Todd's Take

Can Old-Crop Soybean Prices Go Any Higher?

Ever since Brazil's soybean crop was planted last fall, there never has been a period of time when the crop was in doubt. USDA estimated Brazil would have 152.0 million metric tons (mmt) of soybean production in October, and today the estimate stands at 153.0 mmt, or 5.62 billion bushels (bb). Not only is the current crop a new record high for Brazil, it also surpasses the old record, set two years earlier, by 13.5 mmt, or 496 million bushels (mb). Except for extremely dry conditions in Brazil's southern tip, the rains have been consistently available for central and northern Brazil. Even now as harvest is roughly 20% complete, the rainy season continues.

Just over five months ago, the U.S. ended its 2021-22 season with a soybean surplus of 274 mb, the second lowest finish for supplies in six years. After the drought-limited harvest of 4.276 bb in 2022, USDA now expects U.S. ending soybean stocks of 225 mb in 2022-23, the lowest in seven years.

Within USDA's estimate, soybean exports in 2022-23 are pegged at 1.990 bb, the lowest in three seasons, but something doesn't quite add up. Going by USDA's export sales data as of Feb. 9 and Census Bureau data as of December, soybean sales on the books are already within 157 mb of USDA's export estimate for the entire season. With over six months remaining in 2022-23, not even Brazil's big harvest can stop U.S. soybean exports from reaching their 1.990 bb goal.

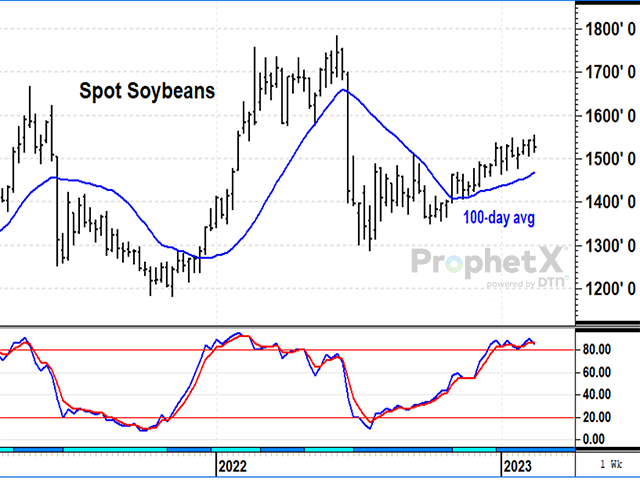

In daily news, we've been hearing for a long time about how bad China's economy was in 2022 and how we needed to be concerned about a possible recession in the U.S. Many soybean traders bailed out of long positions in soybeans this summer, selling the spot market down to $13 per bushel. In DTN market comments, we frequently pointed out that we were not seeing any sign of slowing demand from China and that U.S. soybean supplies were tight.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

As it turns out, China's U.S. soybean purchases in 2022-23 are up 15% to date from a year ago at this time. If you're worried about Brazil's big harvest inspiring sales cancellations from China, there is little risk of that happening. Only 111 mb of China's purchases are currently unshipped.

There is no doubt that the pace of U.S. soybean export sales is about to slow as it normally does this time of year, but Brazil's harvest is only part of the reason. The other factor is that the U.S. does not have much supply available to accommodate much more export business without triggering significant price rationing. In the next six and a half months, the U.S. should easily be able to find 157 mb of sales. In fact, it is likely that U.S. soybean exports will exceed USDA's 1.990 bb estimate.

Keep in mind, USDA's estimate only has a 225 mb surplus to work with; there is not a lot of room for more demand between now and the end of August and we haven't even talked about crush demand yet. Based on March futures prices, the value of crushed soybean products exceeded the cost of uncrushed soybeans by $3.46 per bushel on Thursday afternoon, Feb. 16. That is among the most profitable incentives soybean processors have ever received for buying and crushing soybeans. The odd thing is that USDA's soybean crush total through December is 1% below last year's pace. At this point, I can only speculate as to why soybean processors haven't been buying up all the soybeans they can get. Maybe they're in no hurry to collapse the lucrative margins? Or maybe getting soybeans in this tight market is not so easy? Either way, the incentive remains intact for more purchases ahead.

I can't guarantee what soybean prices will do this summer and, for anyone paying high interest rates on operating loans, there is nothing wrong with selling cash soybeans in the current environment, priced Thursday at $14.88 on DTN's National Soybean Index. For those that can afford the risk, however, there is still a bullish case to make for old-crop soybean prices, even with Brazil's record harvest on the way.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.