Technically Speaking

Weekly Analysis: Energy Markets

Brent Crude Oil: The spot-month contract closed $4.24 higher at $70.45. While the market's secondary (intermediate-term) trend remains down, the minor (short-term) trend on its daily chart is up. However, with the spot-month contract approaching the previous high of $71.28, setting up a potential secondary double-top pattern, daily stochastics have climbed well above the overbought level of 80%. This would indicate the minor uptrend could be nearing its end.

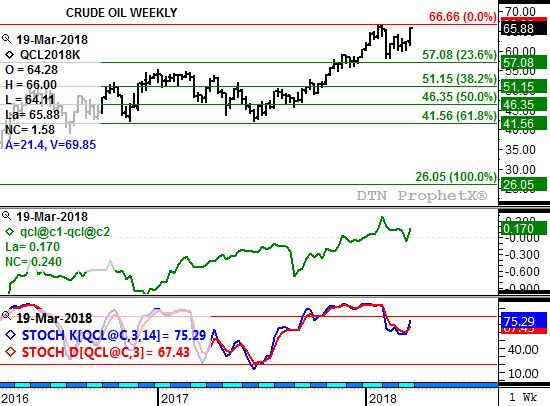

Crude Oil: The spot-month contract closed $3.54 higher at $65.88. Similar to Brent crude, WTI remains in a secondary (intermediate-term) downtrend though its minor (short-term) trend is up. Regarding the latter, the spot-month contract is approaching the previous high of $66.66 with daily stochastics already above the overbought level of 80%. This sets the stage for a potential secondary double-top pattern on the market's weekly chart.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Distillates: The spot-month contract closed 10.66cts higher at $2.0184. Similar to the oil markets, distillates remains in a secondary (intermediate-term) downtrend while its minor (short-term) trend is up. The spot-month contract is testing secondary resistance between $1.9937 and $2.0375, prices that mark the 61.8% and 76.4% retracement levels of the initial sell-off from $2.1431 through the low of $1.8084. Meanwhile, daily stochastics have moved well above the overbought level of 80%, setting the stage for the minor uptrend to come to an end.

Gasoline: RBOB gasoline futures market closed 8.77cts higher at $2.0366. The market remains in a secondary (intermediate-term) uptrend as the spot-month contract posted a new 4-week high of $2.0438 last week. Weekly stochastics are well above the overbought level of 80%, putting the momentum indicator in position for a possible bearish crossover.

Ethanol: The spot-month contract closed 4.2cts lower at $1.451. The market established a secondary (intermediate-term) downtrend last week as the nearby futures contract posted a new 4-week low of $1.448, fractions below the previous 4-week low of $1.449. The April contract has already moved below initial support at $1.468, a price that marks the 23.6% retracement level of the previous uptrend from $1.251 through the recent high of $1.535. Next support is at the 38.2% retracement level of $1.427.

Natural Gas: The spot-month contract closed 9.7cts lower at $2.591. The market remains in a secondary (intermediate-term) sideways-to-down trend with support at $2.521. This price marks the 61.8% retracement level of the previous uptrend from $1.611 through the high of $3.994. Weekly stochastics are bearish below the oversold level of 20%.

Propane (Conway cash price): Conway propane closed 2.00cts higher at $0.6875. The recently established secondary (intermediate-term) 5-wave uptrend strengthened last week. Initial resistance is pegged at $0.7359, the 38.2% retracement level of the previous downtrend from $0.9800 through the recent low of $0.5850.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .