Todd's Take

USDA Stands Pat on Corn Export Sales

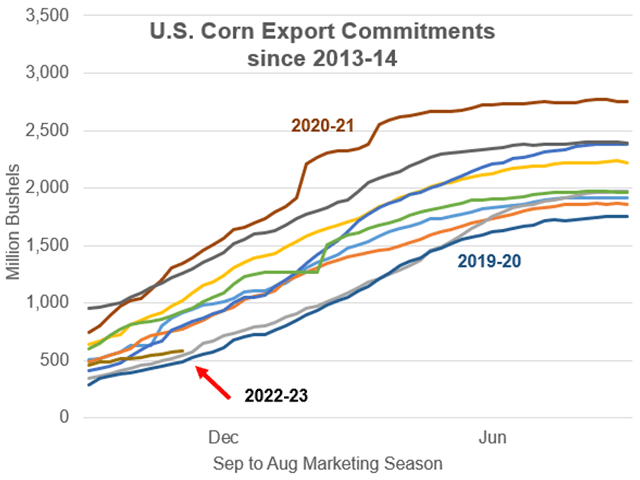

If corn export sales were a football game, I would say corn is down 17-0 with 5 minutes to go in the first quarter. No matter how you look at the numbers, there is nothing impressive about corn's early start. Thursday's report from USDA showed 580 million bushels (mb) of U.S. export commitments as of Nov. 3, down 54% from last year and the lowest total for this date in three years.

Adding to the bearishness, there is no reason to expect a dramatic change anytime soon, as Brazil's FOB corn prices for December have been trading 12% to 14% below comparable U.S. prices and may have another two months of supply before prices balance out. It is understandable that many are wondering why USDA did not reduce its 2.150-billion-bushel (bb) corn export estimate in the November World Agricultural Supply and Demand Estimates (WASDE) report, but given the larger context, I say, what's the rush? The active part of the corn sale season hasn't even started yet, and the current USDA estimate is already down a substantial 13% from a year ago.

One of the current problems for corn prices, I suspect, is that traders give inordinate attention to corn's export sales, as they are highly visible and updated weekly. Exports are important, but it can be easy to forget that corn export sales represent roughly 15% of demand with larger shares going to feed demand and ethanol production.

Because traders often make the mistake of being overly focused on the present situation and on information that is easily obtainable, I think this is a good time to review the other important factors affecting corn prices in 2022-23.

Starting with the recent history of corn export sale commitments, the past nine years show the more active period of sales activity for corn tends to happen from roughly December to June, before Brazil's larger second corn crop becomes available in July. That same history also shows that corn sales don't necessarily unfold in a straight, predictable line. Corn sales often happen in spurts, punctuated by times of quieter activity.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Much of this year's slow start can be explained by Brazil's record corn crop earlier in 2022, but we don't yet know what that second corn crop will look like in 2023. That future crop will have a lot to do with how U.S. corn sales go in the later months of the 2022-23 season.

Lest we forget, Ukraine, the fourth member of the world's top four corn exporters, is still at war, and USDA estimates 610 mb of corn exports for Ukraine in 2022-23, down 43% from the previous season. I cannot stress enough the level of uncertainty Russia's aggression creates, not just for corn, but most of the major markets.

Europe is not much of a corn exporter, but it does need a lot of corn to feed its pork production. Drought slashed European corn production by 23% in 2022, adding to its import needs.

As will often be the case in years to come, China remains a big question mark when it comes to U.S. demand for corn. It became apparent following the initial pandemic in 2020 that China has lost its ability to produce enough corn to meet its domestic needs. USDA currently estimates China's 2022 corn harvest will fall short of demand in 2022-23 by 21.0 million metric tons (mmt), or 827 mb. For political reasons, China prefers to buy corn from Brazil and Ukraine and is said to be getting close to approving purchases from Brazil. Whether China buys directly from the U.S. or not, it appears China still has plenty of corn to buy in 2022-23, a potentially bullish factor for all corn prices.

It may still turn out that USDA will need to reduce its export estimate in the months ahead, but if anyone thinks corn exports will stay down 54% from a year ago this season, that would be a big mistake. There is still a lot of time left in the game, and I, for one, will be interested to see how this plays out. Judging by Thursday's national cash corn price from DTN, the national corn basis is 7 cents above the December contract, which is the strongest for this time of year in over 10 years. That is a bullish factor I wouldn't want to bet against.

This year's DTN Ag Summit will be held virtually on Dec. 12 and 13, meaning you can watch this premiere ag event in the comfort of your favorite chair, at a time convenient for you. Check out the topics and speaking lineups at www.dtn.com/agsummit. We'd love to have you join us!

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.