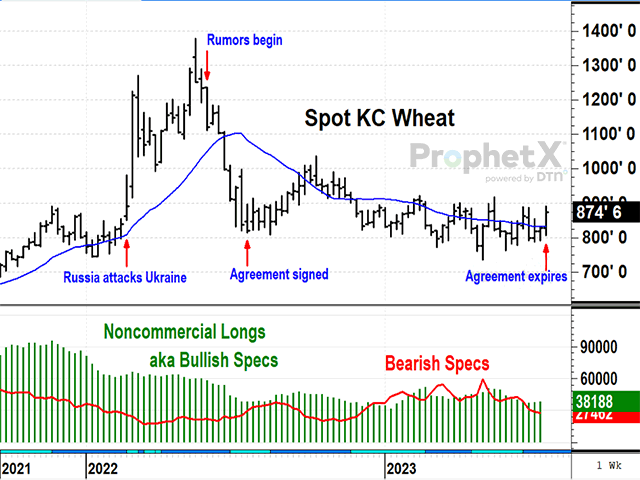

I am not proud to point out how the Todd's Take of May 27, 2022, (see https://www.dtnpf.com/…), pompously argued several reasons why Russia couldn't be trusted to abide by the Black Sea grain deal that was being rumored at the time. By May and June of this year, Russia's true colors started coming through as they dragged their feet on ship inspections and blocked access to the port of Pivdennyi. However, to my astonishing surprise, Russia did not attack grain ships leaving Ukraine for over 11 months. Russia attacked Ukraine's ports at times, but not the ships.

According to BBC.com, nearly 33 million metric tons (mmt) of grain were shipped from Ukraine under the deal with Russia, which is 33 mmt more than I expected. According to the Ukraine Grain Association, corn accounted for 58% of the volume shipped, followed by wheat representing 30%. Combined with record crops from Russia and Australia, Ukraine's wheat supplies actually had significant impact on holding down world wheat prices. Ukraine's contribution was instrumental in keeping buyers comfortably supplied through a time when concerns about Russia's war on Ukraine ran high and still do.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This week, Russia's thin facade of playing Mr. Nice Guy came to an end. Over the weekend, Russia announced it would not extend the grain deal beyond the July 17 deadline. On Monday, July 17, Ukrainian forces were believed to have attacked the Kerch Bridge, disrupting the tie between Russia and Crimea. Three days of Russian attacks on Ukrainian ports followed with several media sources reporting damage to grain loading facilities at Odesa, damage to grain export infrastructure and 60,000 mt of stored grain at the port of Chornomorsk and attacks by drones and missiles on the port of Mykolaiv. On Wednesday, Russia warned that ships headed toward Ukraine would be considered hostile and, on Thursday, Ukraine issued the same warning for ships headed to Russia. It is safe to say, insurers will not be eager to offer coverage in this situation and shipments of grain out of Ukraine through the Black Sea have effectively been halted.

As DTN Ag Policy Editor Chris Clayton explained in Thursday's "Ukraine's Grain Challenges Mount" (see https://www.dtnpf.com/…), the burdens of moving grain out of Ukraine are now going to fall on Ukrainian producers, stuck with the prospect of slower, more expensive transportation routes out the western side of the country. Politically speaking, the West is unlikely to take measures that interfere with Russia's exports of wheat or other foods, but Russia may find private entities less willing or at least more expensive to do business with. If so, Europe stands to benefit from greater demand for wheat, but the U.S. remains low on the totem pole of trade choices.

Of the three U.S. wheats, Minneapolis wheat currently has the best chance of trading higher. The September contract closed at $9.02 Thursday, July 20, the first close above $9.00 in 2023, if even by a small margin. Sporting a good-to-excellent rating of only 51% as of July 16, spring wheat is also facing prospects of more dry weather and higher temperatures on both sides of the U.S.-Canadian border in the week ahead. Thursday's report from the International Grains Council showed an expectation 2023-24 wheat inventories at the world's major exporters will fall to their lowest level in 16 years.

As last year's May 27 Todd's Take proved, I have no special talent for predicting future events, especially regarding Russia's next moves, but there is value in paying attention to the market's own clues. After an erratic week of escalated attacks on Ukraine's ports, I'll be watching not only spring wheat's bullish potential, but how all the wheat prices respond to this week's latest turn of events. We may be witnessing another major turning point in wheat price history.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.