Todd's Take

Grain Prices Have Chance to Move Higher After Months of Speculative Selling

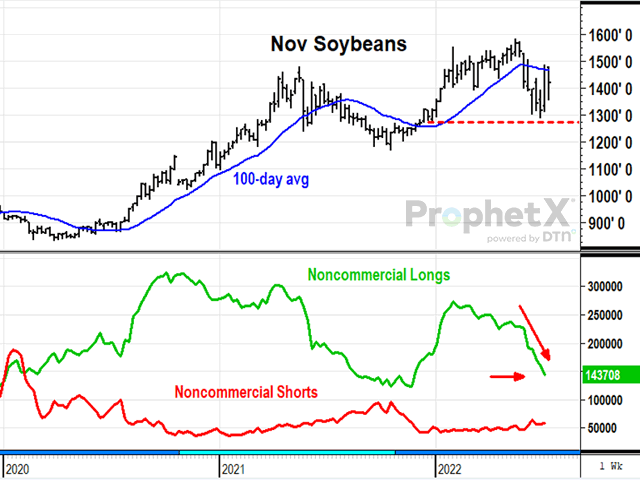

In Thursday's (Aug. 4) Wall Street Journal article, "Speculators Exit Agricultural Markets, Intensifying Crop Sell-off," Ryan Dezember explained, "an exodus of hedge funds and other speculators" has led to a drop in prices for wheat, corn, soybeans, which some analysts are now saying are lower than the fundamental conditions justify (see https://www.wsj.com/…).

Overall, that is how I see it, although I have to note that the term "hedge fund" is a misnomer for speculative funds that have nothing to do with hedging the underlying commodities they trade. I have to admit, it felt good to know I'm not the only one noticing the bullish potential of the current situation in grains, but I am more interested in knowing when the market might agree with that view.

Several times this summer, when prices were falling for no good reason and I was shaking my head in frustration, I often thought of the Benjamin Graham analogy of "Mr. Market" that Warren Buffett often mentions. The description of the market as a poor fellow with incurable emotional problems and wide mood swings has certainly been fitting this year, especially when comparing the speculative positions in the CFTC's weekly reports to the market's price swings.

The same speculative crowd that held over 60,000 long positions in KC wheat in mid-May and helped bid September KC wheat prices up over $13.00 per bushel, couldn't get out of wheat fast enough after Russia offered to let ships of grain leave Ukrainian ports. At the time, I thought there was no way Russia's President Putin would allow shipments of grain to leave Ukraine, an important source of economic aid that would only make Russia's enemy stronger.

This week's success of the Razoni in its quest to take 1 million bushels (mb) of corn from Odesa, Ukraine, to Tripoli, Lebanon, proved me wrong -- at least for now. Early Friday, AP reported three ships carrying a total of 58,000 tons of corn (2.3 mb) left the ports of Odesa and Chernomorsky. We'll hold our breath and say a prayer, but I wouldn't want to be writing the insurance contracts on ships leaving Ukraine.

These are not large, market-shattering amounts of grain and certainly don't justify a $5 drop in wheat prices. We don't even know if wheat is one of the grains being shipped yet, but for specs, trading decisions are all about the trend and crowd perceptions, not facts. The perception has been that Russia will honor its agreement to let the grain flow out of Ukraine and the world will soon have all the wheat it needs.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A similar perception problem also afflicted corn and soybean prices in late June and early July. Falling wheat prices were one early bearish influence and selling among specs picked up as worries about the economy took stock market prices to new lows in mid-June. Climbing interest rates, a rising U.S. dollar and talk of recession going global frightened specs out of their long positions in lots of investments, including corn and soybeans.

On the more legitimate side, timely rains rescued many row crops from a hot and dry summer and protected crop ratings in the mega-producing states of Iowa and Illinois. In the soybean market, palm oil prices plummeted in June, correctly anticipating higher production in 2022. However, the big questions about U.S. corn and soybean yields in 2022 are still not answered and remain at risk with plenty more days of dry weather expected in August.

The results of these speculative hits to wheat, corn and soybean prices are that much of the bearish selling ammunition has been spent. Long positions held by speculators in KC and Chicago wheat are at their lowest levels in seven years. For corn, spring wheat and soybean oil, long positions are at their lowest levels since the pandemic of 2020. In soybeans, long positions held by specs are at their lowest level this year. Soybean meal is the only grain-related contract in which specs have stayed with their bullish positions and are being rewarded after Thursday's close resulted in a new closing high for September meal.

Now that the part of the market that most resembles "Mr. Market" has largely been washed out, I expect grain and oilseed prices to start showing more respect for the relatively tight supply situations they are in.

Looking at the new 2022-23 season from where we now stand, ending stocks of U.S. corn are on track for their second lowest total in nine years and should continue to benefit from Ukraine's dire situation. Ending stocks of U.S. wheat are on track for their lowest total in nine years and for spring wheat, the lowest in 15 years. In the case of soybeans, the supply margins are so tight the market could either experience a painful shortage in 2022-23 or skate by with a comfortable 300-mb surplus -- it's just too close to call.

Once again, final yields will matter in 2022 and USDA will have its next estimates out on Friday, Aug.12. In the meantime, tune into DTN on Monday, Aug. 8 as we begin this year's Digital Yield Tour, sponsored by Gro Intelligence. Different from the traditional roadside crop tours, Gro takes a bird's eye view with satellite imagery and assesses yields down to the county level.

This year, DTN will start with the national estimate on Monday, followed by four days of reviewing each of the major producing states (read a better description by DTN Farm Business Editor Katie Micik Dehlinger at https://www.dtnpf.com/…).

If we took every market move seriously, we would soon become too bullish at the highs and too bearish at the lows, just like Mr. Market. Knowing instead that a segment of the market can get crazy at times, ironically, can help us stay grounded and focus on the things that really matter.

Supplies of grain do matter and now that speculative positions have largely been deflated, there is room for prices to reflect a more bullish view.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be found at Todd.Hultman@dtn.com.

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.