Call the Market

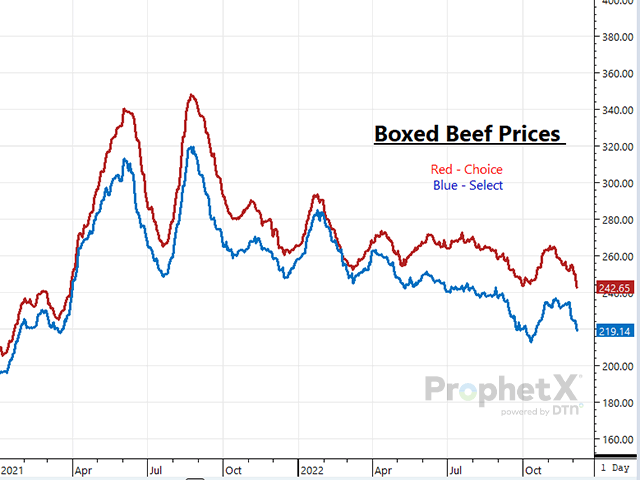

Lower Boxed Beef Prices Catch Market's Attention

As we've seen the calendar turn from late November to the first full week of December, the cattle market sits in a peculiar position. Traders are begging for newsworthy information to base decisions on; but given that we're in the timeframe between Thanksgiving and New Year's, the cattle market is lethargically covering each day, one day at a time.

All in all, the cattle market sits at historically high price points. Last week, the market's weekly weighted average steer price for fat cattle was $155.79, which is $14.75 higher than the same week a year ago and the highest the market has traded since June of 2015. The CME Feeder Cattle Index for Dec. 6, 2022, closed at $178.53, which is $18.10 higher than the same day a year ago. As of last Friday, Dec. 2, the market has processed and estimated 31,309,000 head of cattle in 2022, which is up 1.5% compared to a year ago.

Even with these relatively high price points and impressive achievements, there's an unsettled nature lingering in the cattle market right now. Packers are seeing their margins contract drastically from waning boxed beef prices and the advancements made in the cash sector so, as an effort to manage margin, reduced slaughter speeds are expected throughout the remainder of the year. But what has seemed to catch the industry off-guard this week is the drop in boxed beef prices or, more specially, choice boxed beef prices. Tuesday's afternoon boxed beef report printed choice cuts at $242.65 and select cuts at $219.14. Currently, choice cuts are trading at the lowest point they've been all year, but seeing downward pressure on boxed beef prices ahead of Christmas isn't anything unusual. It's practically clockwork that beef prices bottom around Christmas and then front some sort of rally in January as retailers restock after the long holiday run.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Why is it being blown out of proportion that boxed beef prices are trending lower right now?

-- Traders need something to trade. While many of us would prefer that they focus on tightening fed cattle supplies in the years to come, they've opted to take a cautious approach and focus on the daily whims of beef prices. A couple years ago, a market mentor of mine told me, "Traders gonna trade; it's as simple and as aggravating as that." And while I'd like to think that most days the market focuses on greater things than just boxed beef prices, when traders are hungry for intel, they'll take what they can get.

-- Given the high price points the market is currently seeing, cow-calf producers, stockers/backgrounders and feedlots alike are concerned that any small shift in the market could derail its current momentum. Regardless of what exactly that derailment may be (a railroad strike, rising interest rates, reduction in throughput), cattlemen remain on edge about what's to come in 2023 as they've endured a brutal marketplace since the last time they possessed the lion's share of the market's leverage in 2014.

From a cattlemen's standpoint, it's understandable why they're on edge as producers are fearful any little blip in the market could hinder the fruit that's expected to come in the weeks and months ahead. When evaluating traders' positions, it's incredibly frustrating to see traders continue to cling to the short side of the market and feel the need to suppress the live cattle contracts anywhere from 132 to 220 points just because boxed beef prices are doing what they seasonally do. One would think that, with the U.S. cowherd being the second lowest it's ever been in the last 50 years, more market participants would feel inclined to take a long position. But unfortunately, that weight continues to remain on the shoulders of producers. So, to answer the question posed earlier, I believe traders are responding to the decline in beef prices as they're yearning for something substantial to trade, even though a decline in beef prices is typical for this time of year.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

**

Cattlemen are eager for supply and demand mechanics to swing their way, but the market isn't completely free of hurdles as bearish concerns about the U.S. and global economies loom. Hear DTN Livestock Analyst ShayLe Stewart's thoughts on the 2023 cattle market at the all-virtual DTN Ag Summit on Dec. 12-13. Full details available at www.dtn.com/agsummit

(c) Copyright 2022 DTN, LLC. All rights reserved.