Todd's Take

From Bearish to Bullish, Corn Prices Scramble to Adjust

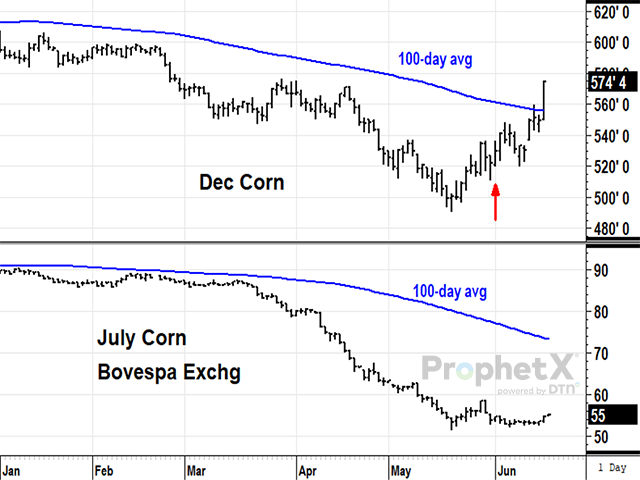

At USDA's Ag Outlook Forum in February, the message for new-crop corn was simple: Prices are headed lower. USDA opened the first day of that forum in Arlington, Virginia, with an estimate for a 15.085-billion-bushel (bb) crop, based on a yield of 181.5 bushels per acre (bpa), resulting in 1.887 bb of ending corn stocks in 2023-24 and an average farm price estimate of $5.60 per bushel. December corn, priced at $5.92 the day before the event, posted five consecutive lower closes, the start of a bearish slump that would reach $4.99 by May 17.

By the time the May World Agricultural Supply and Demand Estimates (WASDE) report came out May 12, USDA's ending stocks estimate for corn had grown to 2.222 bb and the average farm price was down to $4.80. December corn's time below $5.00 would be brief. Farmers were starting to talk about a lack of moisture for their newly planted crops, but traders were having trouble finding hard evidence. Rainfall was below normal for most of the Corn Belt in April and that continued in May. So far in early June, rains have been inadequate and forecasts disappointing. Even the Eastern Corn Belt experienced higher-than-normal temperatures in May and early June, a region that is typically sheltered from western extremes.

On May 25, the U.S. Drought Monitor showed pockets of drought in western Iowa and central Missouri, but it was one week later, on June 1, when the Drought Monitor showed a massive expansion of abnormally dry areas across the central and eastern Midwest. Corn's dry concerns were now getting visible attention and speculators that had gone net short over 62,000 contracts as of May 23 started to reel in their shorts. As I write this on June 15, December corn closed at $5.74 1/2, well above that $4.99 close on May 17 and ending above the 100-day average for the first time since November. The market's momentum has suddenly shifted from bearish to bullish.

Looking at previous Drought Monitors for this time of year, it is unsettling to say the year that most resembles this one is 2012, the poster child for drought. A big difference now from 2012 is that both the National Oceanic and Atmospheric Administration (NOAA) and DTN have been expecting increased chances for rain in the central and eastern Midwest in the months of July and August, related to the arrival of El Nino. That was not the case in 2012.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Oh wait, there's more. NOAA just updated its one-month forecast for July on Thursday, June 15, limiting the areas of above-normal precipitation to the Northern Plains and an area near Ohio and Pennsylvania. The bulk of the central and Eastern Corn Belt now shows an expectation of normal precipitation. The new forecast paved the way for NOAA to also release a new Seasonal Drought Outlook Thursday, which expects persistent and expanding drought throughout much of the Eastern Corn Belt from mid-June to the end of September. This important area showed no drought expectation in NOAA's earlier release on May 31.

DTN's latest forecast for July expects above-normal precipitation for the northwestern Plains and central Corn Belt, but looks dry for states around the Great Lakes, a source of concern.

If you're wondering what this will mean for corn yields this year, join the club. For a rough perspective, consider a national yield of 178 bpa will keep new-crop ending corn stocks near 1.50 bb, a situation not too different from what we just experienced in 2022-23 with reasons for cash basis to stay firm for another year.

Not all analysts will agree, but it seems fair to say the more bearish corn estimates from the May WASDE report are off the table for 2023-24. From my perspective, the higher close on June 15, along with the latest weather data, marks the start of a whole new ballgame for corn.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.