Todd's Take

Painful Conclusions From a Bearish Year in Wheat

You might recall, back on March 10, I wrote about the frustration of trying to explain wheat prices from a fundamental perspective (see "A Tale of Two Wheats, 10 Years Apart" at https://www.dtnpf.com/…).

As I tried to point out with a comparison of May Chicago wheat prices this year versus 2013, the two wheats showed remarkably similar supply situations, but drastically different price outcomes. On March 10, May Chicago wheat was trading 6% above USDA's estimated cost of production in 2013 but was 28% below USDA's estimate in 2023. Now, near the end of April, the comparison is even worse as the May 2023 contract has lost another 64 cents. I thought I was ready for the looney bin in March. Soon, you'll find me rocking in a chair, gazing out the window, waiting for my sanity to return. Yeah, it's bad.

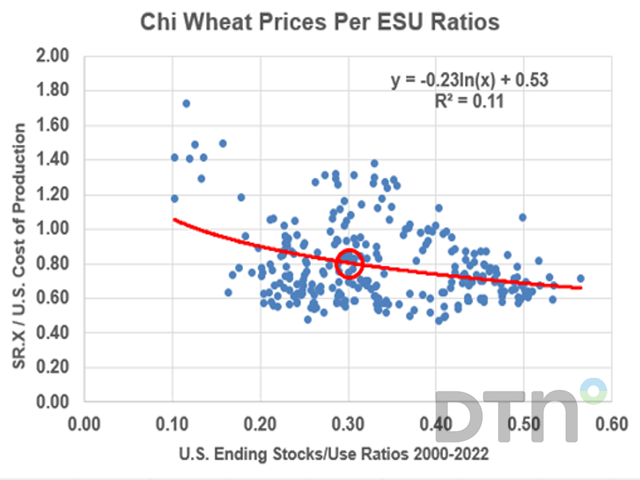

As I watched wheat prices implode this week, I couldn't help but wonder: What if we gave up this whole charade of trying to pretend there's a correlation between wheat prices and supplies and developed a new approach for wheat? After all, my studies show that 23 years of Chicago wheat prices have an R-squared value of 11% when compared to USDA's ending stocks-to-use ratios, much worse than corn's 55% value and soybeans' 49%. When we compare it to world ending stocks-to-use ratios, wheat's correlation gets even worse, falling to 8%. Statistically speaking, wheat's coefficient of determination is closer to 0 than it is to 1, meaning wheat fundamentals are literally meaningless. Like a grieving parent pining for a prodigal son, some of us keep hoping that one day, it will all make sense.

Elaine Kub's column from Oct. 5, 2022, "The Answer is Almost Always 'Sell Some Grain'" (https://www.dtnpf.com/…) offers a good remedy to consider. Read Elaine's words for yourself, but whenever you ask about marketing, her advice will echo in your head, "Sell some grain." Especially in these days of higher interest rates, moving grain is better than hanging on to it, trying to figure out all the variables the markets throw at us. If a calendar helps space those sales out, so be it, but sell some grain. By the way, Elaine received second place for that piece in the 2023 North American Ag Journalists writing awards. It deserves top honors in my book.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The second idea of how to market grain when fundamentals aren't helping comes from my Uncle Gary. After getting bad marketing advice, like many in the 1980s, Gary and his neighbors formed a study group. As many do, they looked at all kinds of things like cycles and various forms of technical analysis. At some point, it dawned on Gary that trying to predict markets just wasn't working, and he started a business advising customers to buy inexpensive put options early in the new season and adjusting strike levels as the season progressed. If prices went down, they had a floor of protection most of their neighbors did not. If prices went up, they could spend a little more to roll to a higher level of protection. It was simple and effective and required no predictive ability. The most frequent comment from customers was that they slept better at night. Among many I encounter, the value of simple put options is often overlooked.

A third possibility that I do not recommend is to trade like a trend-following speculator. I mention it because the trend-following algorithms that influence markets were designed for people that make no pretense of knowing or caring about fundamentals.

The advantage of trend-followers is that they focus on what the market is actually doing and purposely don't care about explanations. When they are wrong, they are usually not wrong for long. The disadvantage for the trend-follower is that it requires rare discipline to believe in an algorithm and not be influenced by misguided opinions or your own emotions. It is also not practical for most farm producers, who have better things to do than check in on markets during the day.

To review, for much of 2022-23, USDA's estimate of U.S. ending wheat stocks was the lowest in 15 years, until the April WASDE report adjusted it to the lowest in nine years. USDA's estimate of world ending wheat stocks, excluding China, is the lowest in 14 years, even with all the wheat Russia has been exporting. For the 2022 crop, USDA estimated wheat's cost of production at $420 an acre or $9.03 a bushel, a number that varies widely by region. I don't expect prices to stay near their highs all year, but in this fundamental environment, trading at deep discounts to the cost of production is just bizarre. I haven't even mentioned the uncertainty of the war in Ukraine.

As I mentioned in March, admitting fundamentals don't matter in wheat is like saying gravity doesn't apply to some people. This year's exaggerated wheat price performance is driving home the lesson that has been there for years. Looking back, it's easy to see the could-ofs and should-ofs, but the most helpful advice would have been to listen to Elaine, hold our nose and "sell some grain."

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.