DTN Retail Fertilizer Trends

Five Major Fertilizer Prices Decrease Significantly

OMAHA (DTN) -- Retail fertilizer prices tracked by DTN for the second full week of March 2023 continue to show lower levels. This trend has been in place for two and a half months.

All eight of the major fertilizer prices are once again lower compared to last month. Five of the eight fertilizers had a substantial price decline. DTN designates a significant move as anything 5% or more.

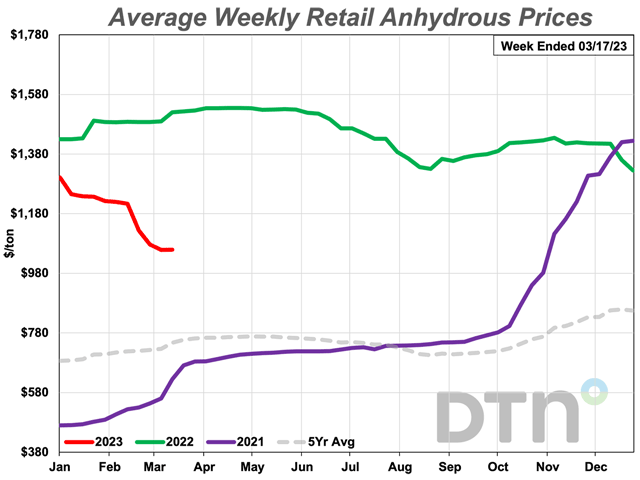

Leading the way lower was anhydrous. The nitrogen fertilizer was 13% lower compared to last month and had an average price of $1,059/ton.

UAN28 was 11% less expensive looking back a month and had an average price of $428/ton. UAN32 was 9% lower compared to a month earlier and had an average price of $521/ton.

Urea was 7% less expensive compared to the previous month with an average price of $638/ton. Potash was 5% lower compared to last month with an average price of $655/ton.

The remaining three fertilizers were all just slightly lower compared to the prior month. DAP had an average price of $825/ton, MAP $821/ton and 10-34-0 $740/ton.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

On a price per pound of nitrogen basis, the average urea price was at $0.69/lb.N, anhydrous $0.65/lb.N, UAN28 $0.76/lb.N and UAN32 $0.81/lb.N.

Natural gas, the main building block of many fertilizers, saw a wildly turbulent year in 2022 with prices and most expect the turbulence isn't going to calm down anytime soon, according to Dow Jones.

Last year was the most volatile on record for natural gas prices, as prices swung from unseasonable lows to record highs and back again. Benchmark gas futures swung by at least 7% on 44 days last year, the most since at least the early 1990s when gas markets were deregulated, and modern trading began.

Analysts, traders and big gas buyers expect this kind of instability to become the norm. Many coal-fired power plants have been retired without wind and solar farms ready to replace their output, pressuring utilities to pay up for gas.

The severe swings even diverge across U.S. regions.

This winter, gas prices in California surged to more than six times the national benchmark price at the time. Unusually warm weather, meanwhile, cut heating demand in part of the country this winter and knocked prices in February below a threshold rarely breached over the past 20 years.

All fertilizers are now double digits lower compared to one year ago. DAP is 15% less expensive, 10-34-0 is 16% lower, MAP is 18% less expensive, potash is 22% lower, UAN32 is 26% less expensive, anhydrous and UAN28 are both 30% lower and urea is 33% less expensive compared to a year prior.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

Fertilizer prices moved higher in 2022 on supply side issues but are lower in 2023, according to University of Minnesota agricultural economist. You can read it here: https://www.dtnpf.com/….

| Dry | ||||

| Date Range | DAP | MAP | POTASH | UREA |

Mar 14-18 2022 | 970 | 1001 | 843 | 954 |

Apr 11-15 2022 | 1047 | 1071 | 875 | 1017 |

May 9-13 2022 | 1059 | 1083 | 881 | 1000 |

Jun 6-Jun 10 2022 | 1057 | 1077 | 880 | 977 |

Jul 4-8 2022 | 1038 | 1053 | 885 | 866 |

Aug 1-5 2022 | 1003 | 1036 | 883 | 812 |

Aug 29-Sep 2 2022 | 952 | 1022 | 877 | 804 |

Sep 26-30 2022 | 947 | 1005 | 874 | 812 |

Oct 24-28 2022 | 930 | 986 | 862 | 827 |

Nov 21-25 2022 | 927 | 972 | 841 | 802 |

Dec 19-Dec 23 2022 | 890 | 909 | 790 | 757 |

Jan 16-Jan 20 2023 | 859 | 865 | 721 | 712 |

Feb 13-Feb 17 2023 | 838 | 857 | 692 | 686 |

Mar 13-Mar 17 2023 | 825 | 821 | 655 | 638 |

| Liquid | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

Mar 14-18 2022 | 876 | 1520 | 610 | 706 |

Apr 11-15 2022 | 906 | 1534 | 630 | 730 |

May 9-13 2022 | 906 | 1529 | 634 | 730 |

Jun 6-Jun 10 2022 | 905 | 1518 | 633 | 731 |

Jul 4-8 2022 | 904 | 1466 | 609 | 702 |

Aug 1-5 2022 | 892 | 1387 | 592 | 679 |

Aug 29-Sep 2 2022 | 866 | 1364 | 576 | 671 |

Sep 26-30 2022 | 861 | 1380 | 581 | 670 |

Oct 24-28 2022 | 759 | 1422 | 580 | 678 |

Nov 21-25 2022 | 753 | 1419 | 583 | 681 |

Dec 19-Dec 23 2022 | 751 | 1360 | 578 | 681 |

Jan 16-Jan 20 2023 | 755 | 1238 | 536 | 634 |

Feb 13-Feb 17 2023 | 754 | 1213 | 483 | 572 |

Mar 13-Mar 17 2023 | 740 | 1059 | 428 | 521 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.