Kub's Den

Strong Grain Prices and Strong Dollar Are Rare Coincidence

The U.S. dollar is getting hot, and sometimes this can be a bearish drag on U.S. dollar-denominated grain prices, but today -- with a tenth of the world's agricultural exports still disrupted by the Russian war, corn at $8, soybeans at $16.50, wheat skyrocketing past $13 per bushel, and a severely problematic spring planting season -- who cares about the dollar? Any subtle influences from underlying currency movements may seem beside the point.

Nevertheless, over a long enough time frame, the inverse pressure of the dollar's value can be one of the most powerful forces that act on commodity price tags. It's one of those things we don't want to forget about amid the louder clamor of more dramatic market developments. On top of that, the strength of the dollar plays a role in two of the other hot topics of the day: crop input costs and inflation.

Back in the 2011-14 timeframe, the roles in this dance were clear: The Federal Reserve's aggressive quantitative easing flooded the financial system with "cheap" dollars, and cheap dollars meant that global buyers could afford relatively high price tags for dollar-denominated commodities. Or, there was the period from 2000 into 2002, when the U.S. Dollar Index (a mathematical basket of currencies from other countries, so it has no units) climbed as high as 121. Grain prices stayed depressed during this time frame because exporters couldn't raise prices while foreign buyers were struggling just to afford the underlying dollars to make the trade. That's the typical pattern: dollar high, grains low or dollar low, grains high. Now we're seeing a rare test of what happens when both the dollar and the grain markets are moving higher at the same time together.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Make no mistake: Grain prices would be high today no matter what was going on in the currency markets. Fundamental supply (lack thereof) and demand (unrelenting) outweighs the lesser consideration of how many Korean won or Mexican pesos or Nigerian naira must be exchanged for U.S. dollars to buy American grain. But if the dollar wasn't surging higher amid buying interest, and all other things were equal, would $8 corn otherwise be $9 corn? It's impossible to say.

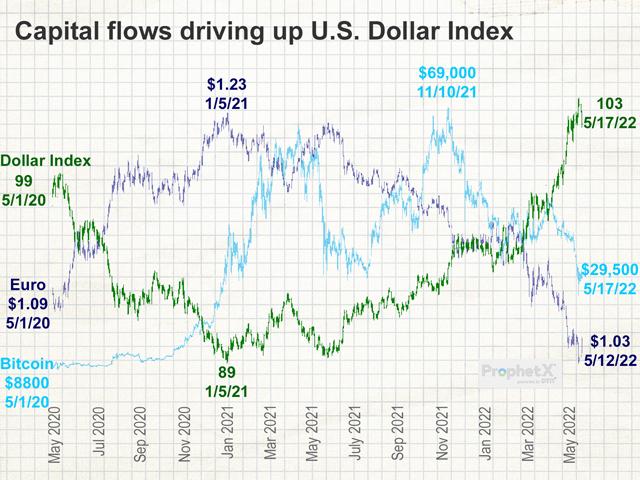

Let's consider the reasons why the dollar is surging, up 16% since a year ago. Regular readers of this column know I'm no fan of cryptocurrency (see https://www.dtnpf.com/…), and all along I've felt that investors would be better off owning either real stuff or real claims to future income streams (like equities or bonds) rather than getting involved in those Ponzi schemes for make-believe internet tokens. I'd like to ignore the crashing price of bitcoin -- not gloat about it, just ignore it. In the context of the surging U.S. dollar, however, it shouldn't be ignored. Already, the popping crypto bubble has caused a "run on the bank," of sorts, and fearful owners of these tokens have been cashing them out for something safer, primarily U.S. dollars. No one can say how much of the recent run-up in the dollar's value has been due to this safe-haven buying interest, but there is a significant threat that as crypto and other asset prices fall, more and more investors will want to hold their capital in "safe" dollars instead, making the value of those dollars continue to move ever-higher.

The dollar is virtually the only attractive safe-haven currency right now. The Federal Reserve will likely continue to raise interest rates to fight inflation, offering relatively better returns for investors who hold Treasury bills or participate in money market funds. Meanwhile, the European Union may have to keep interest rates low to manage their costs from dealing with the Russian war. Nothing else is in a position to be the global reserve currency right now. So, the dollar is it. Any investor concerned about sudden losses in any other asset class will likely become a dollar-buyer, exacerbating the upward trend in value.

Is that higher dollar good or bad for inflation? There is no perfectly predictable relationship between the two phenomena; in fact, inflation can become a self-fulfilling prophecy about a higher dollar, when dollar investors view inflation as the reason why interest rates (returns for holding dollar-denominated debt instruments) must go up. On the other hand, a stronger dollar can also act as a self-correcting mechanism for inflation, as we can more easily pay for imported goods (e.g. fertilizer, farm equipment) with stronger dollars. However, that's only in a perfect world where fertilizer, farm equipment and every other manufactured consumer good wasn't also going through their own overwhelmingly bullish supply-and-demand scenarios.

High grain prices, livestock prices, energy prices and food prices are all parts of aggravating the inflation situation themselves. With all these fluctuating influences throughout the economy, it's impossible to say how much of $8 corn is because of inflation, how much is held back by the stronger dollar and how much is just pure supply and demand. As always, a look at the broader markets reminds us never to accept just one, simple villain (inflation) when reality is always more complex.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2022 DTN, LLC. All rights reserved.