Kub's Den

Diverging Fortunes: Soybeans vs. Corn

It's uncommon for soybean and corn prices not to move in the same direction at roughly the same pace at the same time. The two products are substitutes in some ways (as animal feed or as planted acreage alternatives) and complements in some ways (as components of an investor's managed futures portfolio or as crops planted in a 50-50 rotation), so their markets will be forever linked. It's almost unheard of for the two to diverge in opposite directions.

To be clear, that's not what's been happening lately. Both soybean and corn prices have been moving upward since the August drought intensification in the heart of the Corn Belt -- the November soybean contract by $1.70 1/4 and the December corn contract by 55 1/2 cents between Aug. 10 and Sept. 18. In percentage terms, we can see that soybeans have been the leader: up 20% through that time frame (an official "rally"), while corn prices moved upward by 17%.

The relatively stronger movement from soybeans is, of course, related to some fundamental market realities. It seems like just about every weekday lately I've seen announcements of several hundred thousand metric tons of U.S. soybeans being sold for export (mostly to China). This physical buying spree gets hedged by futures-buying activity at the CBOT, and that drives up the benchmark soybean price for everyone. Meanwhile, the corn market's fundamentals haven't had quite the same bullish excitement. If anything, plateauing ethanol production figures (most recently at 926,000 barrels per day) suggest the demand side of the corn market could end up slower than projected. Even if the projections play out as-is, the two markets have differing prospects: Corn is expected to end the marketing year with 17% of its total usage left over as extra inventory, but soybeans are expected to end up with only a rather tight 10.3% stocks-to-use ratio.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Here's a general rule of thumb: The grain industry tends to feel there is "enough" grain in the system as long as the stocks-to-use ratio remains over 10%, and a grain market may start to get excited about competing for access to bushels if the stocks-to-use ratio drops to less than 10%.

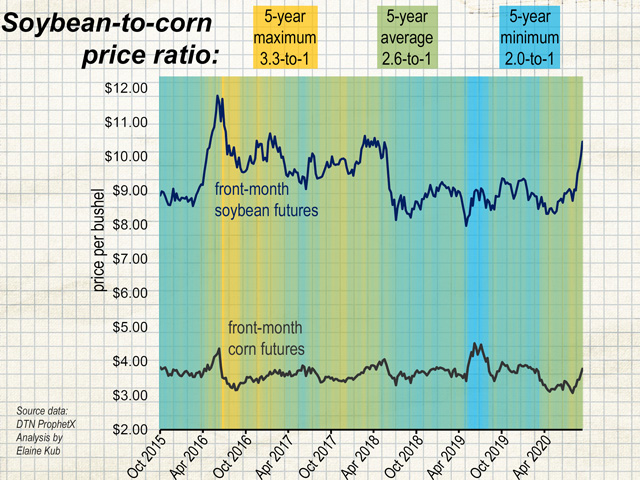

These diverging fundamental fortunes mean that the price ratio between the two crops has fluctuated. At $10.38 per bushel, the new-crop soybean futures price is currently 2.77 times the price of new-crop corn futures, at $3.75. That ratio is unusually high. It's just barely within one standard deviation of the five-year average for the soybean-to-corn price ratio, which is 2.57-to-1.

When a trader sees one asset that's "overpriced" and another asset that's "underpriced" in the same general marketspace, the temptation is always going to be to sell the overpriced one (soybeans, in this case) and buy the underpriced one (i.e. corn). Buy low; sell high.

Grain producers aren't in the same neutral position as traders, however. They are probably already long in both assets, with a fresh inventory of newly harvested corn and soybean bushels waiting to come to market. There's not much reason to buy more corn at this point, but a grain owner could do the other half of the trade: sell the soybeans. (Actually, the grain owner might reasonably sell both soybeans and corn at these prices -- the two markets tend to move together, remember.)

Other than that, there's not much that North American farmers can do with this information about today's price ratios. We usually think about the soybean-to-corn price ratio in the spring when the two crops may be competing to "buy acres," but now there are no planting decisions being made at this time of year. Perhaps I should say there are few planting decisions being made, since it is possible that some fields are being committed to winter wheat instead of row crops, and some fields may be committed to corn for 2021 with fall fertilizer applications. The November 2021 soybean futures contract, currently at $9.71, is 2.49 times the price of the December 2021 corn futures contract, at $3.90 -- both attractive selling opportunities by recent standards, but not necessarily favoring soybeans over corn.

South American grain growers, however, may find some major motivations in the closer realities of nearby prices. They're aiming for the March time frame (global benchmark Chicago futures at $10.30 per bushel) with fields that will be planted next month, assuming the rains forecast for Brazil next week do indeed materialize and kick off a furious planting pace. Their currency, the Brazilian real, continues to bounce along within 10% of its all-time low, which further boosts the domestic price tag that Brazilian farmers will receive for the soybeans they'll plant and sell based on that global benchmark.

Soybeans and corn may have diverging fundamental outlooks and diverging fortunes on their futures charts, but the good news is this: Even corn prices aren't that bad. Calculating 30 to 50 cents of basis taken off the new-crop futures price results in a cash price of $3.40 to $3.20, which is likely profitable for most producers. Furthermore, although I know a few producers who grow 100% corn for animal feed, a vast majority of farmers plant a diversified mix of two or several crops, and they stand to benefit -- even on a small amount of unpriced bushels -- from the fortunate price movements that have been trending in the soybean market lately.

Elaine Kub is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2020 DTN, LLC. All rights reserved.