USDA Livestock Outlook

Smaller Cattle Herd, but Stronger Live Cattle Prices Forecast for 2023

ARLINGTON, Va. (DTN) -- The U.S. cattle herd is forecast to further decline in 2023, USDA economists stated last week.

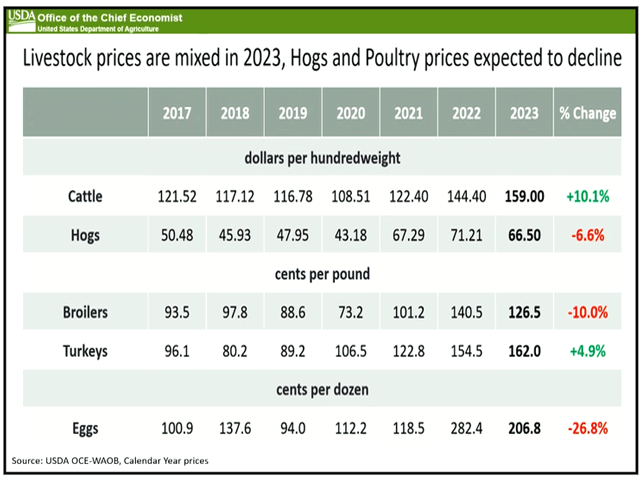

That smaller cattle herd, however, is forecast to push up fed cattle prices an average of 10.1% to $159 per hundredweight (cwt) for 2023, according to USDA. The smaller cattle herd will also increase imports of live cattle.

All told, USDA forecasts total U.S. red meat and poultry production will decline slightly from a record 107.5 billion pounds in 2022 to 106.9 billion pounds of red meat and poultry production for 2023. If realized, it will be the first decline in total red meat and poultry production since 2014.

USDA released its Outlook for Livestock and Poultry production on Thursday as part of the department's Outlook Forum.

SMALLER CATTLE HERD EXPECTED

Pointing to cattle producers retaining 6% fewer replacement heifers for the beef cow herd this year, USDA projects 5% fewer beef heifers to calve in 2023.

"We are in the contraction phase of the cattle cycle," Seth Meyer, USDA's chief economist, said in his opening speech at the forum.

Western drought and high feed prices "make them (producers) uncertain about expansion," Meyer said. He added, "I think drought will continue to play a role on those cattle (numbers)."

USDA cited current data "would suggest increasingly declining placements and lower feedlot numbers throughout 2023."

The declining U.S. supplies also will result in higher imports of live cattle. USDA expects cattle imports will hit 2.1 million head in 2023, up 500,000 head from 2022's imports of 1.6 million cattle.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Cattle shrink is large enough to outstrip an increase in swine and poultry production, USDA forecast.

USDA forecasts lower feed prices, as the department projects corn, soybean and wheat prices will decline in 2023. Corn prices are projected to fall from an average of $6.70 a bushel for the 2022-23 crop to $5.60 a bushel for the 2023-24 crop. Soymeal prices are projected to fall from an average of $450 per ton to $410 per ton as well.

Still, USDA also cites that hay stocks on Dec. 1, 2022, were at 71.9 million tons, down 9% from a year earlier. Major cattle-producing states such as Texas, Oklahoma and Nebraska all had lower hay stocks.

HOGS AND PORK

Citing the Quarterly Hogs and Pigs report, USDA pointed out 1% fewer sows in the second half of 2022, but producers also indicated they intend to farrow more hogs in the second half of 2023.

All told, USDA forecasts total commercial pork production in 2023 at 27.4 billion pounds, about 2% higher than 2022. After a dip in 2022, commercial hog slaughter will rise, as will carcass weights. "Favorable feed prices compared to the previous year and continued demand for pork are likely to provide incentives to feed to heavier weights."

Pork producers will see prices fall with lean hog prices in 2023 projected at $66.50 per cwt, down from an average of $71.21 in 2022, a decline of about 6.6%.

Pork exports fell 10% in 2022 to 6.34 billion pounds because of lower demand, mainly from China, but also Japan, Canada and Colombia. Those losses were offset some by higher demand in Mexico, South Korea and the Dominican Republic. USDA projects 2023 exports will increase slightly from 2022 to about 6.35 billion pounds -- still below 2021 levels.

Pork imports are projected at 1.01 billion pounds, down about 25% from 2022 levels.

BROILERS AND EGGS

Despite the continued risks from highly pathogenic avian influenza (HPAI), USDA projects broiler production in 2023 will bump up 1% to a record 46.7 billion pounds.

USDA cites more broiler-egg placements in the third quarter of 2022, driven partially by recovery efforts from avian influenza. So far, broiler placements in early 2023 are higher than the same period last year.

Broiler exports in 2023 are also expected to increase fractionally to 7.32 billion pounds. There will be more supply, but some exports will continue to be constrained because of restrictions from countries concerned about HPAI.

The average broiler price will come in at $1.27 per pound in 2023, about 10% lower than in 2022.

Eggs have become the focus of food inflation in the last several months because of HPAI losses. USDA projected egg production will increase 4% in 2023 to 9.4 billion dozen eggs. Table egg production will reach 8.1 billion dozen, about 5% higher than in 2022, but still below the record volume from 2019.

"While not quite there yet, a full recovery in the laying flock is expected in the coming year," USDA stated.

Table egg prices moved from an average wholesale price in New York in January 2022 of $1.24 a dozen to a peak of $5.40 a dozen in mid-December. For 2023, USDA expects egg prices will come down to $2.07 a dozen.

For the full USDA Livestock Outlook report, visit https://www.usda.gov/….

Also see "USDA Forecasts Bigger Crops, Lower Prices for 2023-24 Crops" here: https://www.dtnpf.com/….

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.