Technically Speaking

Weekly Analysis: Livestock Markets

Live Cattle: The more active December contract closed $0.20 higher at $117.125. The contract's minor (short-term) trend has turned down on its weekly chart. Selling emerged as the contract tested secondary (intermediate-term) resistance at $119.05, a price that marks the 76.4% retracement level of the previous sell-off from $122.85 through the low of $106.725. Initial minor support is at $116.25, then $114.425 and $112.95.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

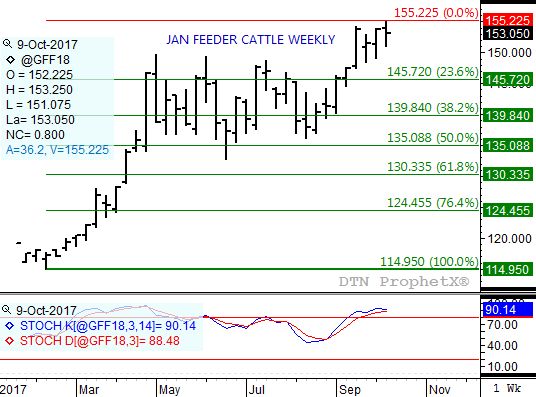

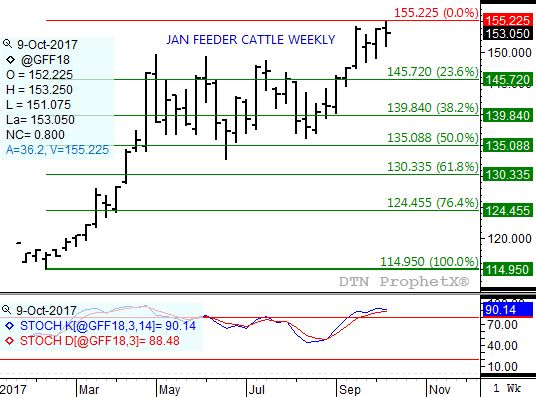

Feeder Cattle: The more active January contract closed $0.65 lower at $153.05. Given the contract's minor (short-term) downtrend, January feeders could also see the secondary (intermediate-term)) trend on its weekly charts turn down. The contract posted a new high of $155.225 last week, putting initial support at $145.725. With weekly stochastics still well above the overbought 80% level, the contract could eventually test support between $139.85 and $135.10.

Lean Hogs: The more active December contract closed $1.275 higher at $62.20 last week. The contract's secondary (intermediate-term) trend still looks to be up based on the bullish outside range posted the week of September 25. However, the market's minor (short-term) trend is set to turn down on its daily chart with resistance at the recent high of $63.45.

Corn (Cash): The DTN National Corn Index (NCI.X, national average cash price) closed at $3.08 1/2, up 3 cents for the week. The NCI.X remains in a secondary (intermediate-term) uptrend on its weekly chart. Last week saw the NCI.X post a bullish outside range, confirming previous bullish signals. Initial resistance is at $3.09 3/4, a price that marks the 23.6% retracement of the previous downtrend from $3.57 1/4 through the low of $2.95 1/4. The 38.2% retracement level is up at $3.19 with the 50% up at $3.26 1/4.

Soybean meal: The more active December contract closed $9.40 higher at $328.60. The contract remains in a secondary (intermediate-term) uptrend, with initial resistance at the previous high of $348.70.

To track my thoughts on the markets throughout the day, follow me on Twitter: www.twitter.com\DarinNewsom

Comments

To comment, please Log In or Join our Community .