Todd's Take

Tips for Taking the Noise Out of Grain Marketing Decisions

When you write market comments every day as DTN analysts do, you quickly realize there is no end to the kinds of information that traders respond to. I can't name all the variables, but below is a short list of factors that commonly move grain prices.

-- Traditional USDA reports pertaining to either the supply or demand of a commodity. Also, any similar private estimate of the sort, no matter how small the sample size or questionable the source.

-- Anything that scares investors can move prices, even if the topic is unrelated to grain markets. All commodity holdings are vulnerable when investors get margin calls, no matter the source.

-- The mega topics that scare grain traders are war, drought, pestilence and plagues, a few of which we've experienced lately. Even far less dramatic fears can panic traders for a day or a week.

-- Rumors of all sorts, no matter if they are true or not.

-- Weather forecasts of various timespans, especially if they resonate with other concerns traders might have.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

-- Rumors of any legislation or political action being considered, regardless of how likely it is of being enacted.

-- Just the mere act of seeing prices get pushed either higher or lower can influence speculators to liquidate contrary positions and distort price movement.

-- Sometimes, crop prices actually go up because there is physical demand for the grain or oilseed, which reduces supply in the market.

-- Sometimes, crop prices go down because producers of the grain respond to a selling price they consider advantageous and add supply to the market.

The funny thing is, from an economic point of view, the last two factors are the most important, but least reported influences on prices. As I see grain markets, in a room full of noisy amateurs, every crop has two quiet elephants in the back that set the boundaries of market behavior it will tolerate: producers and end users. These two put up with a lot of nonsense, but in the end, they are the two influences most connected to reality that also have the power to turn a trend. The more we focus on them, the more likely we are to recognize a good pricing opportunity when we see it. That does not mean we can predict prices; there is too much noise in the room for that.

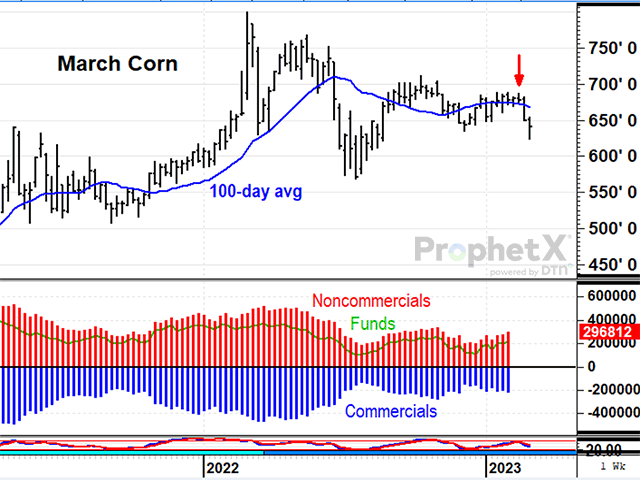

Applied to recent markets, March corn prices in the upper $6s in February were 33% above USDA's cost of production estimate, a historically generous opportunity that was higher than historical corn prices said the market deserved with a 9% ending stocks-to-use ratio. It is still possible Brazil's corn crop could run into trouble the next few months and boost prices further, but nothing is certain. At DTN, we recommended a final old-crop corn sale on Feb. 15, near $6.77 per bushel; $6.77 a bushel was an appealing price for producers.

In soybeans, the decision to make a final sale of old-crop soybeans on Tuesday, Feb. 28, was more difficult. Readers of this space may recall the Feb. 17 column, "Can Old-Crop Soybean Prices Go Any Higher?" at https://www.dtnpf.com/…. As I explained, there actually is a good argument to be made that old-crop soybean supplies will remain tight in the U.S. this summer, even with Brazil's record harvest on the way.

The final decision to sell came down to profitability. The March price of $14.93 at the time of the recommendation was 25% above USDA's estimated cost of production for 2022, another generous opportunity with no guarantee of what will happen in the future. USDA's 5% ending stocks-to-use ratio actually suggests a higher price for cash soybeans, but I was also concerned about the market's more emotional players and the risk they bring. The uptrend in March soybeans was stalling near $15.50, while Brazilian farmers were harvesting record supplies. Wednesday's lower trade turned the weekly stochastic bearish, raising concerns about new pressure being put on noncommercials holding significant long positions in soybeans.

In the end, it was the profitability of the opportunity that had the final say and kept us from being paralyzed by the confusion of trying to outguess what emotional traders are going to do. Moving forward, it is quite possible either corn or soybean prices could trade higher this summer. However, if we, as risk managers, judge ourselves by what the emotional market ends up doing, we'll miss the more valuable lesson of whether or not we made a good decision with the information we had. Focusing as much as possible on producers and end users is my best advice for learning how to get better at making marketing decisions for your farm.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.