DTN Retail Fertilizer Trends

All Retail Fertilizer Prices Lower at Start of 2023, With Half Down Significantly

OMAHA (DTN) -- Average retail prices for all eight major fertilizers were lower the first week of January 2023 compared to last month, according to sellers surveyed by DTN. This is the third straight week prices have been down from the previous month.

And for the second consecutive week, prices for half of the fertilizers were down substantially from last month. DTN designates a considerable move as anything 5% or more.

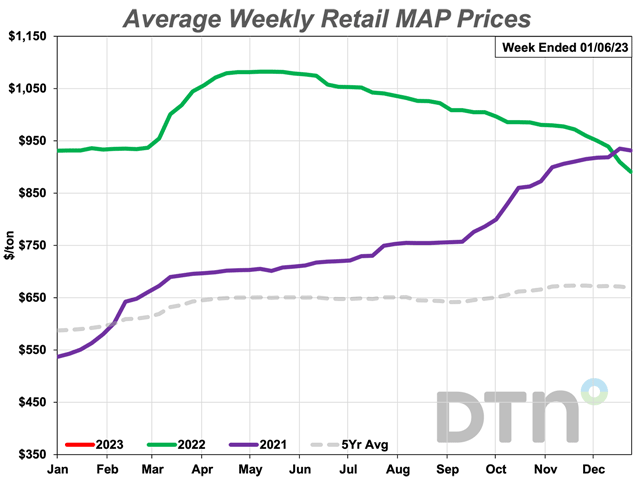

Both MAP and potash were 8% lower compared to last month. MAP had an average price of $879 per ton, while potash was at $752/ton.

Urea was 6% less expensive than last month, and the nitrogen fertilizer had an average price of $739/ton. DAP was 5% lower compared to last month, and the phosphorus fertilizer had an average price of $876/ton.

The remaining four fertilizers were slightly less expensive looking back to last month. 10-34-0 had an average price of $754/ton, anhydrous $1,302/ton, UAN28 $573/ton and UAN32 $673/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.80/lb.N, anhydrous $0.79/lb.N, UAN28 $1.02/lb.N and UAN32 $1.05/lb.N.

The supply of fertilizer is readily available, and farmers should communicate their needs to their fertilizer retailers, according to one speaker at the DTN Virtual Ag Summit in December.

Kreg Ruhl, vice-president of Crop Nutrients for Growmark FS, said if farmers are concerned about fertilizer availability this spring, they shouldn't be, as nutrients seem to be in good supply. Good communication with fertilizer retailers will help to assure farmers receive their fertilizer needs this spring, he said.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

One wild card with both fertilizer price and availability would be logistic snafus. Ruhl said issues with both low Mississippi River levels and a possible rail strike would derail both the current ample supplies and the recent lower prices.

"The Mississippi River is going to need rains, something we can't really control," Ruhl said. "This would be a real concern."

The domestic fertilizer supply picture is really controlled by three main components, he said.

First is the physical supply of fertilizer, which appears to be set with the spring application season rapidly approaching. The second factor is logistics, which would include low river levels and rail issues.

The final supply component is regional or local bottlenecks. An example of this could be an area seeing many farmers putting on anhydrous at one time, thus affecting both supply and price.

Ruhl said the fertilizer market is globally driven but locally decided. Anticipate what you need, where you need it, when you need it and tell your fertilizer supplier of your plans, he said.

Fertilizers are now mostly lower than one year earlier. This week, seven fertilizers are lower while only one is still higher.

UAN32 is 1% lower, UAN28 is 2% less expensive, 10-34-0 is 5% lower, MAP is 6% less expensive, potash is 7% lower, anhydrous is 9% less and urea is 19% lower looking back to a year prior.

One fertilizer is still more expensive compared to last year. DAP is 1% higher looking back a year.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

Farmers will be seeing higher input prices in the New Year, which will put pressure on farm income, according to a Kansas State University Extension agricultural economist. You can read it here: https://www.dtnpf.com/….

DTN recently published a series titled "Global Fertilizer Outlook." Here are those articles:

To see Global Fertilizer Outlook - 1, go to: https://www.dtnpf.com/….

To see Global Fertilizer Outlook - 2, go to: https://www.dtnpf.com/….

To see Global Fertilizer Outlook - 3, go to: https://www.dtnpf.com/….

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Jan 3-7 2022 | 863 | 931 | 807 | 913 |

| Jan 31-Feb 4 2022 | 877 | 933 | 813 | 905 |

| Feb 28-Mar 4 2022 | 879 | 937 | 815 | 887 |

| Mar 28-Apr 1 2022 | 1033 | 1045 | 868 | 1022 |

| Apr 25-29 2022 | 1049 | 1082 | 881 | 1004 |

| May 23-27 2022 | 1056 | 1082 | 879 | 989 |

| Jun 20-Jun 24 2022 | 1040 | 1058 | 885 | 902 |

| Jul 18-22 2022 | 1007 | 1043 | 887 | 836 |

| Aug 15-19 2022 | 978 | 1026 | 881 | 807 |

| Sep 12-16 2022 | 952 | 1009 | 877 | 808 |

| Oct 10-14 2022 | 925 | 986 | 863 | 824 |

| Nov 7-11 2022 | 931 | 980 | 853 | 812 |

| Dec 5-Dec 9 2022 | 920 | 950 | 819 | 784 |

| Jan 2-Jan 6 2023 | 876 | 879 | 752 | 739 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Jan 3-7 2022 | 795 | 1430 | 584 | 679 |

| Jan 31-Feb 4 2022 | 826 | 1487 | 600 | 699 |

| Feb 28-Mar 4 2022 | 837 | 1487 | 603 | 703 |

| Mar 28-Apr 1 2022 | 896 | 1526 | 637 | 711 |

| Apr 25-29 2022 | 906 | 1534 | 631 | 730 |

| May 23-27 2022 | 906 | 1531 | 634 | 731 |

| Jun 20-Jun 24 2022 | 905 | 1497 | 616 | 716 |

| Jul 18-22 2022 | 894 | 1431 | 598 | 696 |

| Aug 15-19 2022 | 878 | 1336 | 576 | 676 |

| Sep 12-16 2022 | 861 | 1369 | 578 | 665 |

| Oct 10-14 2022 | 759 | 1417 | 576 | 670 |

| Nov 7-11 2022 | 758 | 1434 | 582 | 680 |

| Dec 5-Dec 9 2022 | 751 | 1415 | 581 | 681 |

| Jan 2-Jan 6 2023 | 754 | 1302 | 573 | 673 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.