DTN Retail Fertilizer Trends

All Eight Retail Fertilizer Prices Move Lower, With Four Down Significantly

OMAHA (DTN) -- All retail fertilizer prices continued to decline in the third full week of March 2023, according to sellers surveyed by DTN. Prices have been on a steady march lower since the beginning of the year.

All eight of the major fertilizer prices were once again lower compared to last month. Four of the eight fertilizers had a sizable price decline, which DTN designates as anything 5% or more.

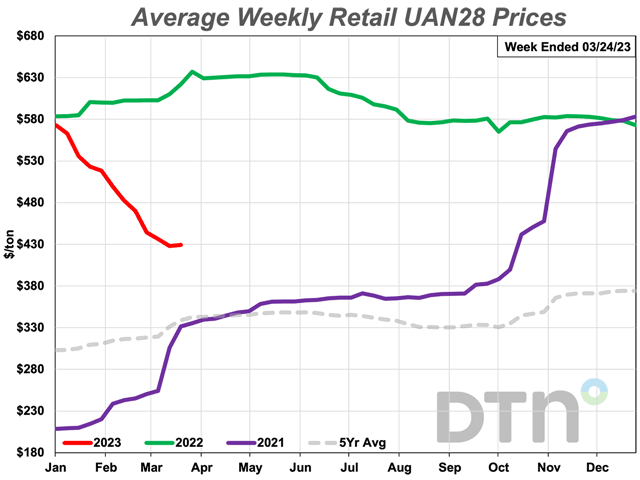

Leading the way lower was UAN28. The liquid nitrogen fertilizer was 9% lower compared to last month with an average retail price of $429 per ton. Anhydrous was 8% less expensive than a month ago with an average price of $1,036/ton.

UAN32 was 7% lower compared to a month earlier and had average price of $514/ton. Urea was 6% less expensive compared to the previous month with an average price of $627/ton.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The remaining four fertilizers were all just slightly lower compared to the prior month. DAP had an average price of $821/ton, MAP $812/ton, potash $645/ton and 10-34-0 $740/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.68/lb.N, anhydrous $0.63/lb.N, UAN28 $0.77/lb.N and UAN32 $0.80/lb.N.

All fertilizers are now lower by double digits compared to one year ago. 10-34-0 is 16% less expensive, DAP is 19% lower, MAP is 20% less expensive, potash is 24% lower, UAN32 is 26% less expensive, both anhydrous and UAN28 are 32% lower and urea is 36% less expensive compared to a year prior.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

The extreme volatility in the natural gas market is expected to remain into the future, according to Dow Jones. You can read more about it here: https://www.dtnpf.com/….

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Mar 21-25 2022 | 1014 | 1018 | 850 | 976 |

| Apr 18-22 2022 | 1050 | 1079 | 879 | 1012 |

| May 16-20 2022 | 1059 | 1083 | 878 | 993 |

| Jun 13-Jun 17 2022 | 1046 | 1074 | 879 | 961 |

| Jul 11-15 2022 | 1030 | 1052 | 885 | 861 |

| Aug 8-12 2022 | 982 | 1032 | 881 | 812 |

| Sep 5-9 2022 | 952 | 1009 | 878 | 800 |

| Oct 3-7 2022 | 934 | 997 | 869 | 826 |

| Oct 31-Nov 4 2022 | 930 | 981 | 857 | 826 |

| Nov 28-Dec 2 2022 | 926 | 960 | 831 | 795 |

| Dec 26-Dec 30 2022 | 885 | 891 | 765 | 751 |

| Jan 23-Jan 27 2023 | 855 | 865 | 714 | 708 |

| Feb 20-Feb 24 2023 | 836 | 834 | 673 | 666 |

| Mar 20-Mar 24 2023 | 821 | 812 | 645 | 627 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Mar 21-25 2022 | 881 | 1523 | 622 | 698 |

| Apr 18-22 2022 | 906 | 1534 | 631 | 730 |

| May 16-20 2022 | 906 | 1529 | 634 | 731 |

| Jun 13-Jun 17 2022 | 905 | 1516 | 630 | 730 |

| Jul 11-15 2022 | 904 | 1449 | 606 | 701 |

| Aug 8-12 2022 | 881 | 1365 | 578 | 678 |

| Sep 5-9 2022 | 866 | 1357 | 579 | 658 |

| Oct 3-7 2022 | 813 | 1390 | 565 | 652 |

| Oct 31-Nov 4 2022 | 759 | 1426 | 583 | 680 |

| Nov 28-Dec 2 2022 | 753 | 1416 | 583 | 681 |

| Dec 26-Dec 30 2022 | 751 | 1325 | 573 | 679 |

| Jan 23-Jan 27 2023 | 754 | 1237 | 523 | 630 |

| Feb 20-Feb 24 2023 | 741 | 1124 | 470 | 554 |

| Mar 20-Mar 24 2023 | 740 | 1036 | 429 | 514 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.