Todd's Take

Will Soybean Oil Supplant Soybean Meal as Darling of the Soy Complex?

On Dec. 15, Food Business News reported yet another new soybean plant being built, but unlike many of the others we've heard about this year, this Bunge plant focuses on producing soy protein concentrate to produce plant-based foods and will have non-GMO capabilities. The plant is expected to process an additional 4.5 million bushels of soybeans per year, and Bunge plans to start contracting with area farmers in time for the 2025 harvest (See more at https://www.foodbusinessnews.net/….)

I thought the news was especially interesting, as it comes at a time when many wonder what is going to become of the soybean meal market during this new era of expanding renewable diesel plant capacity. On Nov. 30, Progressive Farmer Crops Editor Matt Wilde reported on a long list of new soybean crushing plants in the works, expected to add 564 million bushels of soybean crush capacity by 2026. (See that article here: https://www.dtnpf.com/….)

At this week's Ag Summit, Gary Halvorson, senior vice president at CHS, also described the current rush of investment, expanding the nation's capacity to make renewable diesel from soybean oil. I thought it was interesting that the first question he fielded from a listener was, "What will happen to the soybean meal market with all the extra meal that will become available?" (My shorthand version.) A couple days later, I received a phone call from another person asking the same question.

Halvorson explained that soybean meal prices are likely to become much cheaper and, overall, soybean meal will probably have to be exported, possibly to China, because we just don't have the animal feed needs here in the U.S. to accommodate the extra amounts of meal that will be coming. Halvorson reply on Monday didn't have the luxury of knowing yet about Bunge's Wednesday announcement, but it does show that processors are starting to think creatively about what else they could do with meal at a significantly cheaper price.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Personally, I haven't been a fan of plant-based meats since my schooldays, but, hey, if there's a market for Spam, it wouldn't surprise me if someone comes up with a market for cheap meal disguised as food at the right price.

The point that keeps jumping out rather quickly in any discussion of the topic is that projecting how all this will play out in the next five or 10 years is extremely difficult, as there will be unexpected twists and turns along the way. Companies that get involved early while energy supplies are tight, the regulatory environment is favorable, and profit margins are high should do well, especially if they already have established ties in the commercial infrastructure of grain trade.

I also share Halvorson's concerns about investors jumping into the latest hot craze without much experience in the business and over-investing in this opportunity. Don't be surprised if we read about mismanaged plants going bust and being sold for pennies on the dollar in the years ahead. There is a reason we call it a boom-bust cycle. Today is the boom.

So, I'm not much help in predicting soybean meal prices five or 10 years out, and truth be told, I'll be interested to see where the additional soybean acres come from. More important than making predictions we can't be confident of, I can say DTN analysts will continue to report on the key changes as they happen, giving producers our best assessments of how soybean prices are being influenced and when protection might be needed. In the current situation, March soybean meal prices are vulnerable to increased volatility, not far from their highest prices on record and teetering on how Argentina's dry crop conditions play out. Late Thursday, the Buenos Aires Grain Exchange said 19% of Argentina's soybean crop was rated good to excellent, showing an 8-percentage-point bump on rains over the weekend but still dealing with difficult conditions.

Today's higher meal prices are expensive feed costs for pork and poultry producers. It's been difficult assessing meal prices through a choppy summer and fall period, but recommendations in DTN Six Factors Market Strategies have purchase needs covered at lower prices in December and January and in May through July in 2023. USDA expects soybean meal production to increase 2% in 2022-23 and ending stocks to stay close to current levels. At last check, U.S. soybean meal stocks at the end of October were down 3% from a year ago -- no sign of the burdensome load yet many are wondering about in future years.

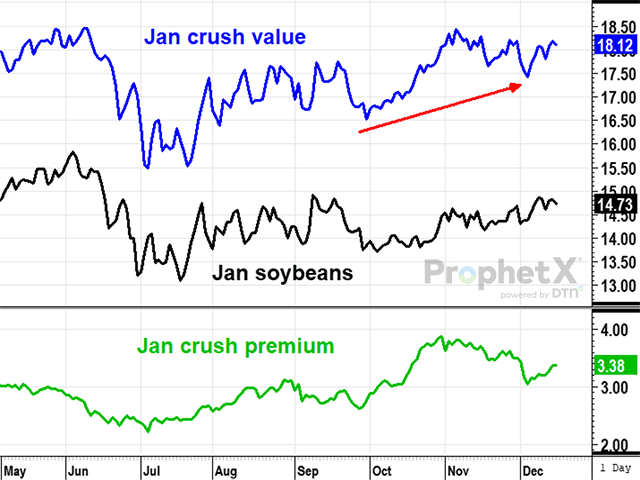

As far as soybeans go, the primary bearish concern is the possibility of a record Brazilian crop in early 2023, estimated by USDA at 5.58 billion bushels. There is nothing about the current boom cycle in renewable diesel that is threatening to soybean prices at the moment and probably won't be in 2023. Based on January futures, the value of crushed soybeans exceeds the cost of a bushel of uncrushed soybeans by $3.38, offering plenty of reward for existing processors as well as enticing new sharks into the water.

It is difficult to say when the rush to crush will weigh on soybean meal prices, and it should be at least two years away. For now, while Argentina's soybean crop is suffering drought, those cheap soy patties won't be forced on us anytime soon.

**

The comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involves substantial risk and is not suitable for everyone.

Todd Hultman can be found at Todd.Hultman@dtn.com

(c) Copyright 2022 DTN, LLC. All rights reserved.